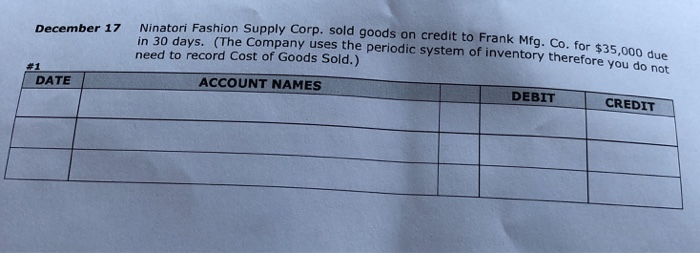

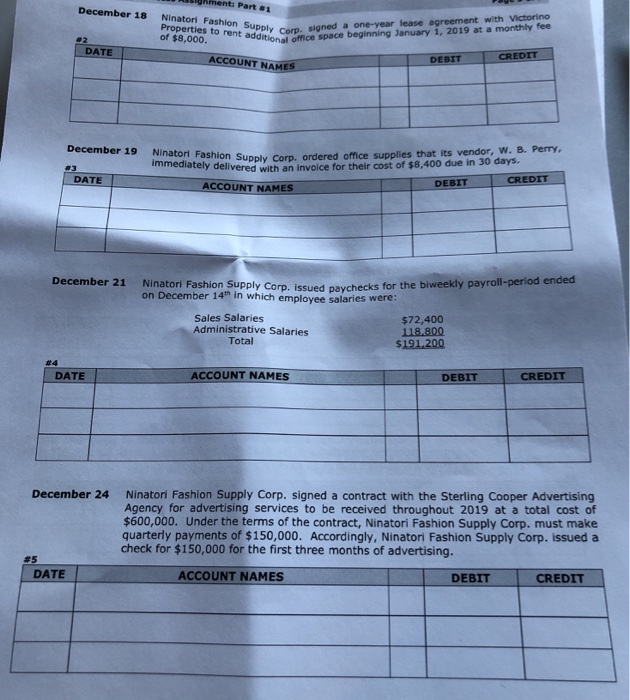

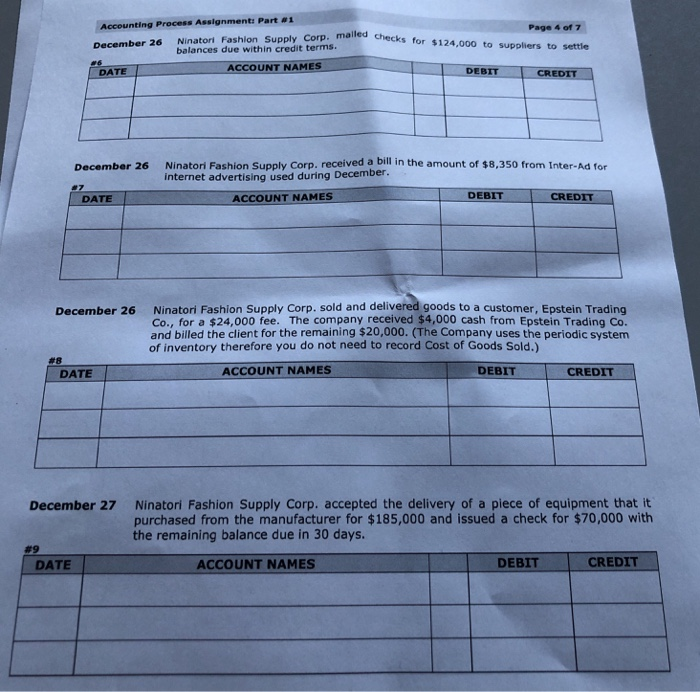

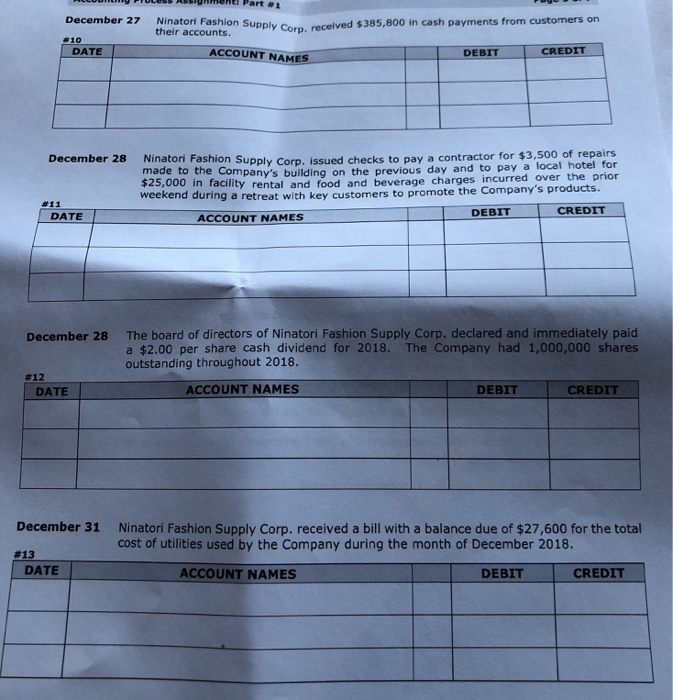

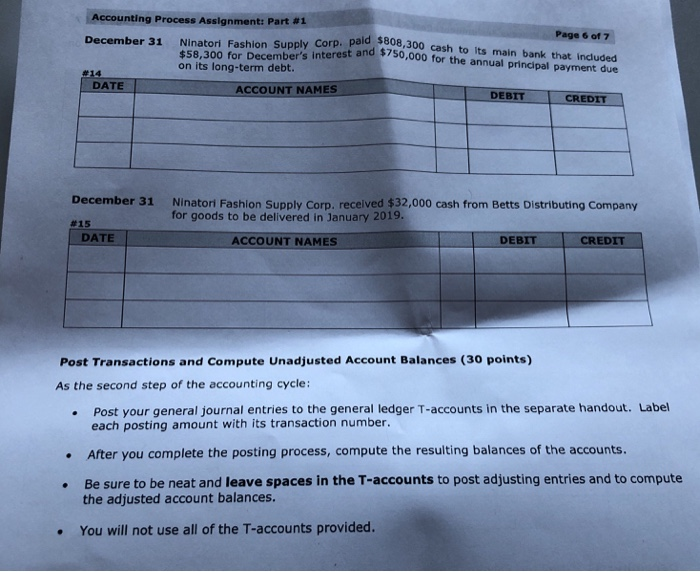

Ninatori Fashion Supply Corp. sold goods on credit to Frank Mfg. Co. in 30 days. (The Company uses the periodic system of inventory therefore you need to record Cost of Goods Sold.) for $35,000 due do not December 17 #1 DATE ACCOUNT NAMES DEBIT CREDIT gnment : Part #1 December 18 Ninatori Fashion corp. Properties to rent additional of $8,000. upply Corp. signed a one-year lease agreement with Victorino onal office space beginning January 1, 2019 at a monthly fee DATE ACCOUNT NAMES CREDIT DEBIT December 19 Ninatori Fashion Corp. delivered with an ACCOUNT NAMES immediatelply Corp. ordered office supplies that its vendor, w. B. Perry. red with an invoice for their cost of $8,400 due in 30 days. #3 DATE CREDIT DEBIT December 21 Ninatori Fashion Supply paychecks December 14m inCorp issued paychecks for the biweekly payroll-period ended Sales Salaries Administrative Salaries $72,400 118.800 $191.200 Total DATE ACCOUNT NAMES -DEBIT CREDIT Ninatori Fashion Supply Corp. signed a contract with the Sterling Cooper Advertising Agency for advertising services to be received throughout 2019 at a total cost of $600,000. Under the terms of the contract, Ninatori Fashion Supply Corp. must make quarterly payments of $150,000. Accordingly, Ninatori Fashion Supply Corp. issued a check for $150,000 for the first three months of advertising December 24 #5 DEBIT CREDIT DATE ACCOUNT NAMES Accounting Process Assignment: Part #1 Page 4 of 7 mailed checks for $124,000 to suppliers to settle December 26 Ninatori Fashion Supply Corp. balances due within credit terms. ACCOUNT NAMES DEBIT DATE CREDIT Ninatori Fashion Supply Corp. received a bill in the amount of $8,350 from Inter-Ad for internet advertising used during December. December 26 DATE ACCOUNT NAMES DEBIT CREDIT Ninatori Fashion Supply Corp. sold and delivered goods to a customer, Epstein Trading Co., for a $24,000 fee. The company received $4,000 cash from Epstein Trading Co. and billed the client for the remaining $20,000. (The Company uses the periodic system of inventory therefore you do not need to record Cost of Goods Sold.) December 26 #8 DATE ACCOUNT NAMES DEBIT CREDIT Ninatori Fashion Supply Corp. accepted the delivery of a piece of equipment that it purchased from the manufacturer for $185,000 and issued a check for $70,000 with the remaining balance due in 30 days December 27 #9 DATE ACCOUNT NAMES DEBIT CREDIT December 27 Ninatori Fashion Supply Coro. recei their accounts. ved $385,800 in cash payments from customers on #10 DATE ACCOUNT NAMES DEBIT CREDIT Ninatori Fashion Supply Corp. issued checks to pay a contractor for $3,500 of repairs December 28 made to the Company's building on the previous day and to pay a local hoter r $25,000 in facility rental and food and beverage charges incurre d over the prior weekend during a retreat with key customers to promote the Company's products. #11 DEBIT CREDIT DATE ACCOUNT NAMES The board of directors of Ninatori Fashion Supply Corp. declared and immediately paid a $2.00 per share cash dividend for 2018. The Company had 1,000,000 shares outstanding throughout 2018. December 28 #12 DATE ACCOUNT NAMES DEBIT CREDIT December 31 Ninatori Fashion Supply Corp. received a bill with a balance due of $27,600 for the total cost of utilities used by the Company during the month of December 2018. #13 DATE ACCOUNT NAMES DEBIT CREDIT Accounting Process Assignment: Part #1 Page 6 of 7 paid $808,300 cash to Its main bank that included 0,000 for the annual principal payment due December 31 Ninatori Fashion Supply Corp. $58,300 for Decembers interest and s750 on its long-term debt. t and $7 #14 DATE ACCOUNT NAMES DEBIT CREDIT December 31 Ninatori Fashion Supply Corp, received $32,000 cash from Betts Distributing Company for goods to be delivered in January 2019. #15 DATE ACCOUNT NAMES DEBIT CREDIT Post Transactions and Compute Unadjusted Account Balances (30 points) As the second step of the accounting cycle: Post your general journal entries to the general ledger T-accounts in the separate handout. Labe each posting amount with its transaction number. After you complete the posting process, compute the resulting balances of the accounts. Be sure to be neat and leave spaces in the T-accounts to post adjusting entries and to compute . the adjusted account balances. You will not use all of the T-accounts provided