Answered step by step

Verified Expert Solution

Question

1 Approved Answer

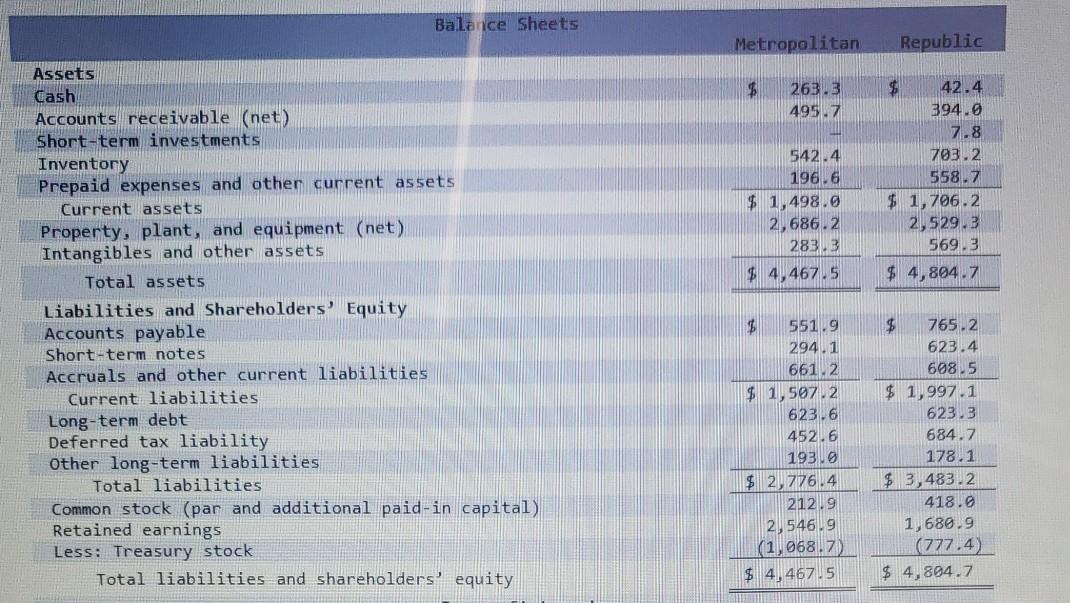

Balance Sheets Metropolitan Republic $ 263.3 495.7 542.4 196.6 $ 1,498.0 2,686.2 283.3 $ 4,467.5 $ 42.4 394.9 7.8 703.2 558.7 $ 1,796.2 2, 529.3

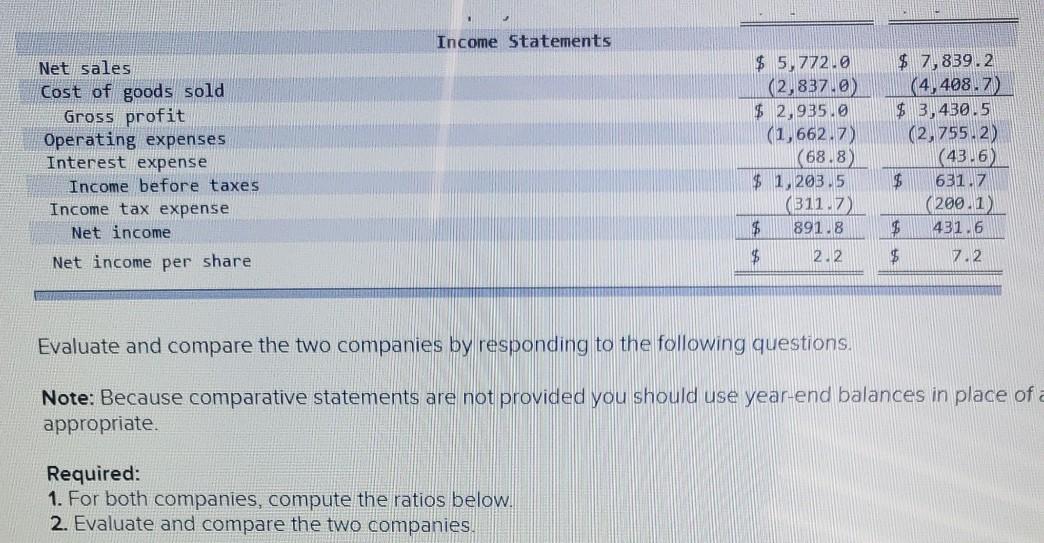

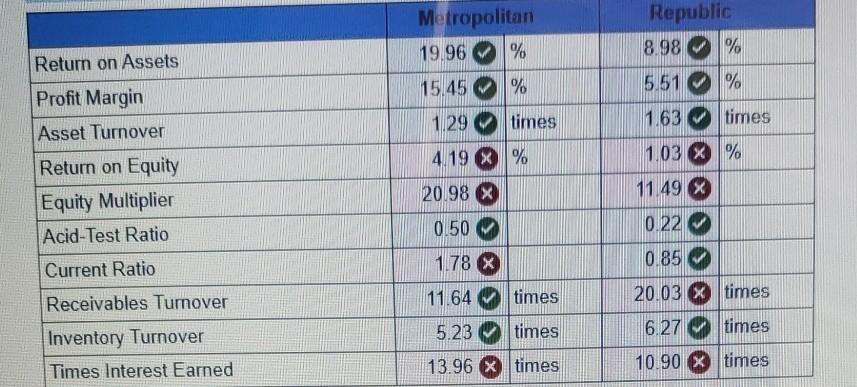

Balance Sheets Metropolitan Republic $ 263.3 495.7 542.4 196.6 $ 1,498.0 2,686.2 283.3 $ 4,467.5 $ 42.4 394.9 7.8 703.2 558.7 $ 1,796.2 2, 529.3 569.3 $ 4,804.7 Assets Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses and other current assets Current assets Property, plant, and equipment (net) Intangibles and other assets Total assets Liabilities and Shareholders' Equity Accounts payable Short-term notes Accruals and other current liabilities Current liabilities Long-term debt Deferred tax liability Other long-term liabilities Total liabilities Common stock (par and additional paid-in capital) Retained earnings Less: Treasury stock Total liabilities and shareholders' equity $ 551.9 294.1 661.2 $1,5072 623.6 452.6 193.0 $ 2,776.4 21219 2,546.9 (1,068.7) $ 4,467.5 $ 765.2 623.4 608.5 $ 1,997.1 623.3 684.7 178.1 $ 3,483.2 418.9 1,680.9 (777.4) $ 4,894.7 Income Statements Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income tax expense Net income Net income per share $ 5,772.0 (2,837.0) $ 2,935.0 (1,662.7) (68.8) $ 1,203.5 (311.7 $ 891.8 $ 2.2 $ 7,839.2 (4 408.7) $ 3,430.5 (2,755.2) (43.6) $ 631.7 (200.1 $ 431.6 $ 7.2 Evaluate and compare the two companies by responding to the following questions. Note: Because comparative statements are not provided you should use year-end balances in place of a appropriate Required: 1. For both companies, compute the ratios below. 2. Evaluate and compare the two companies. Metropolitan 19.96 % Republic 8.98 % Return on Assets 15.45 % 5.51% 1.63 times 1.29 times Profit Margin Asset Turnover Return on Equity Equity Multiplier Acid-Test Ratio 1.03 X % 4.19 X % 20.98 X 11.49 % 0.50 0.22 0.85 Current Ratio 20.03 times Receivables Turnover 1.78 X 11.64 times 5.23 times 13.96 X times 6.27 times Inventory Turnover Times Interest Earned 10.90 x times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started