Question

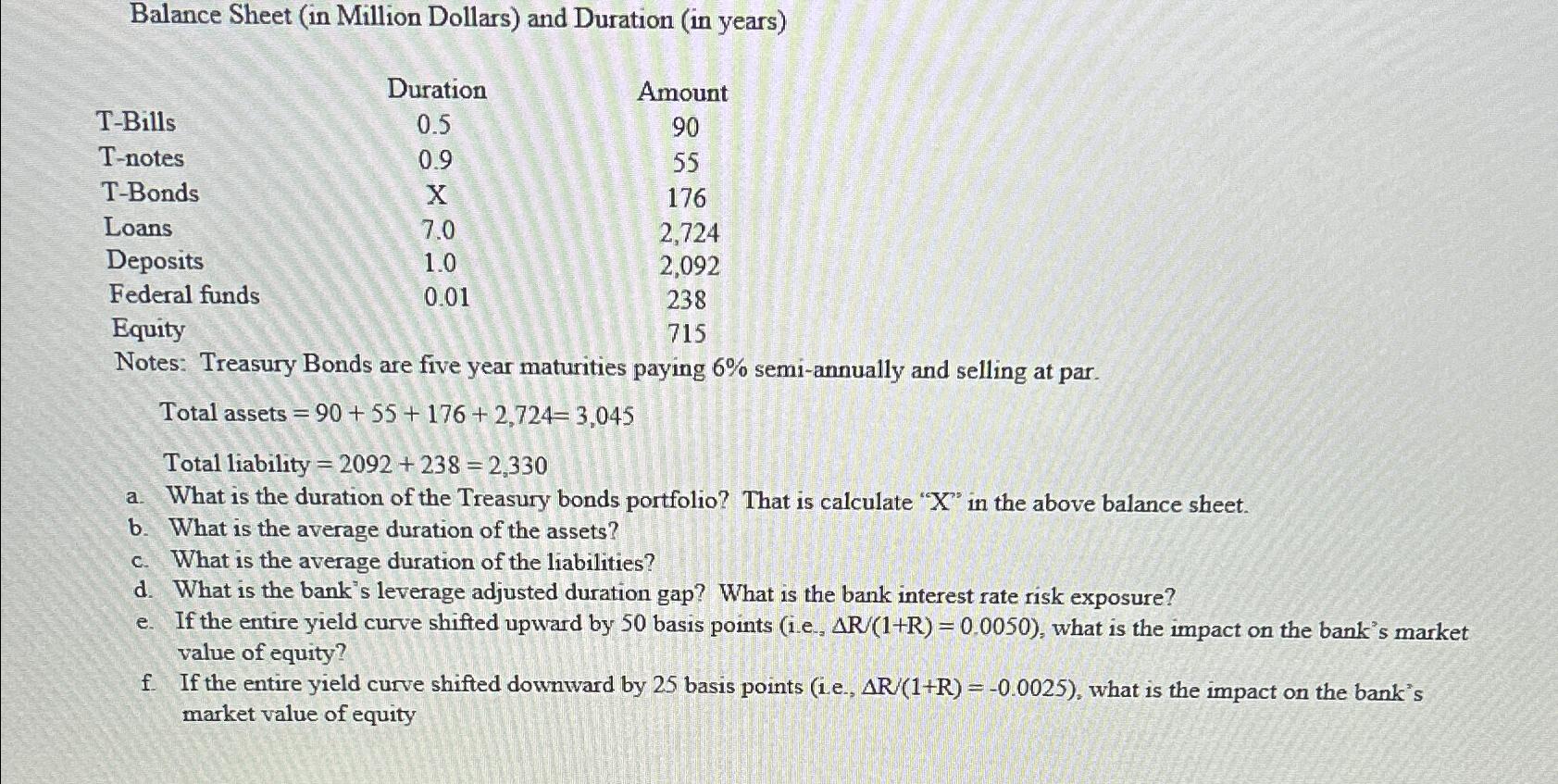

Balance Sheet (in Million Dollars) and Duration (in years) table[[,Duration,Amount],[T-Bills,0.5,90],[T-notes,0.9,55],[T-Bonds, x ,176],[Loans,7.0,2,724],[Deposits,1.0,2,092],[Federal funds,0.01,238],[Equity,,715]] Notes: Treasury Bonds are five year maturities paying 6% semi-annually and selling

Balance Sheet (in Million Dollars) and Duration (in years)\ \\\\table[[,Duration,Amount],[T-Bills,0.5,90],[T-notes,0.9,55],[T-Bonds,

x,176],[Loans,7.0,2,724],[Deposits,1.0,2,092],[Federal funds,0.01,238],[Equity,,715]]\ Notes: Treasury Bonds are five year maturities paying

6%semi-annually and selling at par.\ Total assets

=90+55+176+2,724=3,045\ Total liability

=2092+238=2,330\ a. What is the duration of the Treasury bonds portfolio? That is calculate "

x" in the above balance sheet.\ b. What is the average duration of the assets?\ c. What is the average duration of the liabilities?\ d. What is the bank's leverage adjusted duration gap? What is the bank interest rate risk exposure?\ e. If the entire yield curve shifted upward by 50 basis points (i.e.,

\\\\Delta (R)/(1+R)=0,0050), what is the impact on the bank's market value of equity?\ f. If the entire yield curve shifted downward by 25 basis points (i.e.,

\\\\Delta (R)/(1+R)=-0.0025), what is the impact on the bank's market value of equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started