Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Banana Drinks manufactures banana juice drinks at their facility in Florida, USA. Their facility is quite large and encompasses three main divisions, the juicing

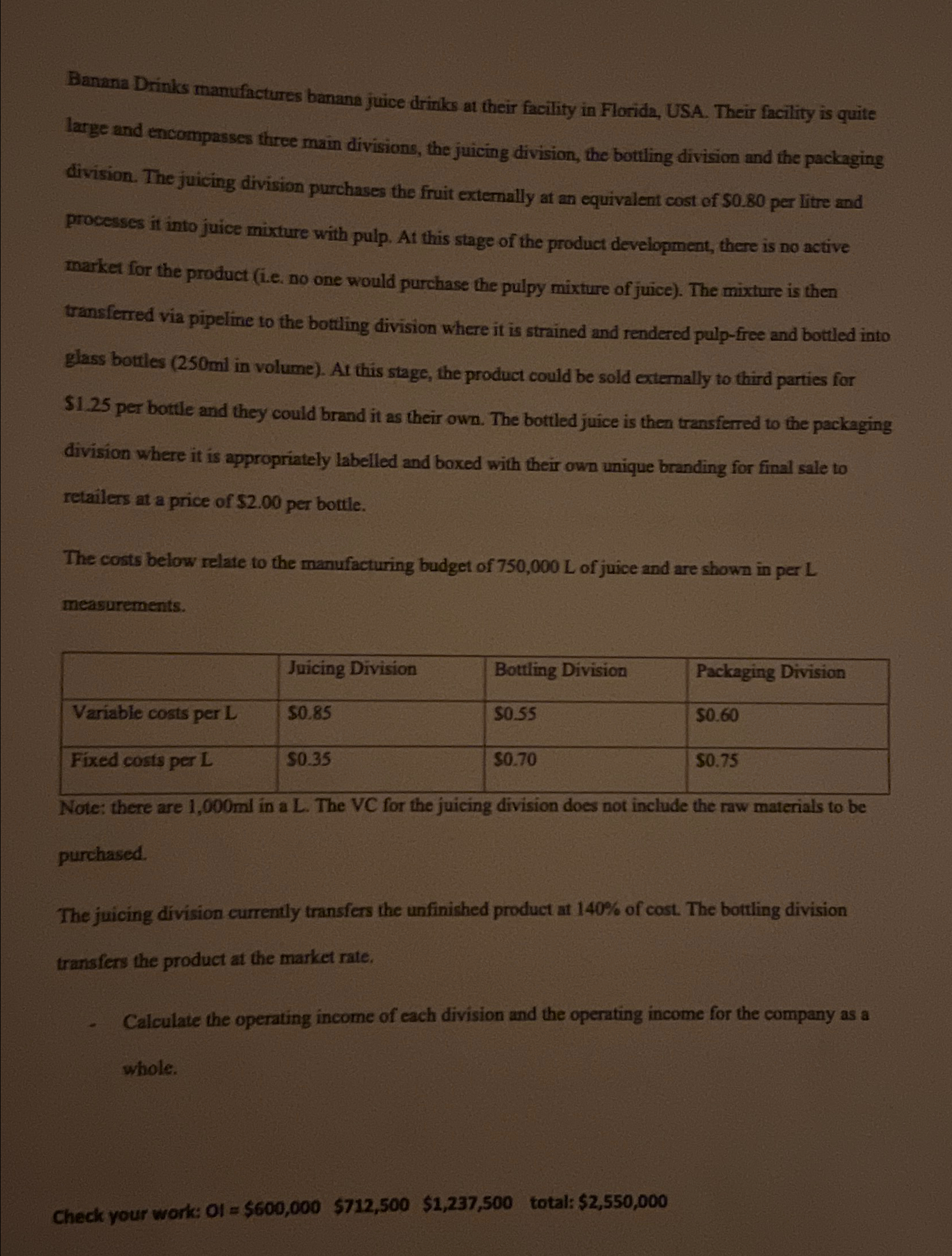

Banana Drinks manufactures banana juice drinks at their facility in Florida, USA. Their facility is quite large and encompasses three main divisions, the juicing division, the bottling division and the packaging division. The juicing division purchases the fruit externally at an equivalent cost of $0.80 per litre and processes it into juice mixture with pulp. At this stage of the product development, there is no active market for the product (i.e. no one would purchase the pulpy mixture of juice). The mixture is then transferred via pipeline to the bottling division where it is strained and rendered pulp-free and bottled into glass bottles (250ml in volume). At this stage, the product could be sold externally to third parties for $1.25 per bottle and they could brand it as their own. The bottled juice is then transferred to the packaging division where it is appropriately labelled and boxed with their own unique branding for final sale to retailers at a price of $2.00 per bottle. The costs below relate to the manufacturing budget of 750,000 L of juice and are shown in per L measurements. Juicing Division Bottling Division Packaging Division Variable costs per L $0.85 $0.55 $0.60 Fixed costs per L $0.35 $0.70 $0.75 Note: there are 1,000ml in a L. The VC for the juicing division does not include the raw materials to be purchased. The juicing division currently transfers the unfinished product at 140% of cost. The bottling division transfers the product at the market rate. Calculate the operating income of each division and the operating income for the company as a whole. Check your work: Ol = $600,000 $712,500 $1,237,500 total: $2,550,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started