Banco Mercantil Internacional's Forex Losses Case Study. Need assistance with 1 and 2.

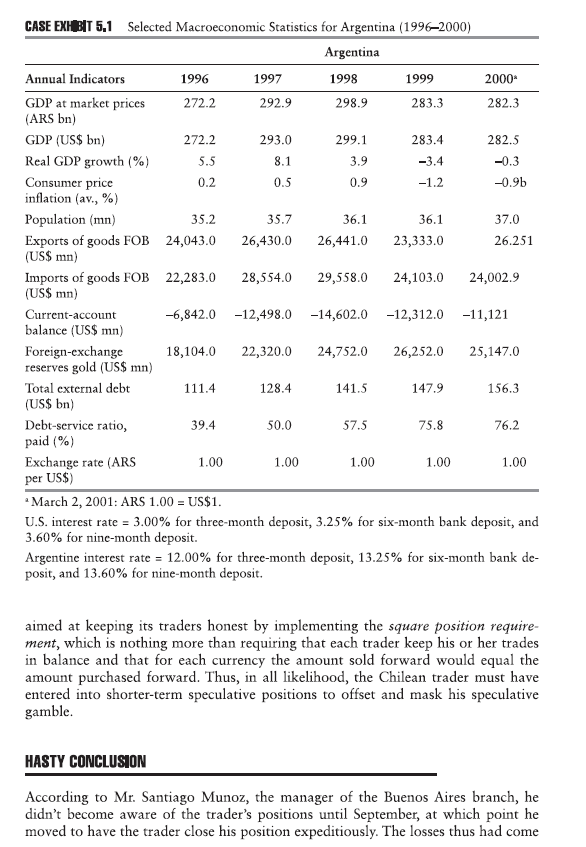

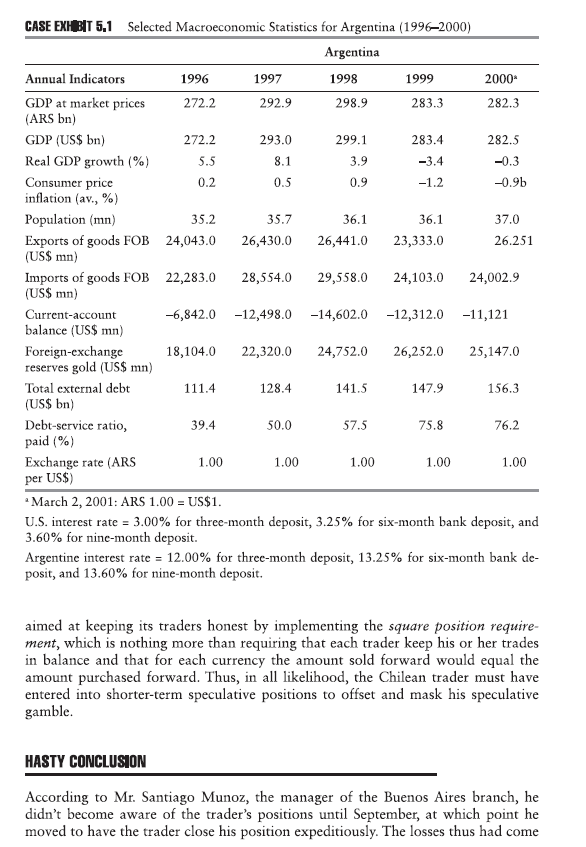

5.1 Banco Mercantil Internacional's Forex Losses This case study accompanies Chapter 5 of International Corporate Finance A speculator is a man who observes the future and acts before it occurs. Bernard Baruch ROGUE TRADER On March 19, 2001, in the heyday of the Argentine currency board of fixed ex- change rates, Banco Mercantil Internacional (BMI)-the second-largest Mexican commercial bank with 177 offices in 11 Latin American countries-announced a loss of US$80 million. The loss was attributed to unauthorized forward speculation on the Argentine peso (ARS) by a Chilean trader in the bank's Buenos Aires branch The amount of the underlying transactions was rumored to be close to US$1.8 bil lion, and initial reports indicated that the losses could be traced to short sales of the U.S. dollar for the Argentine Preliminary accounts indicated that the trader was betting the Argentine peso would not devalue and that the fiscal situation would stabilize. Accordingly, thoe hased Argentine pesos for six and nine months' delivery at respective forward rates of ARS 1.15 and ARS 1.25 US$1, fully expecting that as Argentina restored economic growth, the forward discounts on the peso would narrow.1 Banco Mercantil's officials stated that the trader involved had violated corporate guidelines when he persisted in maintaining an uncovered position in his trading accounts. For trader had purc 5.1 Banco Mercantil Internacional's Forex Losses This case study accompanies Chapter 5 of International Corporate Finance A speculator is a man who observes the future and acts before it occurs. Bernard Baruch ROGUE TRADER On March 19, 2001, in the heyday of the Argentine currency board of fixed ex- change rates, Banco Mercantil Internacional (BMI)-the second-largest Mexican commercial bank with 177 offices in 11 Latin American countries-announced a loss of US$80 million. The loss was attributed to unauthorized forward speculation on the Argentine peso (ARS) by a Chilean trader in the bank's Buenos Aires branch The amount of the underlying transactions was rumored to be close to US$1.8 bil lion, and initial reports indicated that the losses could be traced to short sales of the U.S. dollar for the Argentine Preliminary accounts indicated that the trader was betting the Argentine peso would not devalue and that the fiscal situation would stabilize. Accordingly, thoe hased Argentine pesos for six and nine months' delivery at respective forward rates of ARS 1.15 and ARS 1.25 US$1, fully expecting that as Argentina restored economic growth, the forward discounts on the peso would narrow.1 Banco Mercantil's officials stated that the trader involved had violated corporate guidelines when he persisted in maintaining an uncovered position in his trading accounts. For trader had purc