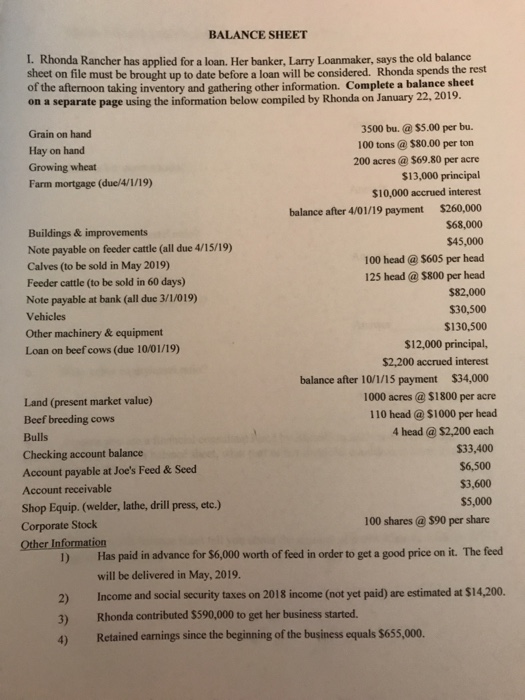

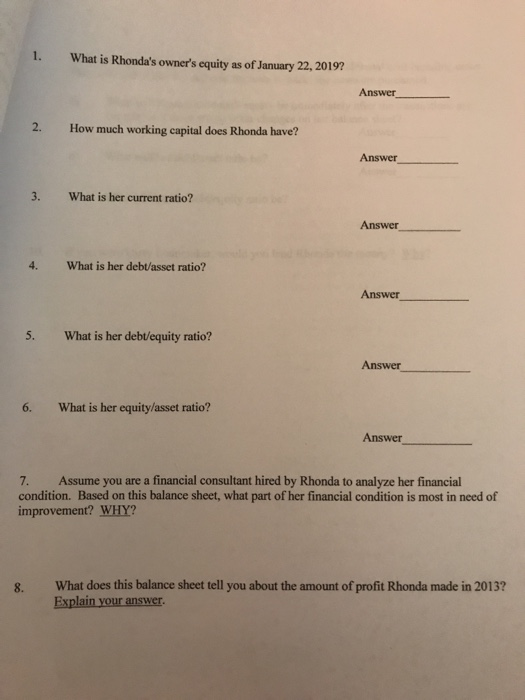

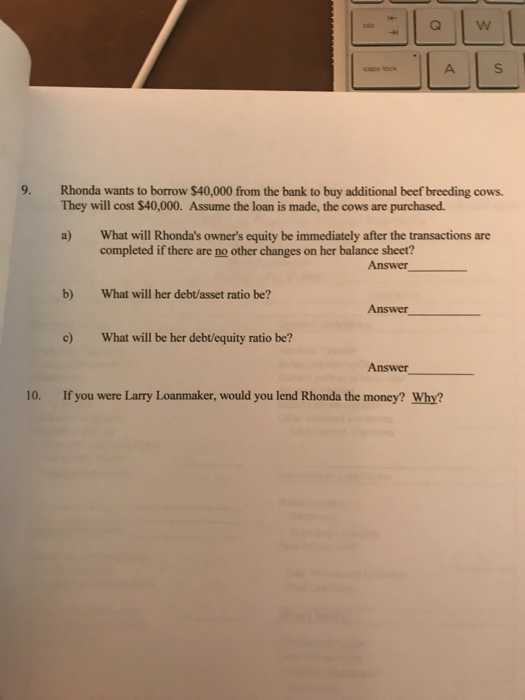

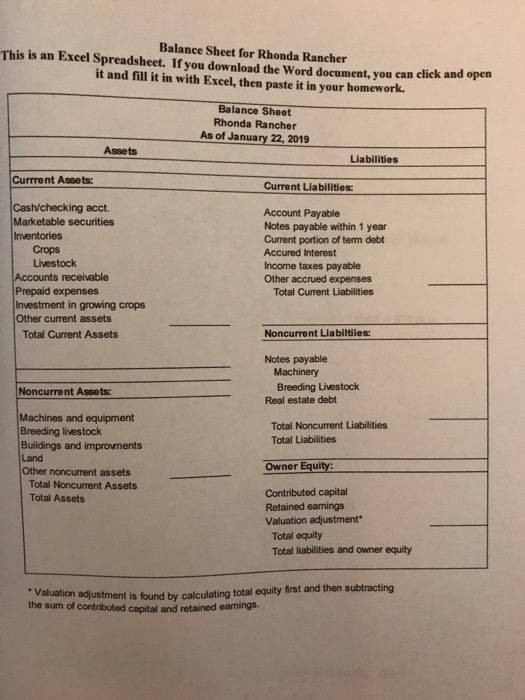

BALANCE SHEET I. Rhonda Rancher has applied for a loan. Her banker, Larry Loanmaker, says the old balance sheet on file must be brought up to date before a loan will be considered. Rhonda spends the rest of the aftenoon taking inventory and gathering other information. Complete a balance sheet on a separate page using the information below compiled by Rhonda on January 22, 2019. 3500 bu.@ $5.00 per bu. 100 tons @$80.00 per ton Grain on hand Hay on hand Growing wheat Farm mortgage (due/4/1/19) 200 acres @ $69.80 per acre $13,000 principal $10,000 accrued interest balance after 4/01/19 payment $260,000 Buildings & improvements Note payable on feeder cattle (all due 4/15/19) Calves (to be sold in May 2019) Feeder cattle (to be sold in 60 days) Note payable at bank (all due 3/1/019) Vehicles Other machinery &equipment Loan on beef cows (due 10/01/19) $68,000 $45,000 100 head@ $605 per head 125 head@ $800 per head $82,000 $30,500 $130,500 $12,000 principal, $2,200 accrued interest balance after 10/1/15 payment $34,000 1000 acres @ $1800 per acre 110 head @ $1000 per head 4 head@ $2,200 each Land (present market value) Beef breeding cows Bulls Checking account balance Account payable at Joe's Feed&Seed Account receivable Shop Equip. (welder, lathe, drill press, etc.) Corporate Stock Other Information 33,400 $6,500 $3,600 $5,000 100 shares @ $90 per share Has paid in advance for$6,000 worth offed in order to get a good price on it. The feed will be delivered in May, 2019. i) 2) Income and social security taxes on 2018 income (not yet paid) are estimated at $14,200 3) Rhonda contributed $590,000 to get her business started. 4) Retained eanings since the beginning of the business equals $655,000. 1. What is Rhonda's owner's equity as of January 22, 2019? Answer 2. How much working capital does Rhonda have? Answer_ 3. What is her current ratio? Answer_ 4. What is her debl/asset ratio? Answer 5. What is her debt/equity ratio? Answer 6. What is her equity/asset ratio? Answer 7. Assume you are a financial consultant hired by Rhonda to analyze her financial condition. Based on this balance sheet, what part of her financial condition is most in need of improvement? WHY? 8. What does this balance sheet tell you about the amount of profit Rhonda made in 2013? Explain your answer. 1. What is Rhonda's owner's equity as of January 22, 20192 Answer 2. How much working capital does Rhonda have? Answer 3. What is her current ratio? Answer 4. What is her debt/asset ratio? Answer 5. What is her deb/equity ratio? Answer 6. What is her equity/asset ratio? Answer 7. Assume you are a financial consultant hired by Rhonda to analyze her financial con dition. Based on this balance sheet, what part of her financial condition is most in need of improvement? WHY? 8. What does this balance sheet tell you about the amount of profit Rhonda made in 2013? in your answer. 9. Rhonda wants to borrow $40,000 from the bank to buy additional beef breeding cows. They will cost $40,000. Assume the loan is made, the cows are purchased. a) What will Rhonda's owner's equity be immediately after the transactions are completed if there are no other changes on her balance sheet? Answer b) What will her debt/asset ratio be? Answer c) What will be her debt/equity ratio be? Answer 10. If you were Larry Loanmaker, would you lend Rhonda the money? Why? Balance Sheet for Rhonda Rancher This is an Exeel Spreadsheet. If you download the Word document, you can elick and open it and fill it in with Excel, then paste it in your homework Balance Sheet Rhonda Rancher As of January 22, 2019 Assets Liabilities Currrent Assets: Current Liabilities: Cash/checking acct. Marketable securities Inventories Account Payable Notes payable within 1 year Current portion of term debt Accured Interest Income taxes payable Other accrued expenses Crops Livestock Accounts receivable Prepaid expenses Investment in growing crops Other current assets Total Current Liabilities Total Current Assets Noncurrent Liabiltiies: Notes payable Machinery Breeding Livestock Noncurrent Assets: Real estate debt Machines and equipment Breeding livestock Buildings and Land Other noncurrent assets Total Noncurrent Liabilities Total Liabilities Owner Equity: Total Noncurrent Assets Total Assets Contributed capital Retained eamings Valuation adjustment Total equity Total liabilities and owner equity Valuation the sum of contibuted capital and retained adjustment is found by calculating total equity first and then subtracting eamings. BALANCE SHEET I. Rhonda Rancher has applied for a loan. Her banker, Larry Loanmaker, says the old balance sheet on file must be brought up to date before a loan will be considered. Rhonda spends the rest of the aftenoon taking inventory and gathering other information. Complete a balance sheet on a separate page using the information below compiled by Rhonda on January 22, 2019. 3500 bu.@ $5.00 per bu. 100 tons @$80.00 per ton Grain on hand Hay on hand Growing wheat Farm mortgage (due/4/1/19) 200 acres @ $69.80 per acre $13,000 principal $10,000 accrued interest balance after 4/01/19 payment $260,000 Buildings & improvements Note payable on feeder cattle (all due 4/15/19) Calves (to be sold in May 2019) Feeder cattle (to be sold in 60 days) Note payable at bank (all due 3/1/019) Vehicles Other machinery &equipment Loan on beef cows (due 10/01/19) $68,000 $45,000 100 head@ $605 per head 125 head@ $800 per head $82,000 $30,500 $130,500 $12,000 principal, $2,200 accrued interest balance after 10/1/15 payment $34,000 1000 acres @ $1800 per acre 110 head @ $1000 per head 4 head@ $2,200 each Land (present market value) Beef breeding cows Bulls Checking account balance Account payable at Joe's Feed&Seed Account receivable Shop Equip. (welder, lathe, drill press, etc.) Corporate Stock Other Information 33,400 $6,500 $3,600 $5,000 100 shares @ $90 per share Has paid in advance for$6,000 worth offed in order to get a good price on it. The feed will be delivered in May, 2019. i) 2) Income and social security taxes on 2018 income (not yet paid) are estimated at $14,200 3) Rhonda contributed $590,000 to get her business started. 4) Retained eanings since the beginning of the business equals $655,000. 1. What is Rhonda's owner's equity as of January 22, 2019? Answer 2. How much working capital does Rhonda have? Answer_ 3. What is her current ratio? Answer_ 4. What is her debl/asset ratio? Answer 5. What is her debt/equity ratio? Answer 6. What is her equity/asset ratio? Answer 7. Assume you are a financial consultant hired by Rhonda to analyze her financial condition. Based on this balance sheet, what part of her financial condition is most in need of improvement? WHY? 8. What does this balance sheet tell you about the amount of profit Rhonda made in 2013? Explain your answer. 1. What is Rhonda's owner's equity as of January 22, 20192 Answer 2. How much working capital does Rhonda have? Answer 3. What is her current ratio? Answer 4. What is her debt/asset ratio? Answer 5. What is her deb/equity ratio? Answer 6. What is her equity/asset ratio? Answer 7. Assume you are a financial consultant hired by Rhonda to analyze her financial con dition. Based on this balance sheet, what part of her financial condition is most in need of improvement? WHY? 8. What does this balance sheet tell you about the amount of profit Rhonda made in 2013? in your answer. 9. Rhonda wants to borrow $40,000 from the bank to buy additional beef breeding cows. They will cost $40,000. Assume the loan is made, the cows are purchased. a) What will Rhonda's owner's equity be immediately after the transactions are completed if there are no other changes on her balance sheet? Answer b) What will her debt/asset ratio be? Answer c) What will be her debt/equity ratio be? Answer 10. If you were Larry Loanmaker, would you lend Rhonda the money? Why? Balance Sheet for Rhonda Rancher This is an Exeel Spreadsheet. If you download the Word document, you can elick and open it and fill it in with Excel, then paste it in your homework Balance Sheet Rhonda Rancher As of January 22, 2019 Assets Liabilities Currrent Assets: Current Liabilities: Cash/checking acct. Marketable securities Inventories Account Payable Notes payable within 1 year Current portion of term debt Accured Interest Income taxes payable Other accrued expenses Crops Livestock Accounts receivable Prepaid expenses Investment in growing crops Other current assets Total Current Liabilities Total Current Assets Noncurrent Liabiltiies: Notes payable Machinery Breeding Livestock Noncurrent Assets: Real estate debt Machines and equipment Breeding livestock Buildings and Land Other noncurrent assets Total Noncurrent Liabilities Total Liabilities Owner Equity: Total Noncurrent Assets Total Assets Contributed capital Retained eamings Valuation adjustment Total equity Total liabilities and owner equity Valuation the sum of contibuted capital and retained adjustment is found by calculating total equity first and then subtracting eamings