Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Excercise: #2 When should the payments be given? Exercises: How far have you gone with compound interest? Let's find out. A. Answer the following exercises:

Excercise: #2 When should the payments be given?

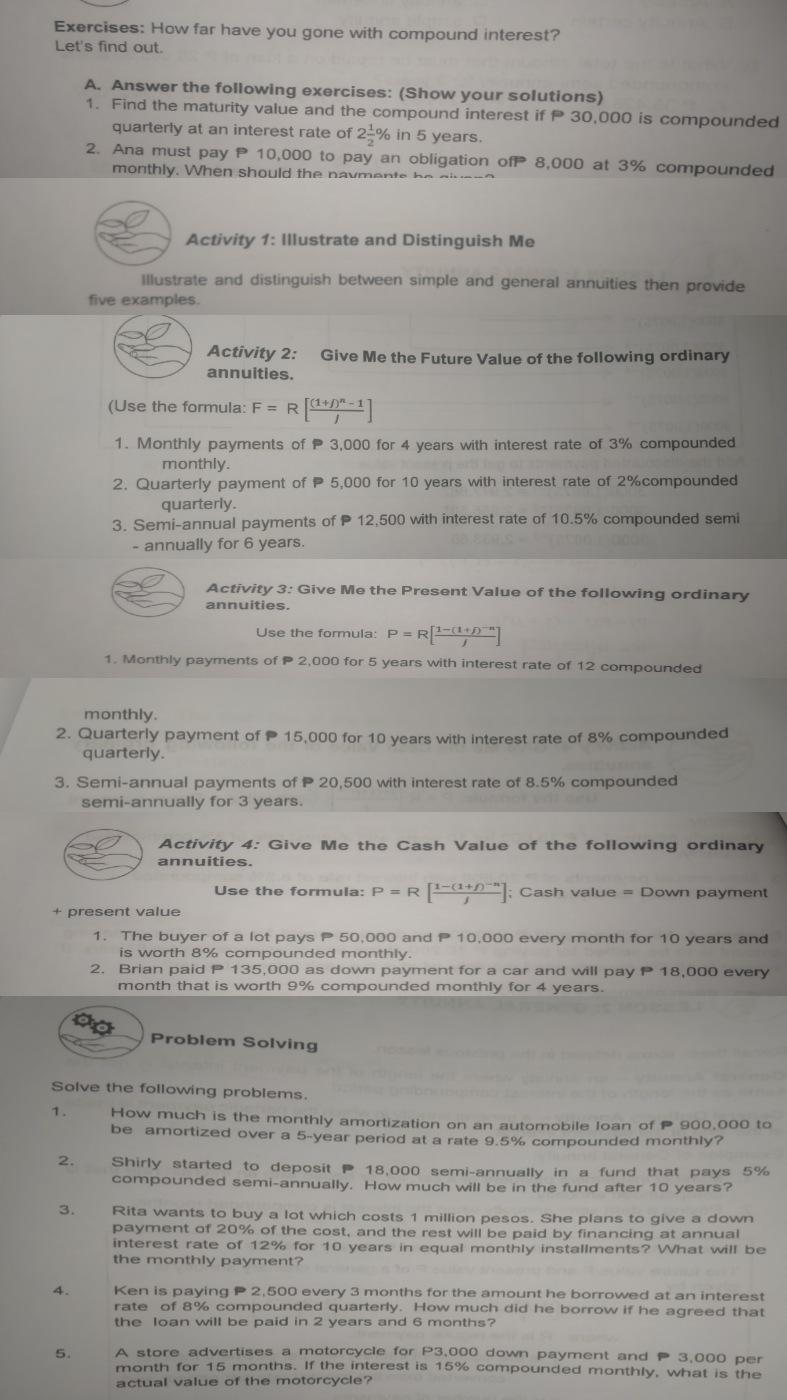

Exercises: How far have you gone with compound interest? Let's find out. A. Answer the following exercises: (Show your solutions) 1. Find the maturity value and the compound interest if P 30,000 is compounded quarterly at an interest rate of 24% in 5 years. 2. Ana must pay P 10,000 to pay an obligation ofP 8,000 at 3% compounded monthly. When should the navmente ho mi Activity 1: Illustrate and Distinguish Me illustrate and distinguish between simple and general annuities then provide five examples Activity 2: Give Me the Future Value of the following ordinary annuities. (Use the formula: F= R(4*)*-+] 1. Monthly payments of P 3,000 for 4 years with interest rate of 3% compounded monthly 2. Quarterly payment of P 5,000 for 10 years with interest rate of 2%compounded quarterly. 3. Semi-annual payments of P 12,500 with interest rate of 10.5% compounded semi - annually for 6 years. Activity 3: Give Me the Present Value of the following ordinary annuities. Use the formula: P ={-419"] 1. Monthly payments of P 2,000 or 5 years with interest rate of 12 compounded monthly 2. Quarterly payment of P 15,000 for 10 years with interest rate of 8% compounded quarterly 3. Semi-annual payments of P 20,500 with interest rate of 8.5% compounded semi-annually for 3 years. Activity 4: Give Me the Cash Value of the following ordinary annuities. Use the formula: P=R [--]: Cash value = Down payment + present value 1. The buyer of a lot pays P 50.000 and P 10.000 every month for 10 years and is worth 8% compounded monthly. 2. Brian paid P 135,000 as down payment for a car and will pay P 18.000 every month that is worth 9% compounded monthly for 4 years. 00 Problem Solving Solve the following problems. 1 How much is the monthly amortization on an automobile loan of P 900,000 to be amortized over a 5-year period at a rate 9.5% compounded monthly? 2. Shirly started to deposit P 18.000 semi-annually in a fund that pays 5% compounded semi-annually. How much will be in the fund after 10 years? 3 Rita wants to buy a lot which costs 1 million pesos. She plans to give a down payment of 20% of the cost, and the rest will be paid by financing at annual interest rate of 12% for 10 years in equal monthly installments? What will be the monthly payment? Ken is paying P 2.500 every 3 months for the amount he borrowed at an interest rate of 8% compounded quarterly. How much did he borrow if he agreed that the loan will be paid in 2 years and 6 months? A store advertises a motorcycle for P3.000 down payment and P 3.000 per month for 15 months. If the interest is 15% compounded monthly, what is the actual value of the motorcycle? 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started