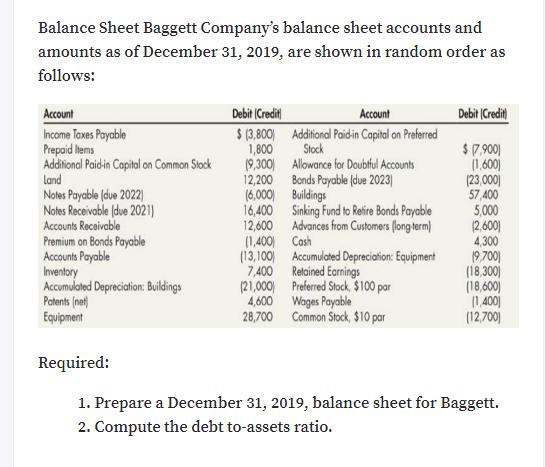

Balance Sheet Baggett Company's balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Debit (Credit) Debit

Balance Sheet Baggett Company's balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Debit (Credit) Debit (Credit $ (3,800) Addifional Paidin Capital on Preferred 1,800 (9,300) Allowance for Doubtful Accounts 12,200 (6,000 Buildings 16,400 Sinking Fund to Refire Bonds Payable 12,600 Account Account Income Taxes Payable Prepaid tems Additional Paidin Copital on Common Slock Land Notes Payable (due 2022) Notes Receivable (due 2021) Accounts Receivable Premium on Bonds Payable Accounts Payable Inventory Accumulated Depreciation: Buildings Patents (net Equipment Stock $7,900) (1,600) (23,000) 57 400 5,000 (2,600) 4,300 19.700) (18,300) (18,600) (1.400| (12,700| Bonds Payable (due 2023| Advances from Customers (long term) (1,400) Cash (13,100 Accumulated Depreciation: Equipment 7,400 Retained Earnings (21,000 Preferred Stock, $100 par 4,600 Wages Payable 28,700 Common Stock, $10 par Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Debt to asset ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started