Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bananas sells gift cards in $15, $25, and $50 increments. Assume Bananas sells $19.2 million in iTunes gift cards in November, an customers redeem

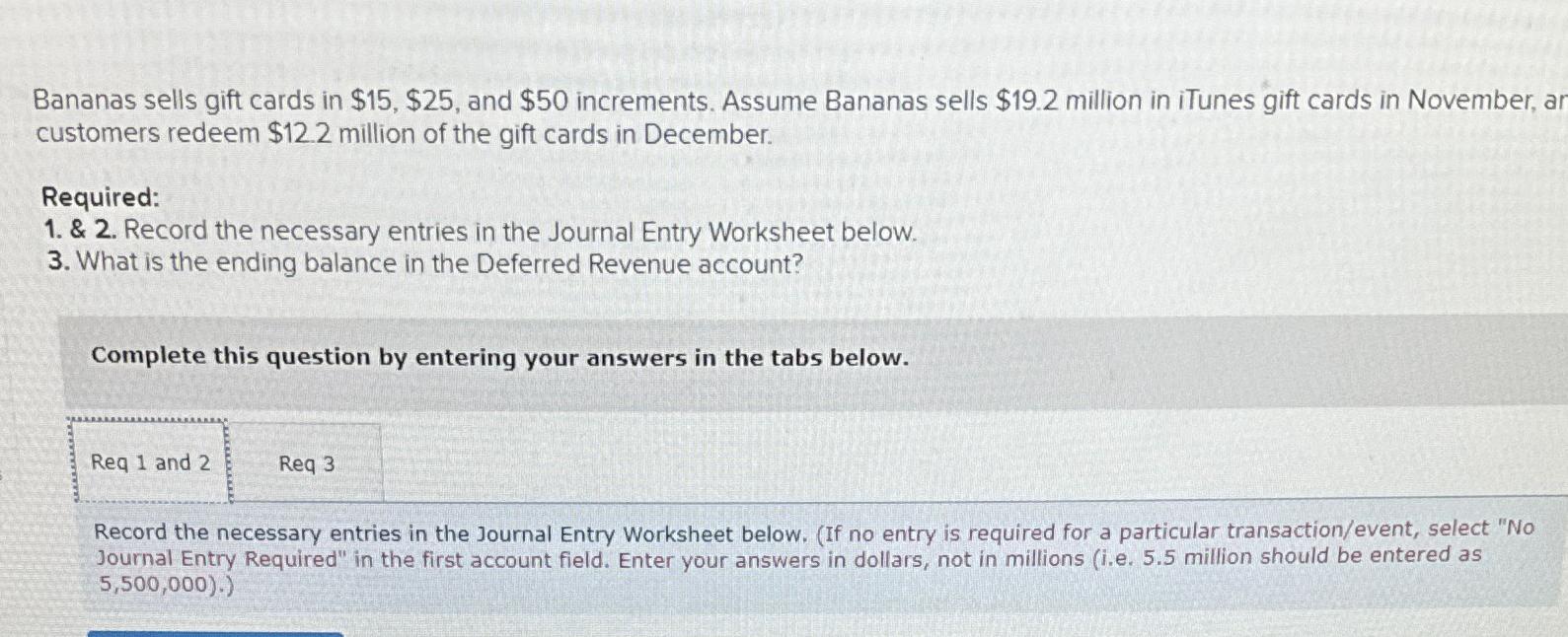

Bananas sells gift cards in $15, $25, and $50 increments. Assume Bananas sells $19.2 million in iTunes gift cards in November, an customers redeem $12.2 million of the gift cards in December. Required: 1. & 2. Record the necessary entries in the Journal Entry Worksheet below. 3. What is the ending balance in the Deferred Revenue account? Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5.5 million should be entered as 5,500,000).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Req 1 2 Journal Entries Transaction Sale of iTunes Gift Cards in November Debit Gift Cards Receivabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d678d5855d_967396.pdf

180 KBs PDF File

663d678d5855d_967396.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started