Answered step by step

Verified Expert Solution

Question

1 Approved Answer

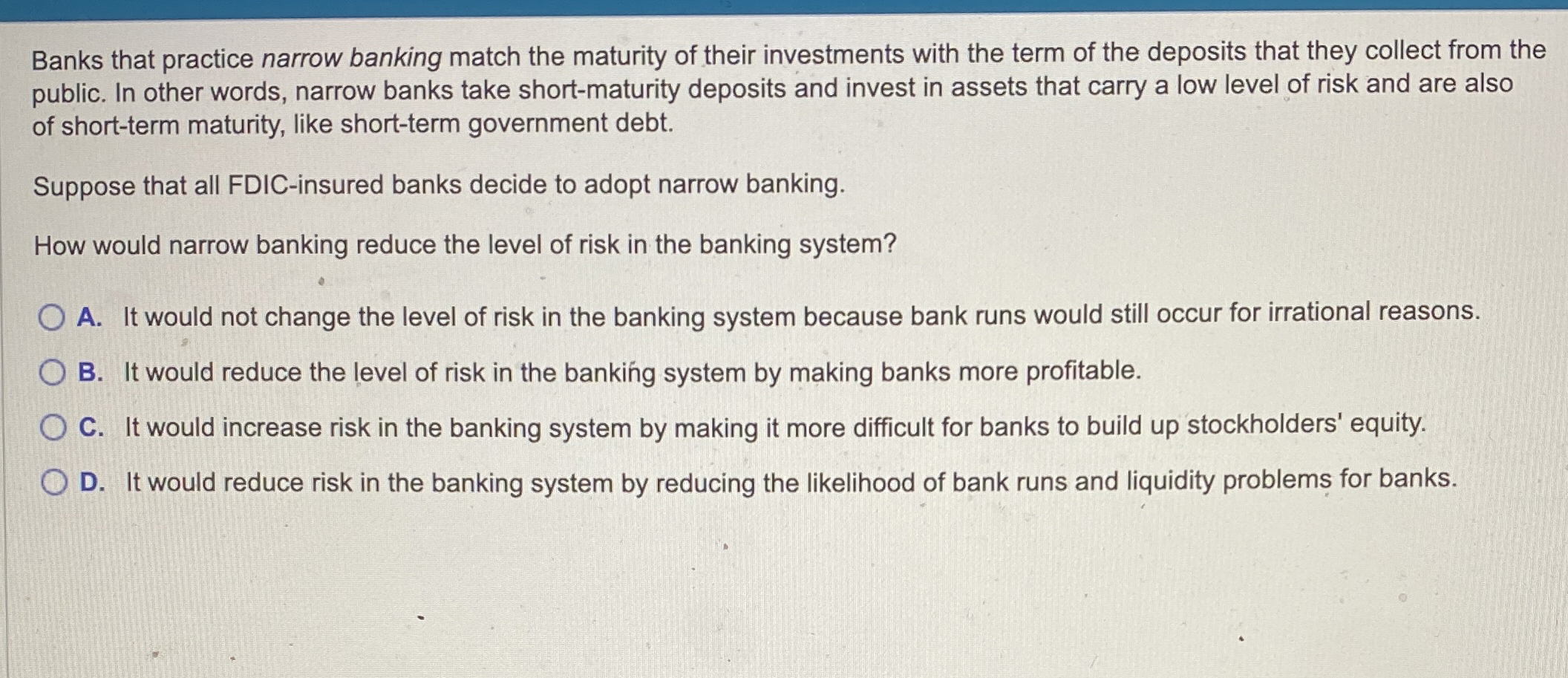

Banks that practice narrow banking match the maturity of their investments with the term of the deposits that they collect from the public. In other

Banks that practice narrow banking match the maturity of their investments with the term of the deposits that they collect from the public. In other words, narrow banks take shortmaturity deposits and invest in assets that carry a low level of risk and are also of shortterm maturity, like shortterm government debt.

Suppose that all FDICinsured banks decide to adopt narrow banking.

How would narrow banking reduce the level of risk in the banking system?

A It would not change the level of risk in the banking system because bank runs would still occur for irrational reasons.

B It would reduce the level of risk in the banking system by making banks more profitable.

C It would increase risk in the banking system by making it more difficult for banks to build up stockholders' equity.

D It would reduce risk in the banking system by reducing the likelihood of bank runs and liquidity problems for banks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started