Answered step by step

Verified Expert Solution

Question

1 Approved Answer

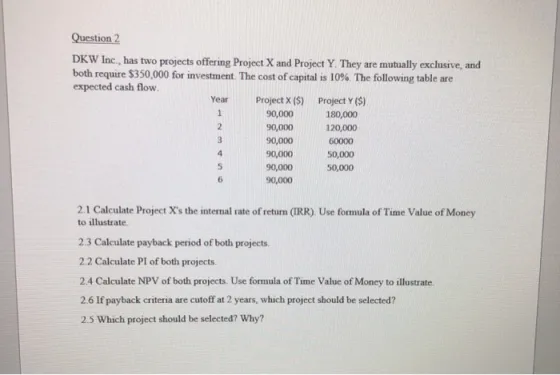

Question 2 DKW Inc., has two projects offering Project X and Project Y. They are mutually exclusive, and both require $350,000 for investment. The

Question 2 DKW Inc., has two projects offering Project X and Project Y. They are mutually exclusive, and both require $350,000 for investment. The cost of capital is 10%. The following table are expected cash flow. Year 1 2 3 4 5 Project X (5) 90,000 90,000 90,000 90,000 90,000 90,000 Project Y ($) 180,000 120,000 60000 50,000 50,000 2.1 Calculate Project X's the internal rate of return (IRR). Use formula of Time Value of Money to illustrate 2.3 Calculate payback period of both projects. 2.2 Calculate PI of both projects. 2.4 Calculate NPV of both projects. Use formula of Time Value of Money to illustrate 2.6 If payback criteria are cutoff at 2 years, which project should be selected? 2.5 Which project should be selected? Why?

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Solution are the steps to solve this question 1 Calculate IRR of Project X using the IRR function in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started