Question

Bank XYZ wishes to raise its liabilities by $30m to cover its long-term lending for the next quarter. It can raise the funds via

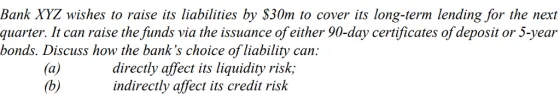

Bank XYZ wishes to raise its liabilities by $30m to cover its long-term lending for the next quarter. It can raise the funds via the issuance of either 90-day certificates of deposit or 5-year bonds. Discuss how the bank's choice of liability can: (a) (b) directly affect its liquidity risk; indirectly affect its credit risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Directly affect its liquidity risk The choice between issuing 90day certificates of deposit and 5year bonds directly affects the banks liquidity ris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations management

Authors: Jay Heizer, Barry Render

10th edition

978-0136119418, 136119417, 978-0132163927

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App