Answered step by step

Verified Expert Solution

Question

1 Approved Answer

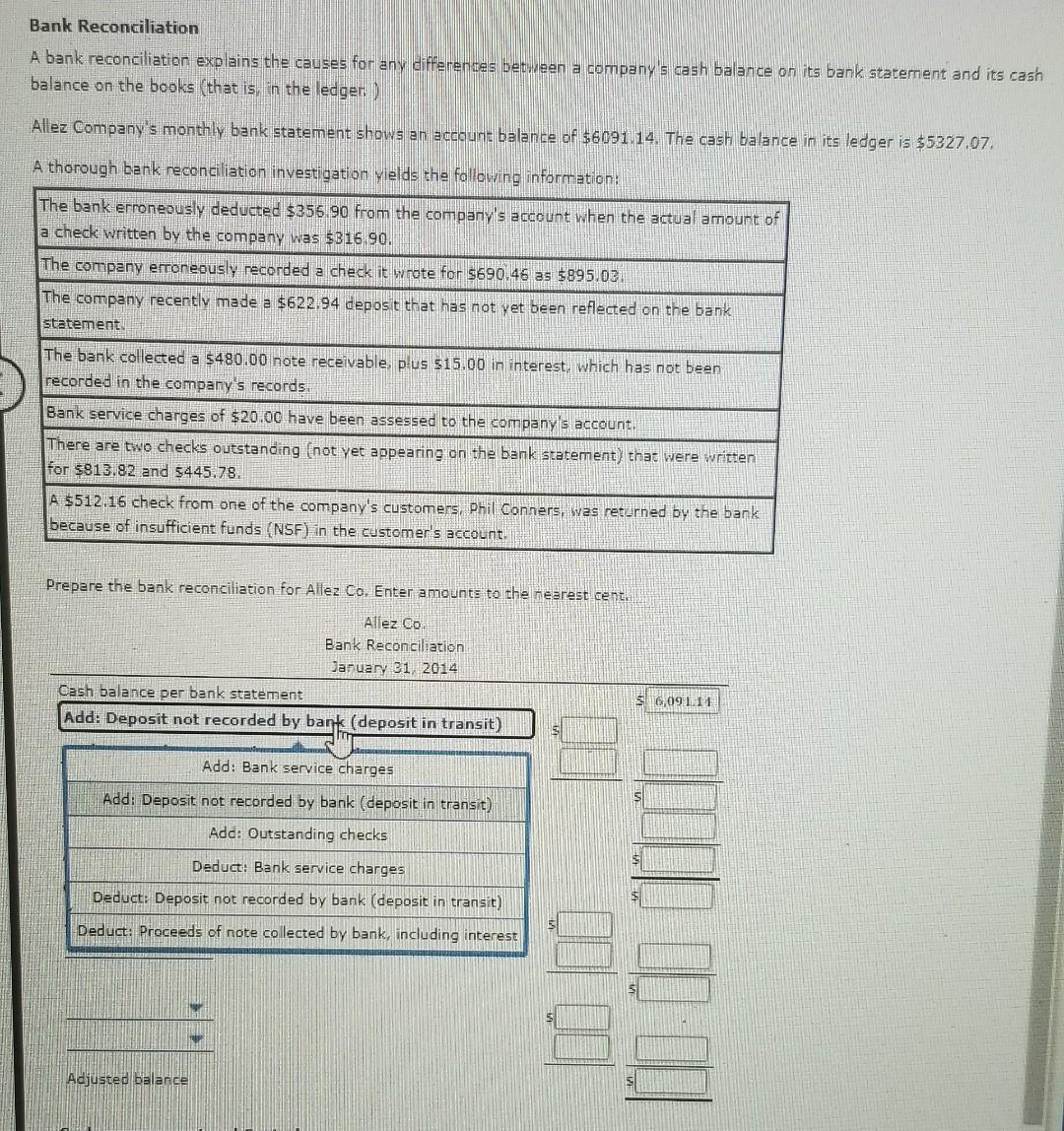

Bank Reconciliation A bank reconciliation explains the causes for any differences between a company's cash balance on its bank statement and its cash balance on

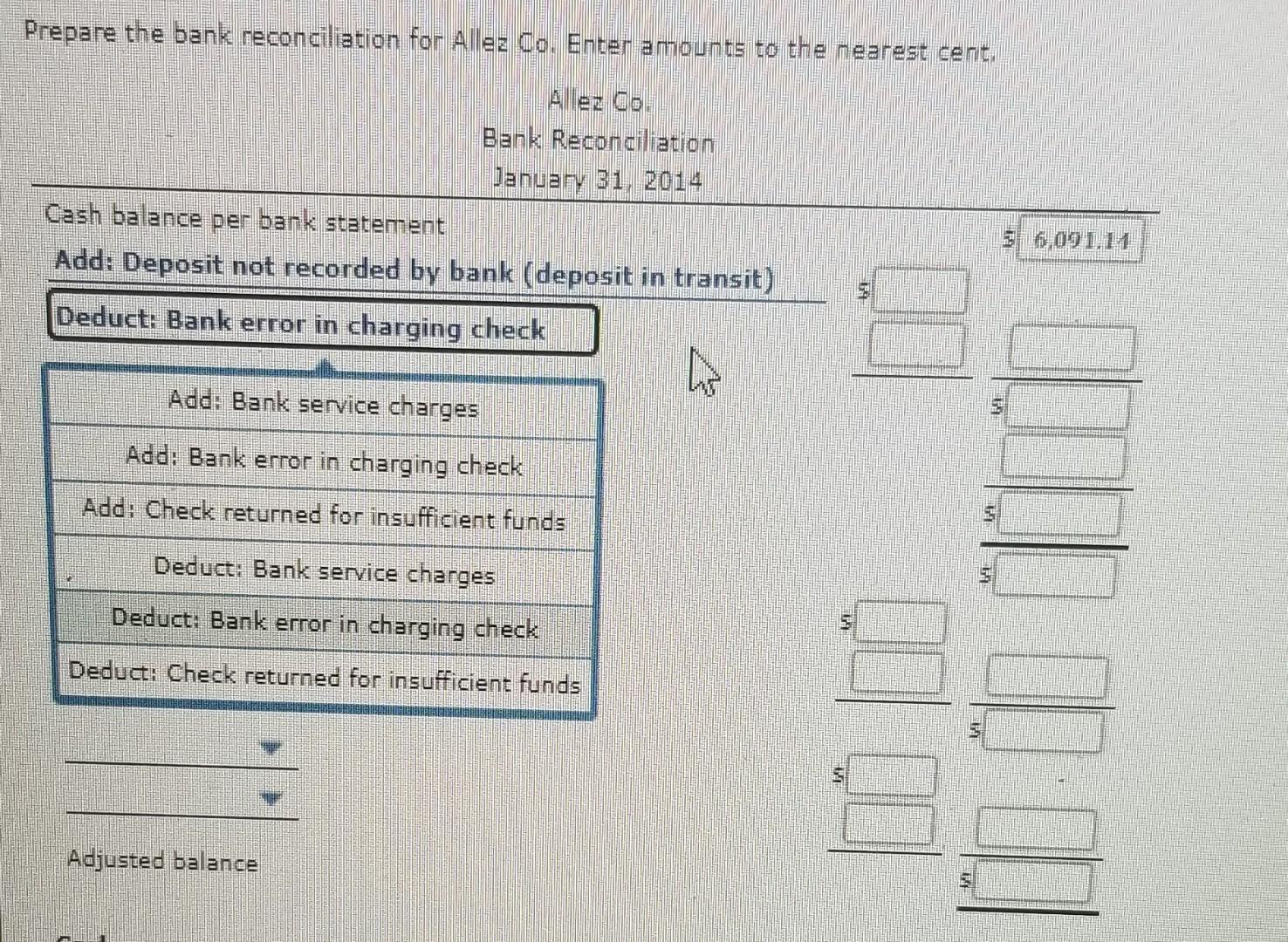

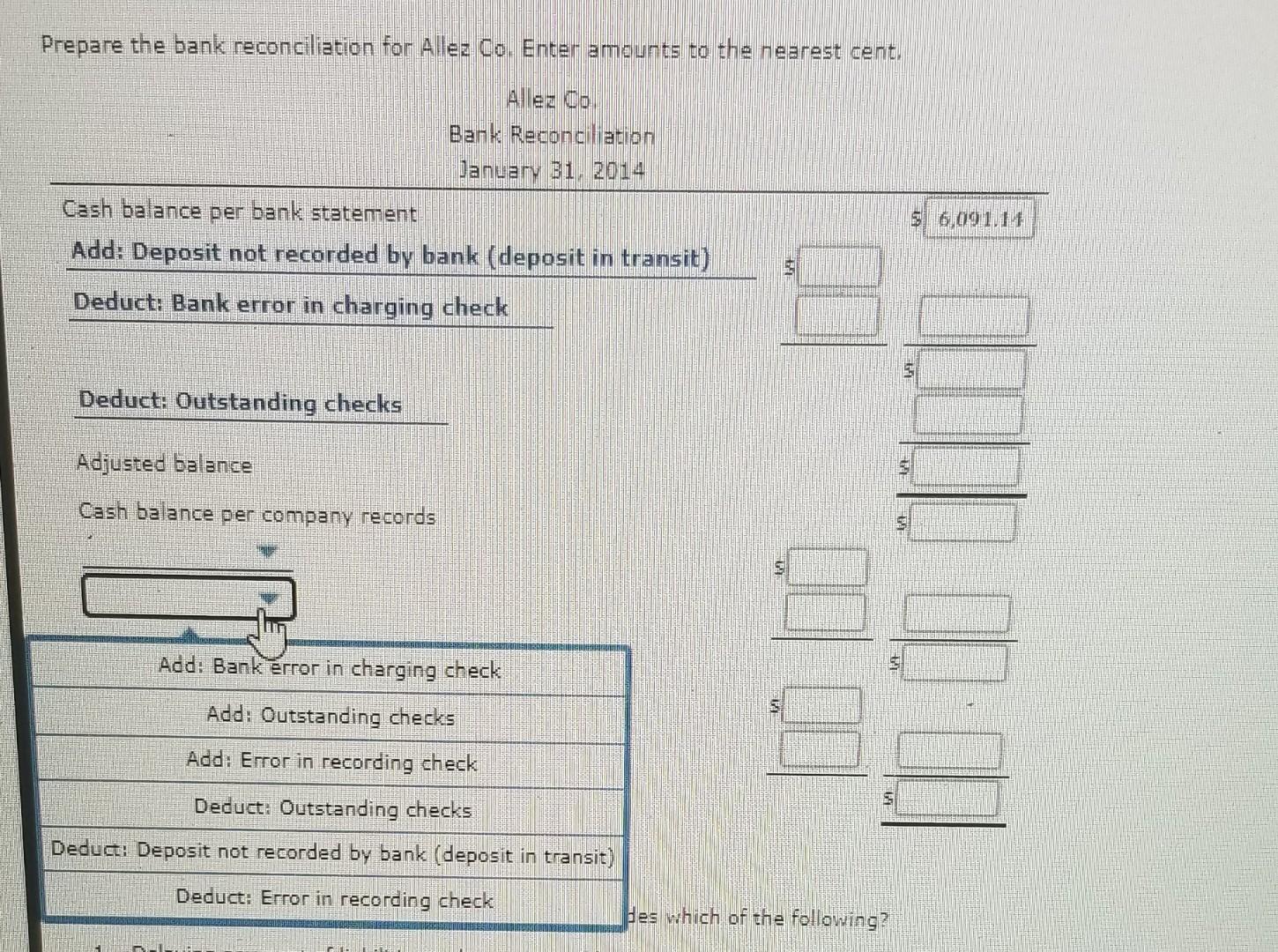

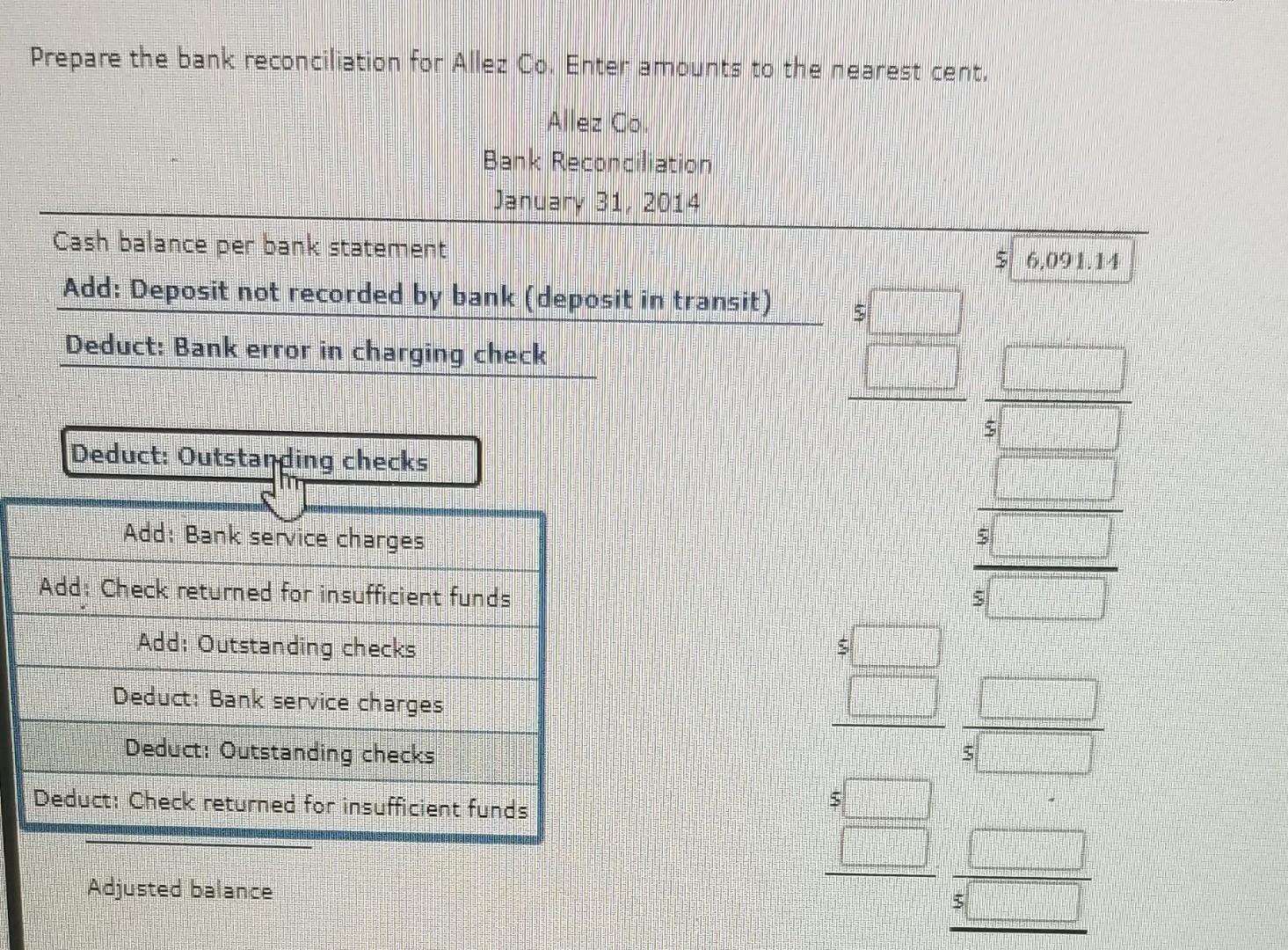

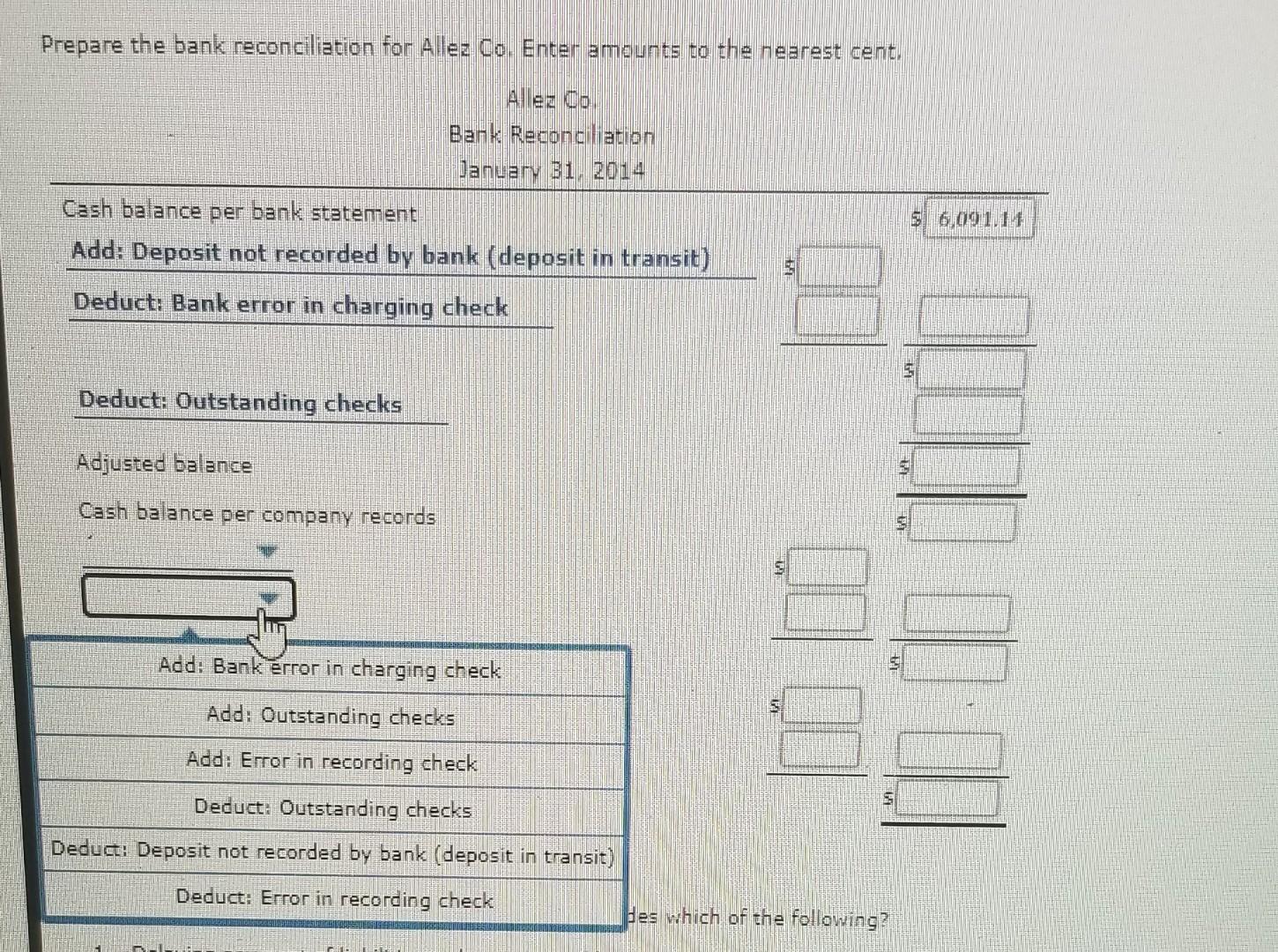

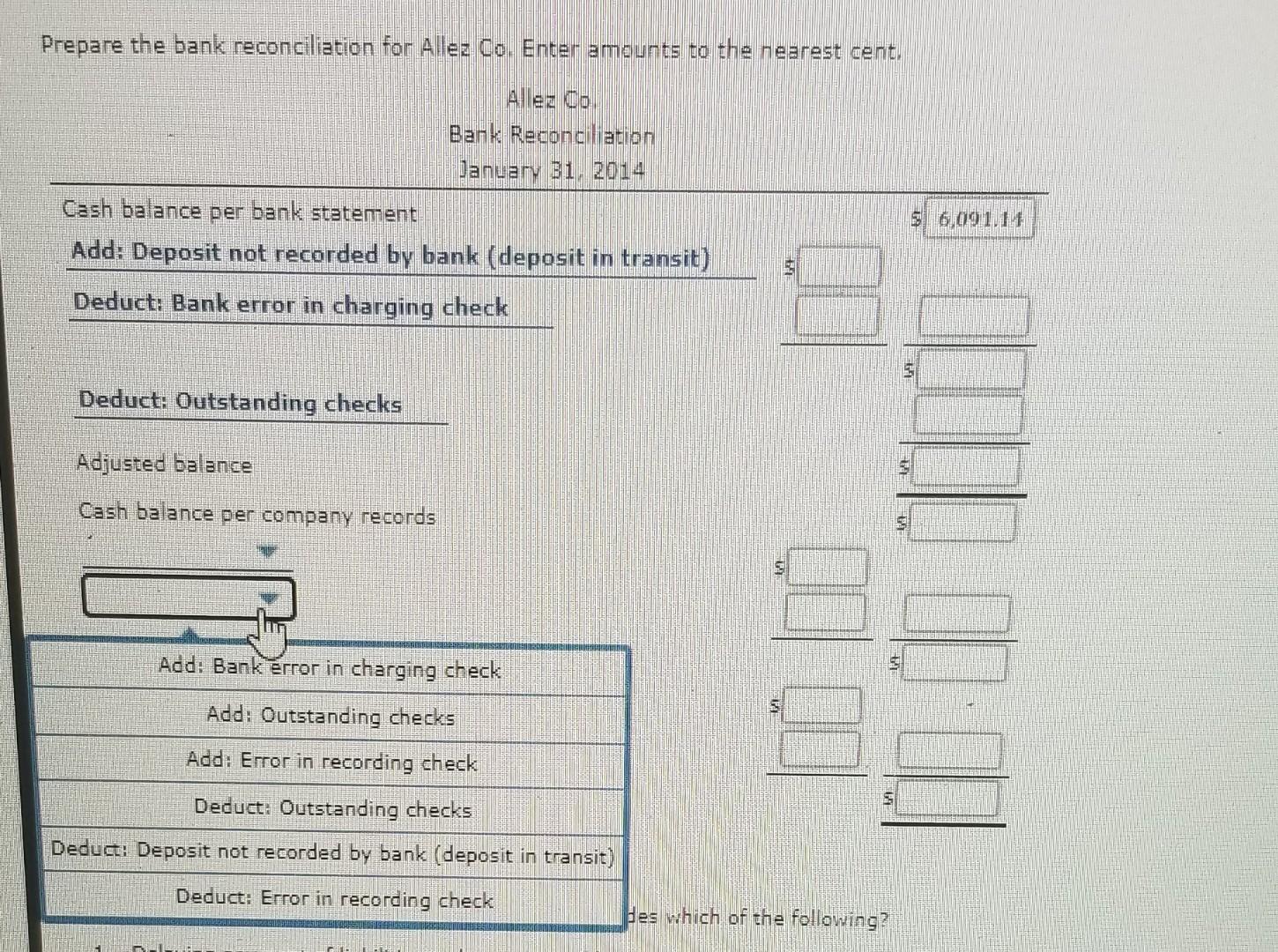

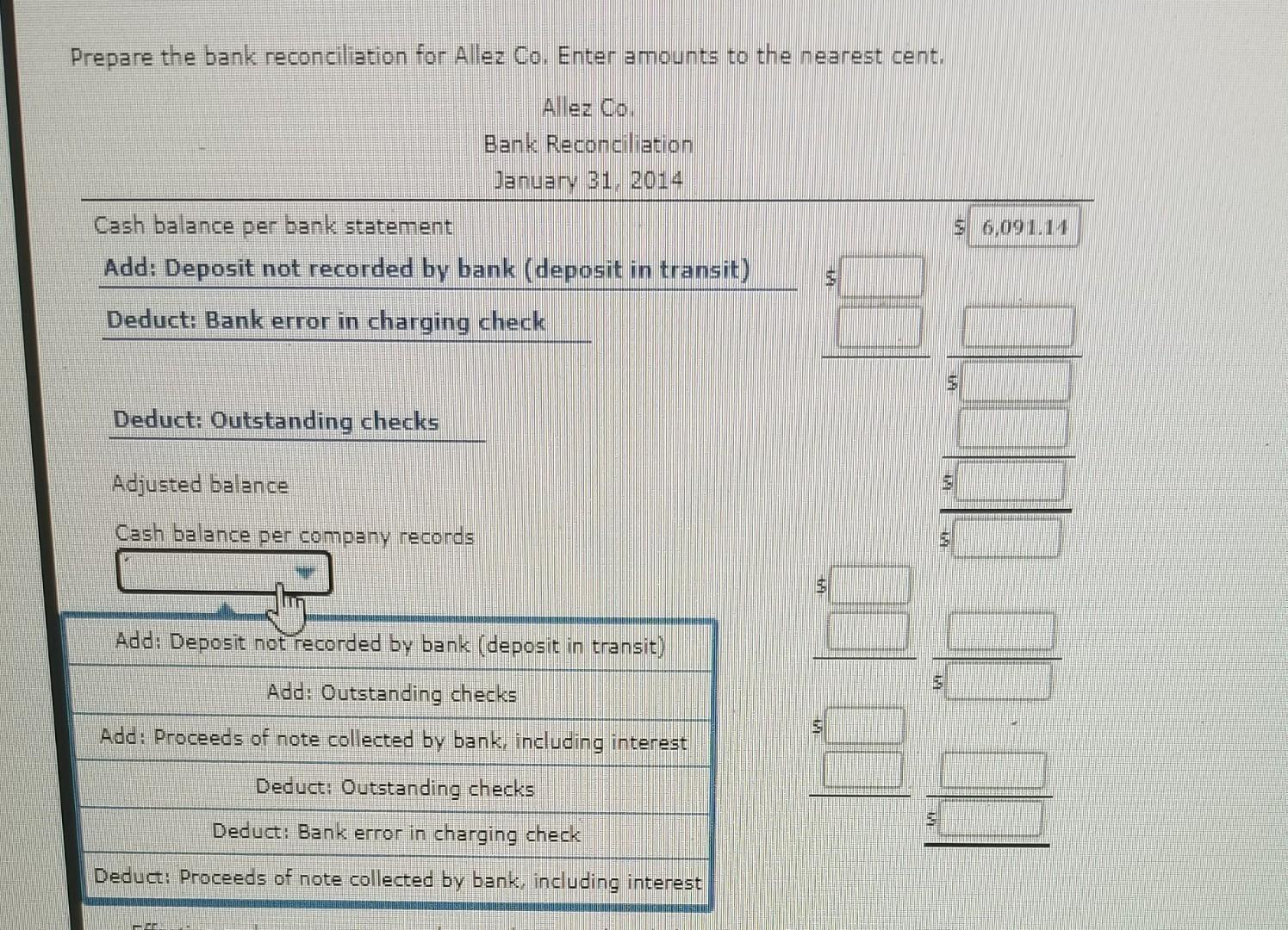

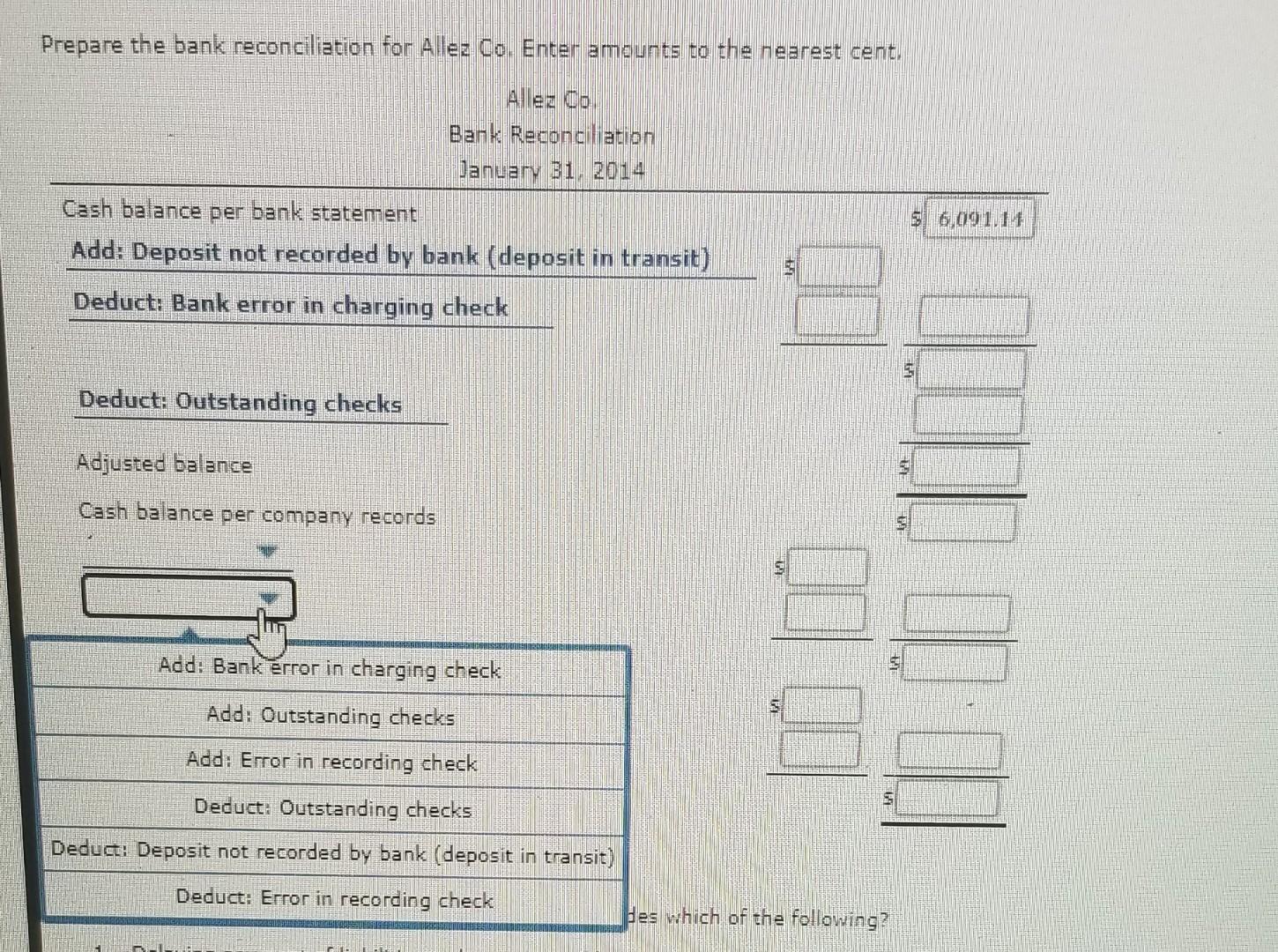

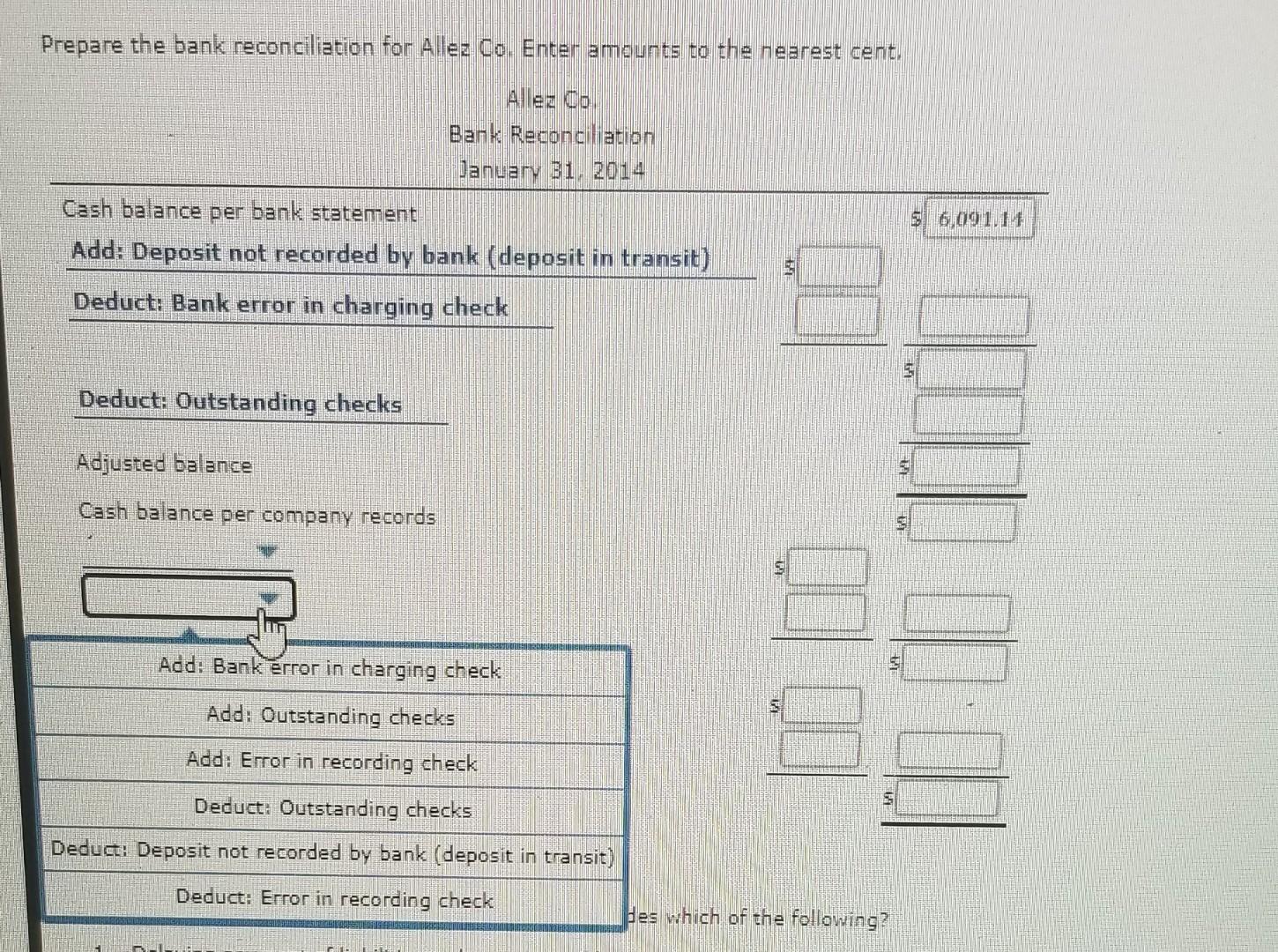

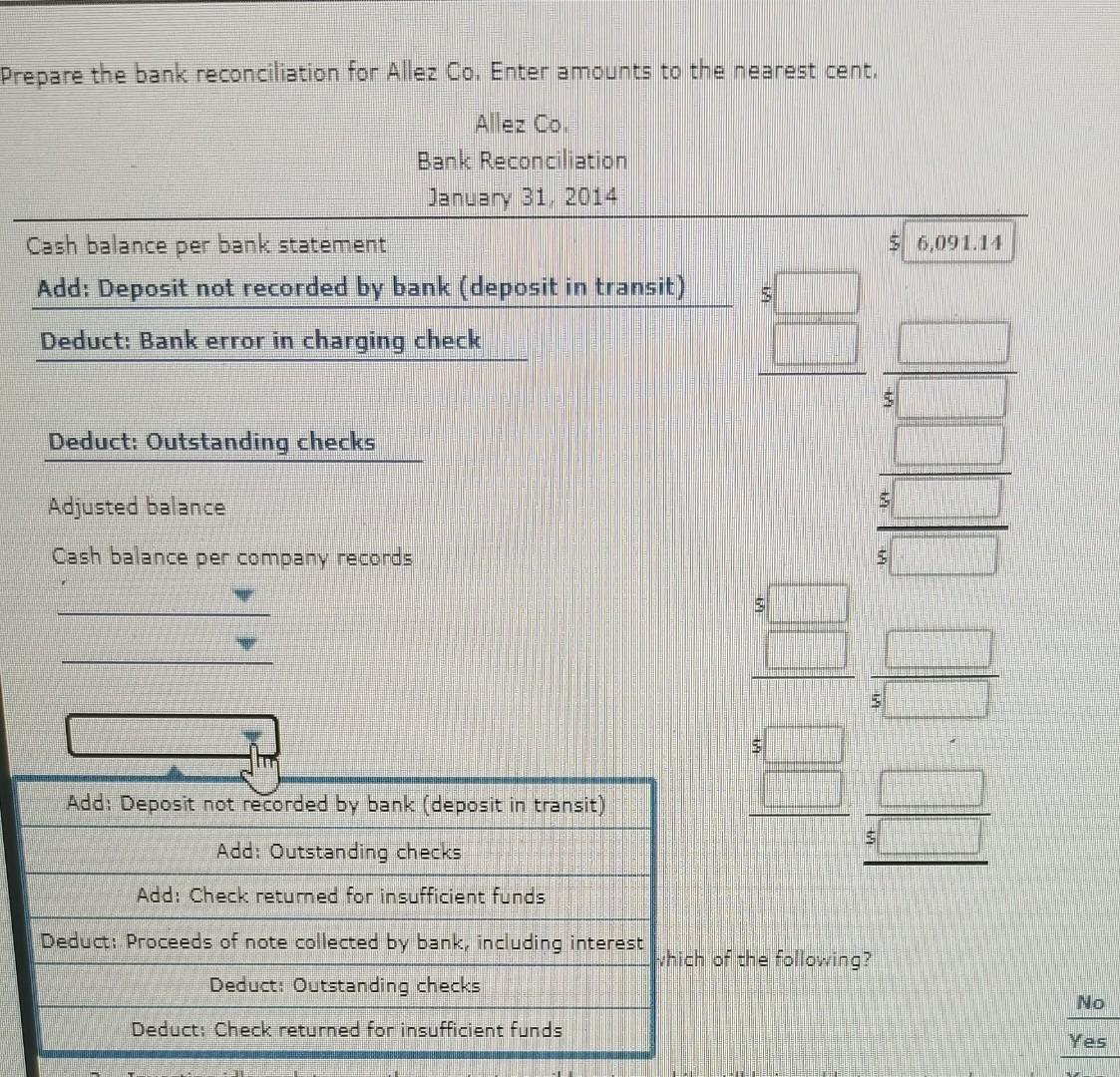

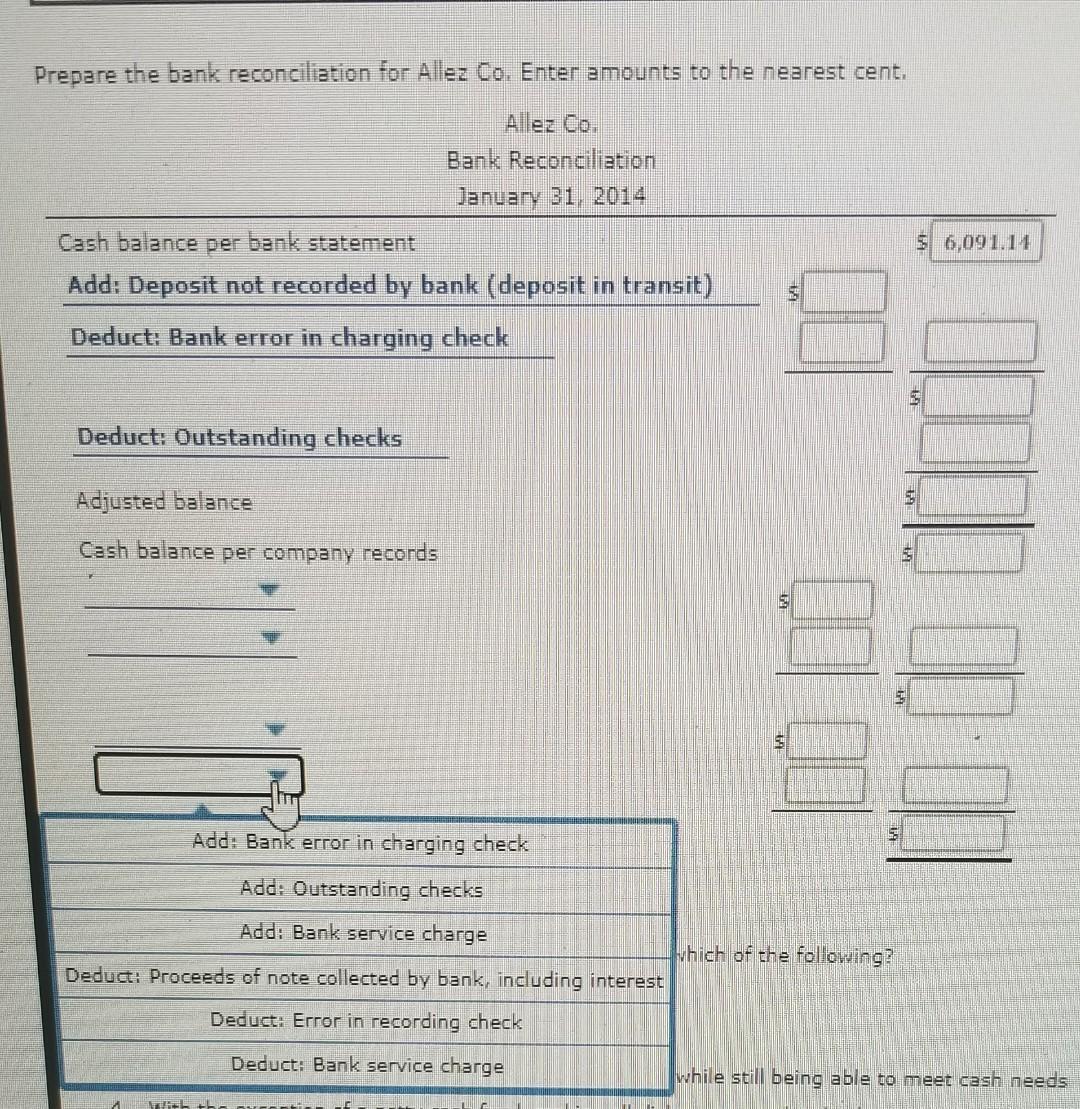

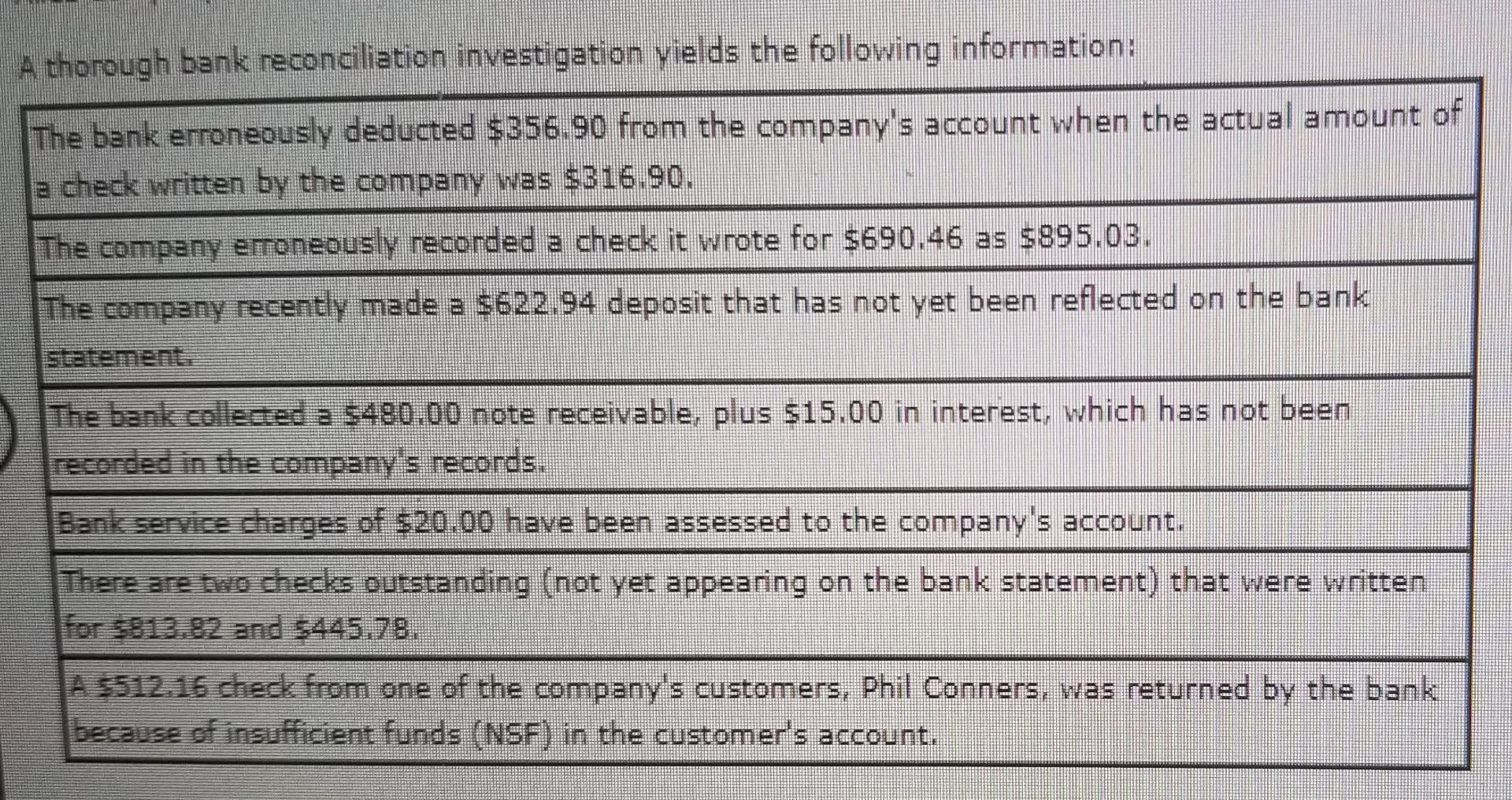

Bank Reconciliation A bank reconciliation explains the causes for any differences between a company's cash balance on its bank statement and its cash balance on the books (that is in the ledger Allez Company's monthly bank statement shows an account balance of $6091 14. The cash balance in its ledger is $5327.07. A thorough bank reconciliation investigation yields the following information: The bank erroneously deducted $356.90 from the company's account when the actual amount of a check written by the company was $316 90. The company erroneously recorded a check it wrote for $690.46 as $895.031 The company recently made a $622.94 deposit that has not yet been reflected on the bank statement The bank collected a $480.00 note receivable, plus 515.00 in interest, which has not been recorded in the company's records, Bank service charges of $20.00 have been assessed to the company's account, There are two checks outstanding (not yet appearing on the bank statement that were written for 5913.82 and 5445.78. A $512.16 check from one of the company's customers, Phil Conners, was returned by the bank because of insufficient funds (NSF) in the customer's account. Prepare the bank reconciliation for Allez Co. Enter amounts to the nearest cent. Allez co Bank Reconciliation January 21, 2014 Cash balance per bank statement Add: Deposit not recorded by bank (deposit in transit) S6,09 1.11 Add: Bank service charges S Add: Deposit not recorded by bank (deposit in transit) Add: Outstanding checks Deduct: Bank service charges $ Deduct: Deposit not recorded by bank (deposit in transit) $ Deduct: Proceeds of note collected by bank, including interest Adjusted balance Prepare the bank reconciliation for Allez co. Enter amounts to the nearest cent. Bank Reconciliation January 31, 2014 Cash balance per bank statement Add: Deposit not recorded by bank (deposit in transit) Deduct: Bank error in charging check Add: Bank service charges Add: Bank error in charging check Add: Check returned for insufficient funds Deduct: Bank service charges Deduct: Bank error in charging check DO Deduct: Check returned for insufficient funds Adjusted balance Prepare the bank reconciliation for Allez Co. Enter amounts to the nearest cent, Allez Co Bank Reconciliation January 31, 2014 Cash balance per bank statement Add: Deposit not recorded by bank (deposit in transit) Deduct: Bank error in charging check Deduct: Outstanding checks Adjusted balance Cash balance per company records U Add: Bank error in charging check Add: Outstanding checks Add: Error in recording check S Deduct: Outstanding checks Deduct: Deposit not recorded by bank (deposit in transit) Deduct: Error in recording check Hes which of the following? Prepare the bank reconciliation for Allez Co. Enter amounts to the nearest cent, Allez 06. Bank Reconciliation January 31, 2014 Cash balance per bank statement Add: Deposit not recorded by bank (deposit in transit) Deduct: Bank error in charging check Deduct: Outstanding checks Add: Bank service charges Add: Check returned for insufficient funds Add: Outstanding checks Deduct: Bank service charges Deduct: Outstanding checks Deduct: Check returned for insufficient funds 10 Adjusted balance Prepare the bank reconciliation for Allez Co. Enter amounts to the nearest cent. Allez Co. Bank Reconciliation January 31, 2014 Cash balance per bank statement Add: Deposit not recorded by bank (deposit in transit) Deduct: Bank error in charging check Deduct: Outstanding checks Adjusted balance Cash balance per company records Add: Deposit not recorded by bank (deposit in transit) 5 Add: Outstanding checks Add: Proceeds of note collected by bank, including interest Deduct: Outstanding checks Deduct: Bank error in charging check Deduct: Proceeds of note collected by bank, including interest Prepare the bank reconciliation for Allez Co. Enter amounts to the nearest cent. Allez Co Bank Reconciliation January 31, 2014 Cash balance per bank statement Add: Deposit not recorded by bank (deposit in transit) 6,09111 Deduct: Bank error in charging check Deduct: Outstanding checks Adjusted balance Cash balance per company records Add: Deposit not recorded by bank (deposit in transit) Add: Outstanding checks Add: Check returned for insufficient funds Deduct: Proceeds of note collected by bank, including interest Which of the following? Deduct: Outstanding checks NO Deduct: Check returned for insufficient funds Ves Prepare the bank reconciliation for Allez Co. Enter amounts to the nearest cent. Bank Reconciliation January 31, 2014 Cash balance per bank statement Add: Deposit not recorded by bank (deposit in transit) Deduct: Bank error in charging check $ 6,091.14 Deduct: Outstanding checks Adjusted balance Cash balance per company records Add: Bank error in charging check Add: Outstanding checks Add: Bank service charge Which of the following? Deduct: Proceeds of note collected by bank, including interest Deduct: Error in recording check Deduct: Bank service charge while still being able to meet cash needs A thorough bank reconciliation investigation yields the following information: The bank erroneously deducted $356.90 from the company's account when the actual amount of a check written by the company was $316.90. The company erroneously recorded a check it wrote for $690.46 as $895.03. The company recently made a $622.94 deposit that has not yet been reflected on the bank The bank collected a $480.00 note receivable, plus $15.00 in interest, which has not been recorded in the company's records. Bank service charges of $20.00 have been assessed to the company's account. There are two checks outstanding (not yet appearing on the bank statement) that were written for $813.82 and $445.78. A $312.16 check from one of the company's customers, Phil Conners, was returned by the bank because of insufficient funds (NSF) in the customer's account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started