Answered step by step

Verified Expert Solution

Question

1 Approved Answer

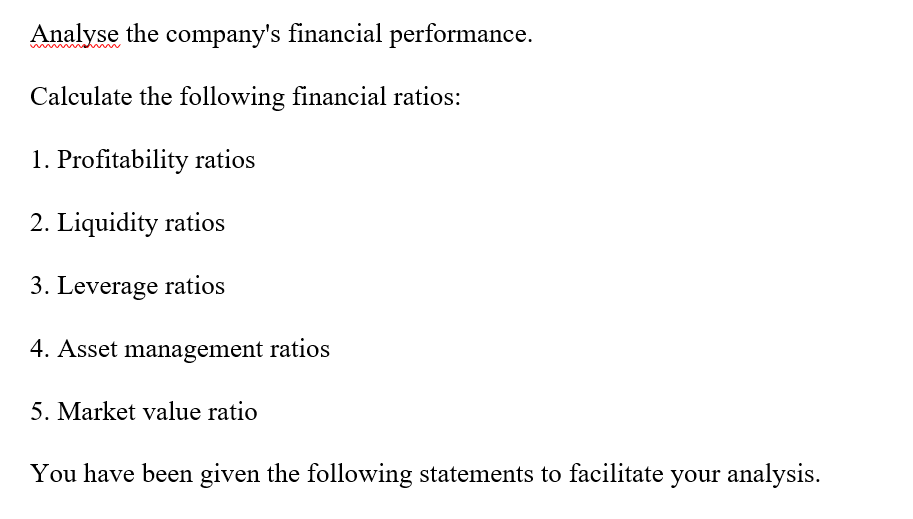

(Balance sheet) (P&L) Analyse the company's financial performance. Calculate the following financial ratios: 1. Profitability ratios 2. Liquidity ratios 3. Leverage ratios 4. Asset management

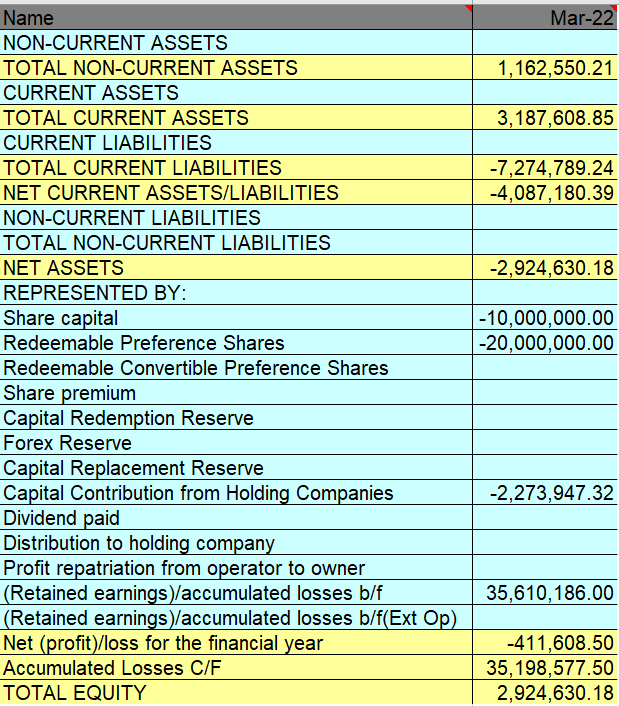

(Balance sheet)

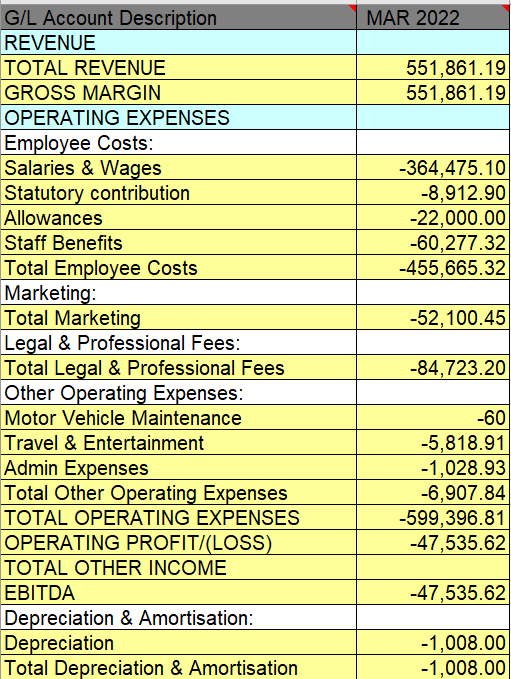

(P&L)

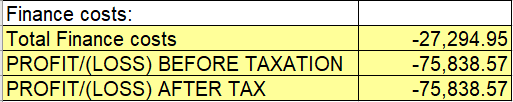

Analyse the company's financial performance. Calculate the following financial ratios: 1. Profitability ratios 2. Liquidity ratios 3. Leverage ratios 4. Asset management ratios 5. Market value ratio You have been given the following statements to facilitate your analysis. \begin{tabular}{l|r} \hline Name & Mar-22 \\ \hline NON-CURRENT ASSETS & \\ \hline TOTAL NON-CURRENT ASSETS & 1,162,550.21 \\ \hline CURRENT ASSETS & \\ \hline TOTAL CURRENT ASSETS & 3,187,608.85 \\ \hline CURRENT LIABILITIES & 7,274,789.24 \\ \hline TOTAL CURRENT LIABILITIES & 4,087,180.39 \\ \hline NET CURRENT ASSETS/LIABILITIES & \\ \hline NON-CURRENT LIABILITIES & 2,924,630.18 \\ \hline TOTAL NON-CURRENT LIABILITIES & \\ \hline NET ASSETS & 10,000,000.00 \\ \hline REPRESENTED BY: & 20,000,000.00 \\ \hline Share capital & \\ \hline Redeemable Preference Shares & \\ \hline Redeemable Convertible Preference Shares & \\ \hline Share premium & 2,273,947.32 \\ \hline Capital Redemption Reserve & \\ \hline Capital Replacement Reserve & 35,198,577.50 \\ \hline Capital Contribution from Holding Companies & 2,924,630.18 \end{tabular} Finance costs: \begin{tabular}{|l|r|} \hline Total Finance costs & 27,294.95 \\ \hline PROFIT/(LOSS) BEFORE TAXATION & 75,838.57 \\ \hline PROFIT/(LOSS) AFTER TAX & 75,838.57 \\ \hline \end{tabular} Analyse the company's financial performance. Calculate the following financial ratios: 1. Profitability ratios 2. Liquidity ratios 3. Leverage ratios 4. Asset management ratios 5. Market value ratio You have been given the following statements to facilitate your analysis. \begin{tabular}{l|r} \hline Name & Mar-22 \\ \hline NON-CURRENT ASSETS & \\ \hline TOTAL NON-CURRENT ASSETS & 1,162,550.21 \\ \hline CURRENT ASSETS & \\ \hline TOTAL CURRENT ASSETS & 3,187,608.85 \\ \hline CURRENT LIABILITIES & 7,274,789.24 \\ \hline TOTAL CURRENT LIABILITIES & 4,087,180.39 \\ \hline NET CURRENT ASSETS/LIABILITIES & \\ \hline NON-CURRENT LIABILITIES & 2,924,630.18 \\ \hline TOTAL NON-CURRENT LIABILITIES & \\ \hline NET ASSETS & 10,000,000.00 \\ \hline REPRESENTED BY: & 20,000,000.00 \\ \hline Share capital & \\ \hline Redeemable Preference Shares & \\ \hline Redeemable Convertible Preference Shares & \\ \hline Share premium & 2,273,947.32 \\ \hline Capital Redemption Reserve & \\ \hline Capital Replacement Reserve & 35,198,577.50 \\ \hline Capital Contribution from Holding Companies & 2,924,630.18 \end{tabular} Finance costs: \begin{tabular}{|l|r|} \hline Total Finance costs & 27,294.95 \\ \hline PROFIT/(LOSS) BEFORE TAXATION & 75,838.57 \\ \hline PROFIT/(LOSS) AFTER TAX & 75,838.57 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started