Question

Balance Sheet & Income StatementCoast Ltd., which has just started trading on 1 January 2019, has the following account balances prior to the recording of

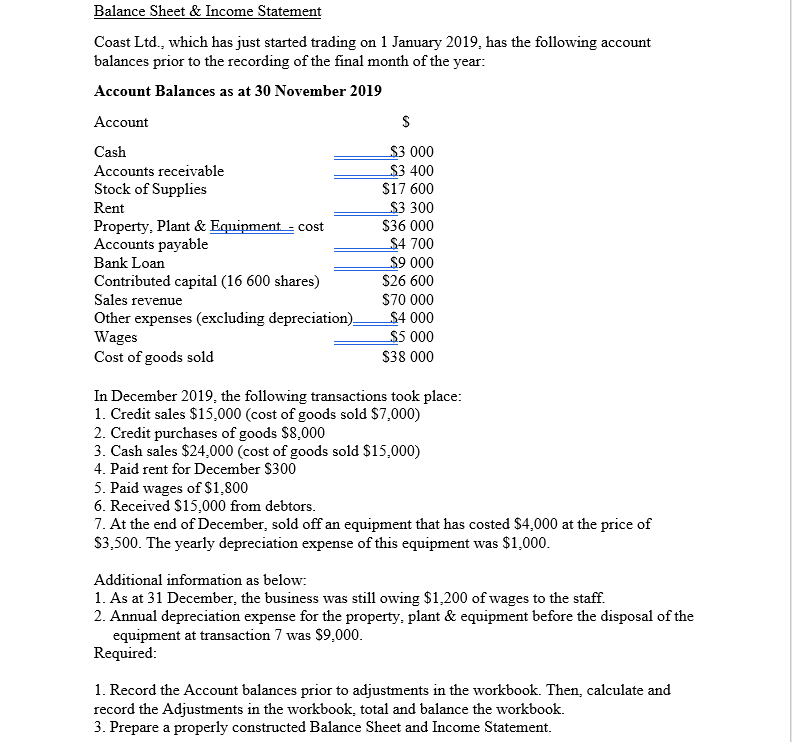

Balance Sheet & Income StatementCoast Ltd., which has just started trading on 1 January 2019, has the following account balances prior to the recording of the final month of the year:Account Balances as at 30 November 2019Account $Cash $3 000Accounts receivable $3 400Stock of Supplies $17 600Rent $3 300Property, Plant & Equipment - cost $36 000Accounts payable $4 700Bank Loan $9 000Contributed capital (16 600 shares) $26 600Sales revenue $70 000Other expenses (excluding depreciation) $4 000Wages $5 000Cost of goods sold$38 000In December 2019, the following transactions took place:1. Credit sales $15,000 (cost of goods sold $7,000)2. Credit purchases of goods $8,0003. Cash sales $24,000 (cost of goods sold $15,000)4. Paid rent for December $3005. Paid wages of $1,8006. Received $15,000 from debtors.7. At the end of December, sold off an equipment that has costed $4,000 at the price of $3,500. The yearly depreciation expense of this equipment was $1,000.Additional information as below:1. As at 31 December, the business was still owing $1,200 of wages to the staff.2. Annual depreciation expense for the property, plant & equipment before the disposal of the equipment at transaction 7 was $9,000.Required:1. Record the Account balances prior to adjustments in the workbook. Then, calculate and record the Adjustments in the workbook, total and balance the workbook.3. Prepare a properly constructed Balance Sheet and Income Statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started