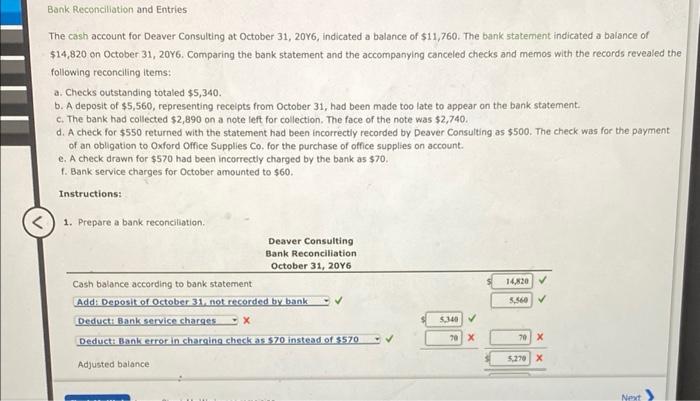

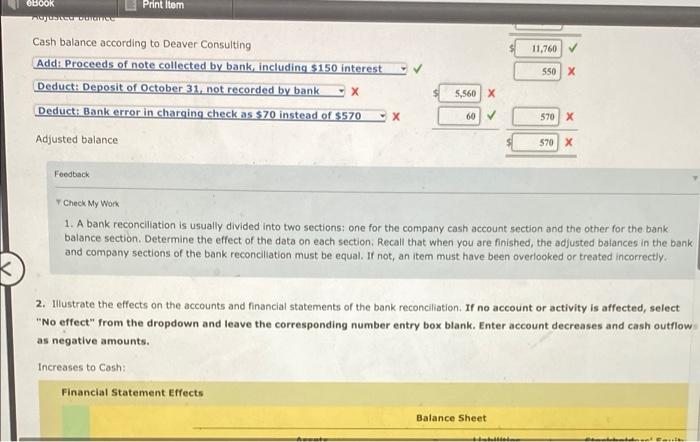

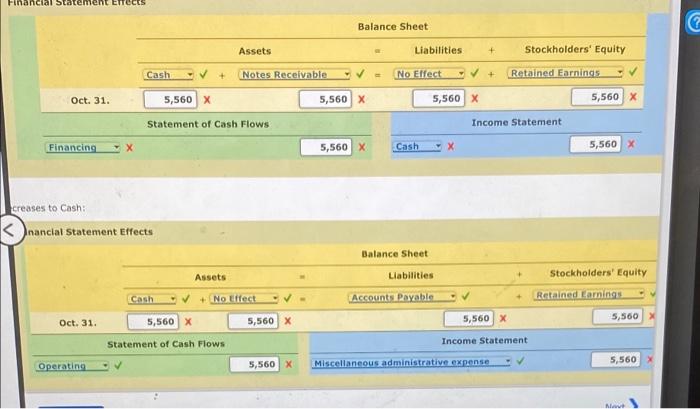

Bank Reconciliation and Entries The cash account for Deaver Consulting at October 31, 2016, Indicated a balance of $11,760. The bank statement indicated a balance of $14,820 on October 31, 2016. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: a. Checks outstanding totaled $5,340. b. A deposit of $5,560, representing receipts from October 31, had been made too late to appear on the bank statement c. The bank had collected $2,890 on a note left for collection. The face of the note was $2,740. d. A check for $550 returned with the statement had been incorrectly recorded by Deaver Consulting as $500. The check was for the payment of an obligation to Oxford Office Supplies Co. for the purchase of office supplies on account. e. A check drawn for $570 had been incorrectly charged by the bank as $70. 1. Bank service charges for October amounted to $60. Instructions: 1. Prepare a bank reconciliation Deaver Consulting Bank Reconciliation October 31, 2016 Cash balance according to bank statement Addi Deposit of October 31, not recorded by bank Deducta Bank service charges X 1207 5.340 Deduct: Bankerror in charging checkias 570 Instead of 5570 70X 70 x 5220 X Adjusted balance Next OBOOK Print Item TAJUL DOCG 11,760 Cash balance according to Deaver Consulting Add: Proceeds of note collected by bank, including $150 interest Deduct: Deposit of October 31, not recorded by bank Deduct: Bank error in charging check as $70 instead of $570 550 X 5,560 X X 60 570 X Adjusted balance 570 X Feedback Check My Work 1. A bank reconciliation is usually divided into two sections: one for the company cash account section and the other for the bank balance section. Determine the effect of the data on each section. Recall that when you are finished, the adjusted balances in the bank and company sections of the bank reconciliation must be equal. If not, an item must have been overlooked or treated incorrectly 2. Mustrate the effects on the accounts and financial statements of the bank reconciliation. If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. Enter account decreases and cash outflow as negative amounts. Increases to Cash Financial Statement Effects Balance Sheet ca. Financial Statement EteCES Balance Sheet G Assets Liabilities + Cash Notes Receivable No Effect Stockholders' Equity Retained Earnings 5,560 Oct. 31. 5,560 X 5,560 X 5,560 x Statement of Cash Flows Income Statement Financing 5,560 X Cash 5,560 x creases to Cash: