Answered step by step

Verified Expert Solution

Question

1 Approved Answer

bank recinciliation Questions, Classroom De dation Exercises, Exercises, and Pr blems P9-5C. Ginger Company of Bathurst has a policy of depositing all receipts and making

bank recinciliation

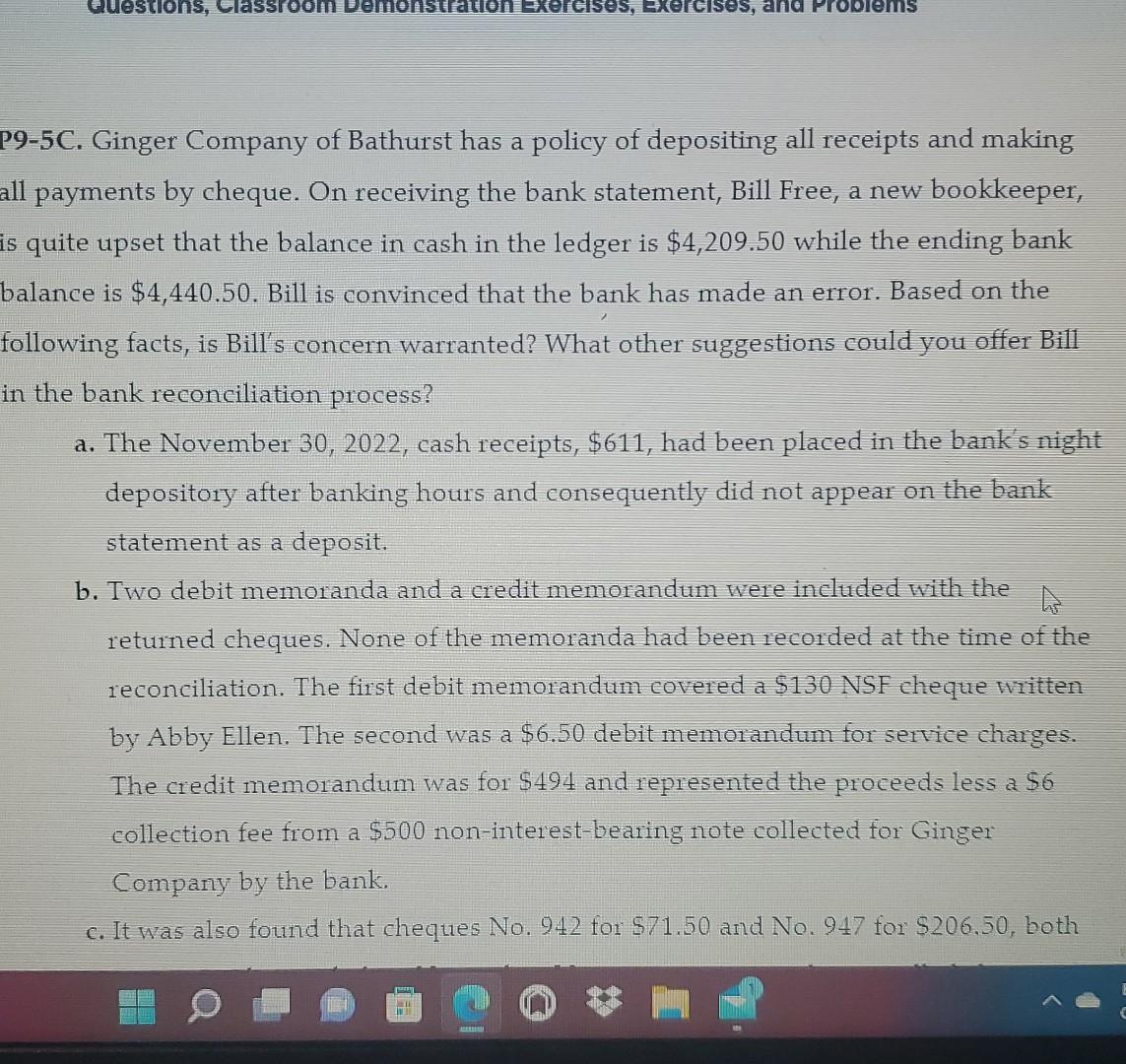

Questions, Classroom De dation Exercises, Exercises, and Pr blems P9-5C. Ginger Company of Bathurst has a policy of depositing all receipts and making all payments by cheque. On receiving the bank statement, Bill Free, a new bookkeeper, is quite upset that the balance in cash in the ledger is $4,209.50 while the ending bank balance is $4,440.50. Bill is convinced that the bank has made an error. Based on the following facts, is Bill's concern warranted? What other suggestions could you offer Bill in the bank reconciliation process? a. The November 30, 2022, cash receipts, $611, had been placed in the bank's night depository after banking hours and consequently did not appear on the bank statement as a deposit. b. Iwo debit memoranda and a credit memorandum were included with the returned cheques. None of the memoranda had been recorded at the time of the reconciliation. The first debit memorandum covered a $130 NSF cheque written by Abby Ellen. The second was a $6.50 debit memorandum for service charges. The credit memorandum was for S494 and represented the proceeds less a S6 collection fee from a $500 non-interest-bearing note collected for Ginger Company by the bank. c. It was also found that cheques No. 942 for $71.50 and No. 947 for $206.50, both Questions, Classroom De dation Exercises, Exercises, and Pr blems P9-5C. Ginger Company of Bathurst has a policy of depositing all receipts and making all payments by cheque. On receiving the bank statement, Bill Free, a new bookkeeper, is quite upset that the balance in cash in the ledger is $4,209.50 while the ending bank balance is $4,440.50. Bill is convinced that the bank has made an error. Based on the following facts, is Bill's concern warranted? What other suggestions could you offer Bill in the bank reconciliation process? a. The November 30, 2022, cash receipts, $611, had been placed in the bank's night depository after banking hours and consequently did not appear on the bank statement as a deposit. b. Iwo debit memoranda and a credit memorandum were included with the returned cheques. None of the memoranda had been recorded at the time of the reconciliation. The first debit memorandum covered a $130 NSF cheque written by Abby Ellen. The second was a $6.50 debit memorandum for service charges. The credit memorandum was for S494 and represented the proceeds less a S6 collection fee from a $500 non-interest-bearing note collected for Ginger Company by the bank. c. It was also found that cheques No. 942 for $71.50 and No. 947 for $206.50, both

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started