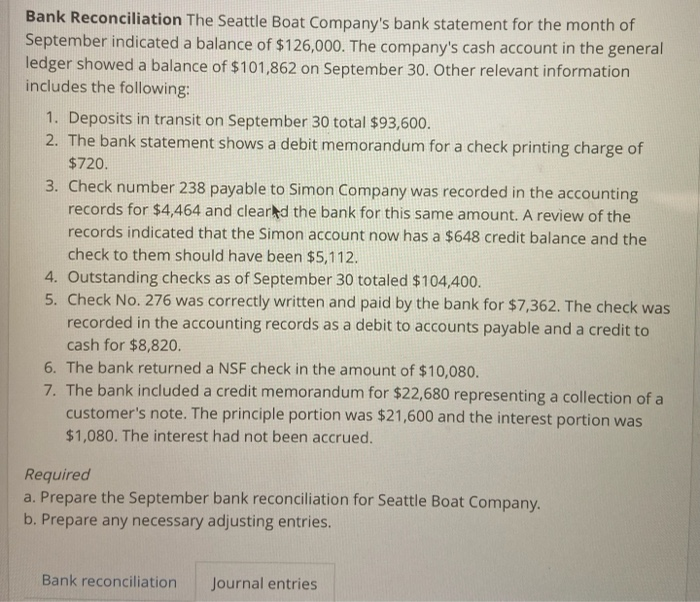

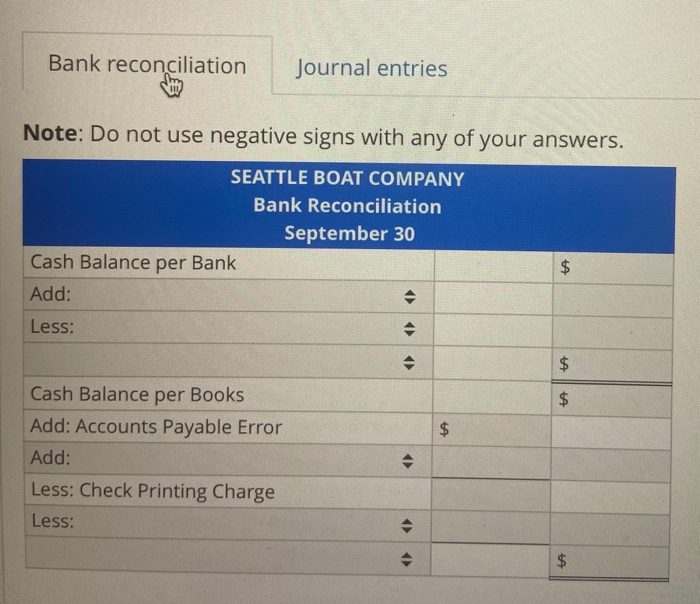

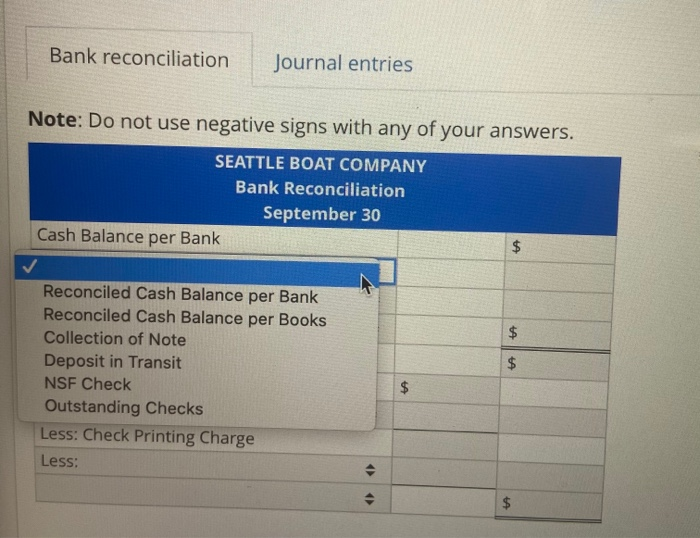

Bank Reconciliation The Seattle Boat Company's bank statement for the month of September indicated a balance of $126,000. The company's cash account in the general ledger showed a balance of $101,862 on September 30. Other relevant information includes the following: 1. Deposits in transit on September 30 total $93,600. 2. The bank statement shows a debit memorandum for a check printing charge of $720. 3. Check number 238 payable to Simon Company was recorded in the accounting records for $4,464 and cleared the bank for this same amount. A review of the records indicated that the Simon account now has a $648 credit balance and the check to them should have been $5,112. 4. Outstanding checks as of September 30 totaled $104,400. 5. Check No. 276 was correctly written and paid by the bank for $7,362. The check was recorded in the accounting records as a debit to accounts payable and a credit to cash for $8,820. 6. The bank returned a NSF check in the amount of $10,080. 7. The bank included a credit memorandum for $22,680 representing a collection of a customer's note. The principle portion was $21,600 and the interest portion was $1,080. The interest had not been accrued. Required a. Prepare the September bank reconciliation for Seattle Boat Company. b. Prepare any necessary adjusting entries. Bank reconciliation Journal entries Bank reconciliation Journal entries Note: Do not use negative signs with any of your answers. SEATTLE BOAT COMPANY Bank Reconciliation September 30 Cash Balance per Bank Add: $ Less: $ ta $ TA Cash Balance per Books Add: Accounts Payable Error Add: Less: Check Printing Charge Less: > > $ Bank reconciliation Journal entries Note: Do not use negative signs with any of your answers. SEATTLE BOAT COMPANY Bank Reconciliation September 30 Cash Balance per Bank A TA $ $ $ Reconciled Cash Balance per Bank Reconciled Cash Balance per Books Collection of Note Deposit in Transit NSF Check Outstanding Checks Less: Check Printing Charge Less: $ $ e $ Bank reconciliation Journahentries GENERAL JOURNAL Description Debit Credit Date Sept 30 $ $ $ > To correct check error in recording check No. 276. 30 Notes Receivable To record note collection by bank. 30 > To record check printing charge. 30 To record check printing charge. 30 > > To record NSF check