Answered step by step

Verified Expert Solution

Question

1 Approved Answer

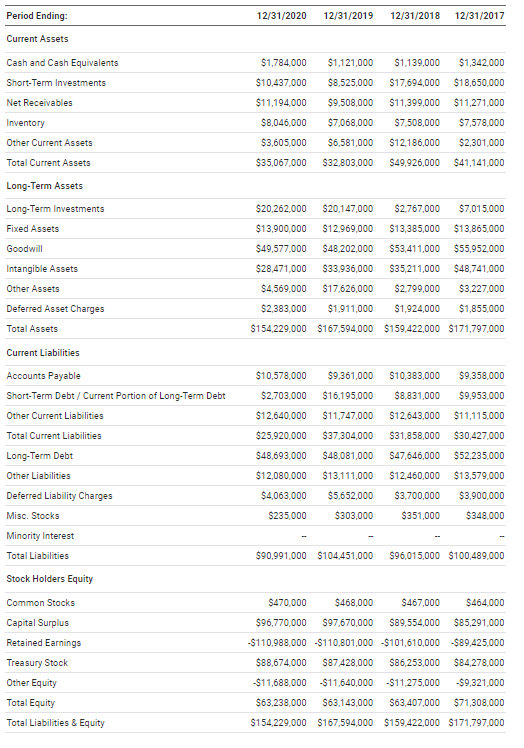

Balance sheet Explain the development these years looking on the statement, and critically evaluate the financial statement, cross-sectionally and identify their main strengths and weaknesses

Balance sheet

Explain the development these years looking on the statement, and critically evaluate the financial statement, cross-sectionally and identify their main strengths and weaknesses and make recommendations for future improvement.

12/31/2020 12/31/2019 12/31/2018 12/31/2017 Period Ending: Current Assets Cash and Cash Equivalents Short-Term Investments $1,784,000 $1,121,000 $1,139,000 $1,342,000 $10,437,000 $8,525,000 $17,694,000 $18,650,000 Net Receivables $11,194,000 $9,508,000 $11,399,000 $11,271,000 $8,046,000 $7,068,000 $7,508,000 $7,578,000 Inventory Other Current Assets Total Current Assets $3,605,000 $6,581,000 $12,186,000 $2,301,000 $35,067,000 $32,803,000 $49.926.000 $41,141,000 Long-Term Assets Long-Term Investments $20,262,000 $2,767,000 $7.015.000 $13,865,000 Fixed Assets $20,147,000 $12.969,000 $48,202,000 $13.900,000 $49,577,000 $13,385,000 Goodwill $53,411,000 $55,952.000 Intangible Assets $28,471,000 $33,936,000 $35,211,000 $48,741,000 Other Assets $4,569,000 $17,626,000 $2,799,000 $3,227,000 Deferred Asset Charges $2,383,000 $1,911,000 $1,924,000 $1,855,000 Total Assets $154,229,000 $167,594,000 $159,422,000 $171,797,000 Current Liabilities $10,578,000 $9,361,000 $9,358,000 $10,383,000 $8,831,000 $2,703,000 $16,195,000 $9.953,000 $12.640,000 $11,747,000 $12,643,000 $11,115,000 $25,920,000 $37,304,000 $31,858,000 $30,427,000 $48,693,000 $48,081,000 $47,646,000 $52,235,000 Accounts Payable Short-Term Debt / Current Portion of Long-Term Debt Other Current Liabilities Total Current Liabilities Long-Term Debt Other Liabilities Deferred Liability Charges Misc. Stocks Minority Interest Total Liabilities Stock Holders Equity $12.080.000 $13,111,000 $12.460,000 $13,579,000 $4,063,000 $5,652,000 $3,900,000 $3,700,000 $351,000 $235.000 $303,000 $348,000 $90,991,000 $104,451,000 $96,015,000 $100,489,000 Common Stocks $470,000 $468,000 $467,000 $464.000 Capital Surplus Retained Earnings Treasury Stock Other Equity Total Equity Total Liabilities & Equity $96,770,000 $97,670,000 $89,554,000 $85,291,000 $110,988,000 $110,801,000 $101,610,000 $89,425,000 $88,674,000 $87.428,000 $86,253,000 $84,278,000 $11,688,000 -$11.640.000 -$11,275,000 $9,321,000 $63,238,000 $63,143,000 $63,407,000 $71,308,000 $154,229,000 $167,594,000 $159,422,000 $171,797,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started