Answered step by step

Verified Expert Solution

Question

1 Approved Answer

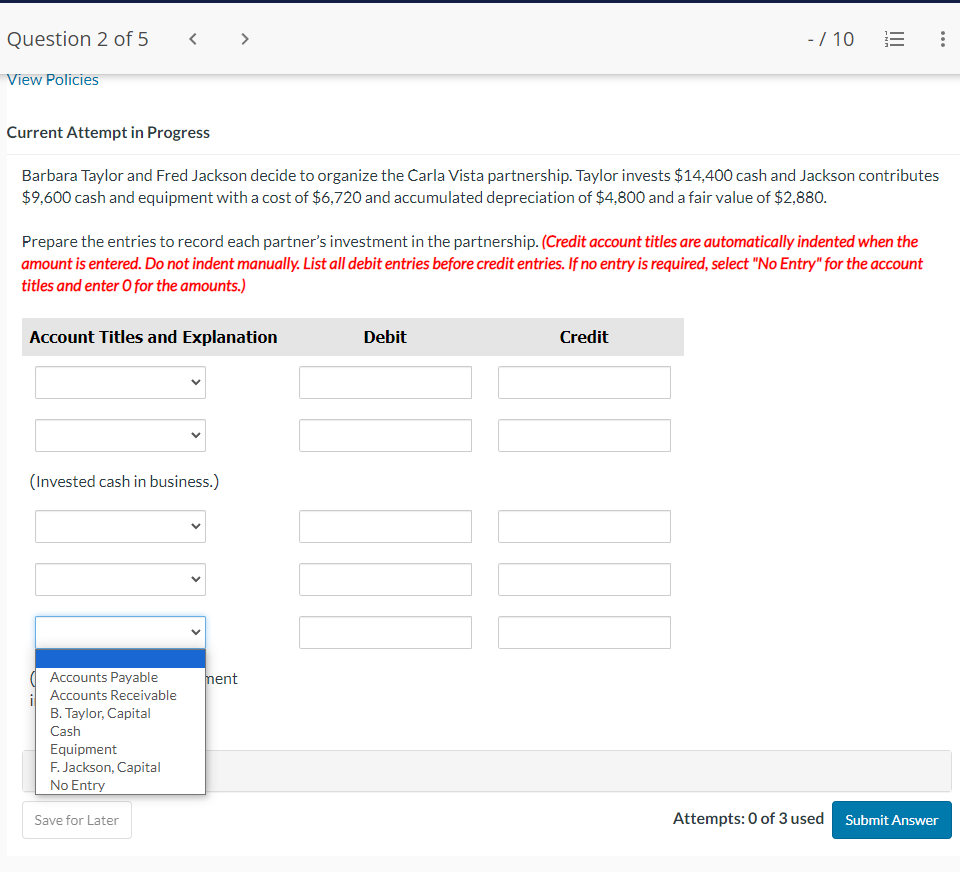

Barbara Taylor and Fred Jackson decide to organize the Carla Vista partnership. Taylor invests $14,400 cash and Jackson contributes $9,600 cash and equipment with a

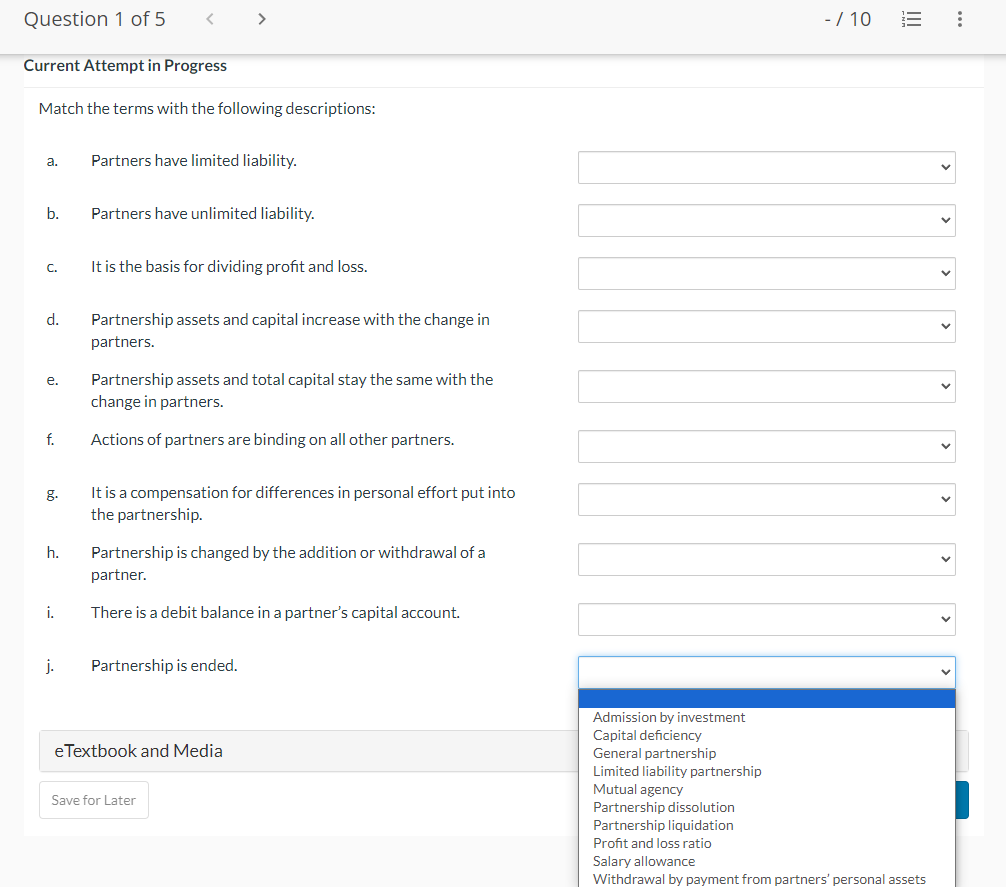

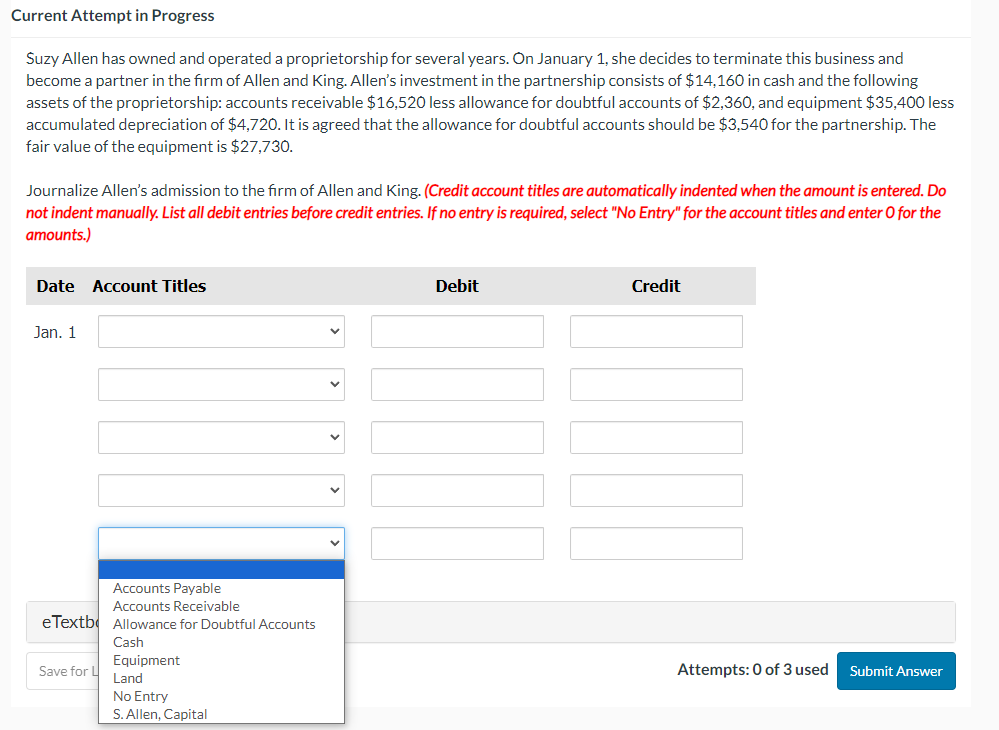

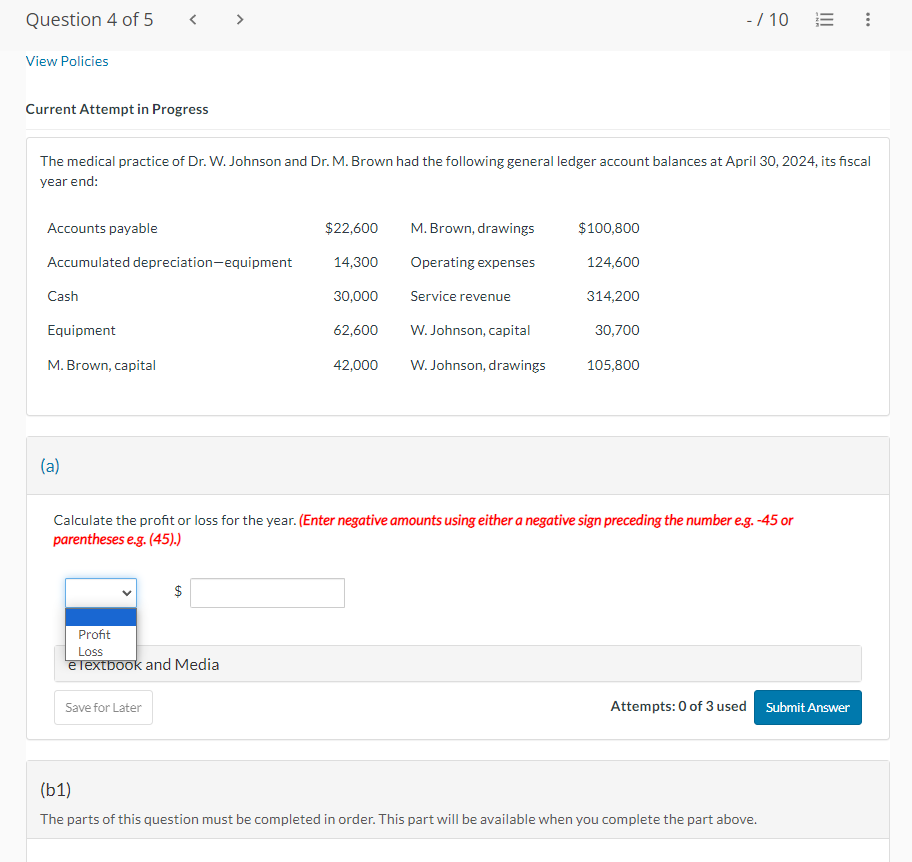

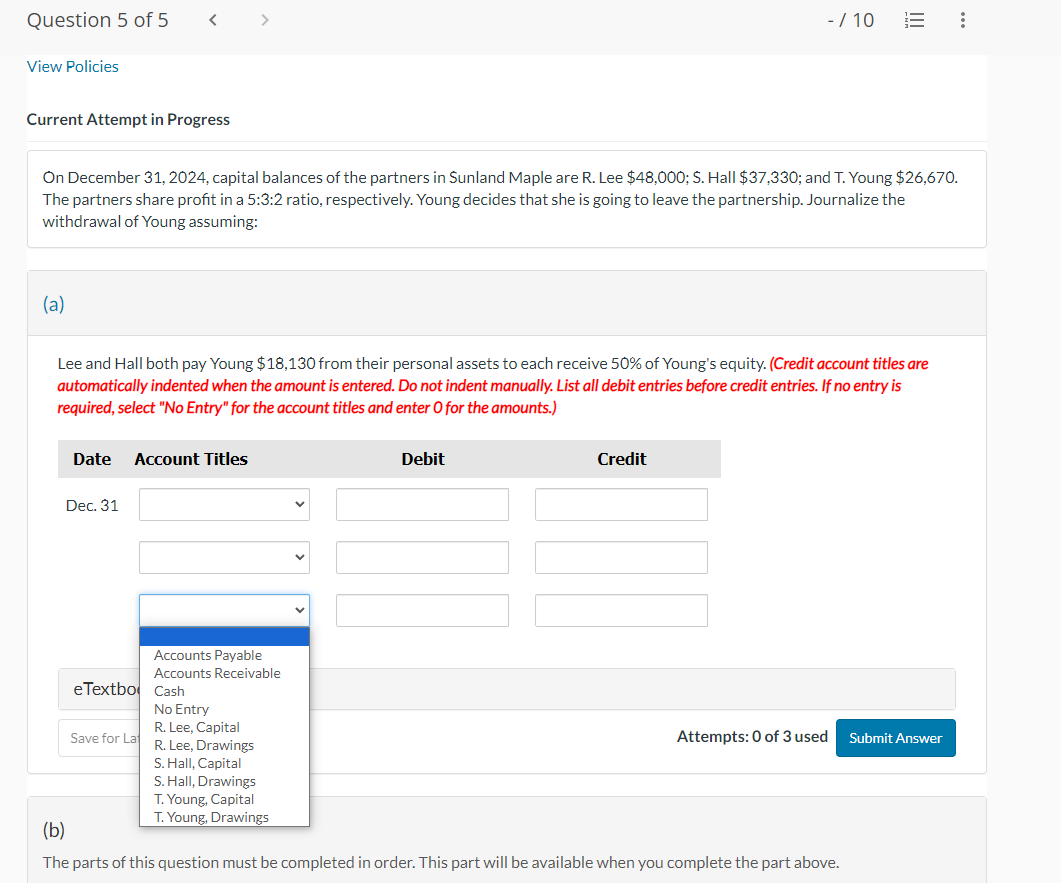

Barbara Taylor and Fred Jackson decide to organize the Carla Vista partnership. Taylor invests $14,400 cash and Jackson contributes $9,600 cash and equipment with a cost of $6,720 and accumulated depreciation of $4,800 and a fair value of $2,880. Prepare the entries to record each partner's investment in the partnership. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Current Attempt in Progress The medical practice of Dr. W. Johnson and Dr. M. Brown had the following general ledger account balances at April 30, 2024, its fiscal year end: (a) Calculate the profit or loss for the year. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) $ Profit Loss elextbook and Media Attempts: 0 of 3 used (b1) The parts of this question must be completed in order. This part will be available when you complete the part above. Question 1 of 5 /10 Current Attempt in Progress Match the terms with the following descriptions: a. Partners have limited liability. b. Partners have unlimited liability. c. It is the basis for dividing profit and loss. d. Partnership assets and capital increase with the change in partners. e. Partnership assets and total capital stay the same with the change in partners. f. Actions of partners are binding on all other partners. g. It is a compensation for differences in personal effort put into the partnership. h. Partnership is changed by the addition or withdrawal of a partner. i. There is a debit balance in a partner's capital account. j. Partnership is ended. eTextbook and Media Save for Later Admission by investment Capital deficiency General partnership Limited liability partnership Mutual agency Partnership dissolution Partnership liquidation Profit and loss ratio Salary allowance Withdrawal by payment from partners' personal assets Suzy Allen has owned and operated a proprietorship for several years. On January 1 , she decides to terminate this business and become a partner in the firm of Allen and King. Allen's investment in the partnership consists of $14,160 in cash and the following assets of the proprietorship: accounts receivable $16,520 less allowance for doubtful accounts of $2,360, and equipment $35,400 less accumulated depreciation of $4,720. It is agreed that the allowance for doubtful accounts should be $3,540 for the partnership. The fair value of the equipment is $27,730. Journalize Allen's admission to the firm of Allen and King. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) On December 31,2024 , capital balances of the partners in Sunland Maple are R. Lee $48,000; S. Hall $37,330; and T. Young $26,670. The partners share profit in a 5:3:2 ratio, respectively. Young decides that she is going to leave the partnership. Journalize the withdrawal of Young assuming: (a) Lee and Hall both pay Young $18,130 from their personal assets to each receive 50% of Young's equity. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) ts: 0 of 3 used The parts of this question must be completed in order. This part will be available when you complete the part above

Barbara Taylor and Fred Jackson decide to organize the Carla Vista partnership. Taylor invests $14,400 cash and Jackson contributes $9,600 cash and equipment with a cost of $6,720 and accumulated depreciation of $4,800 and a fair value of $2,880. Prepare the entries to record each partner's investment in the partnership. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Current Attempt in Progress The medical practice of Dr. W. Johnson and Dr. M. Brown had the following general ledger account balances at April 30, 2024, its fiscal year end: (a) Calculate the profit or loss for the year. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) $ Profit Loss elextbook and Media Attempts: 0 of 3 used (b1) The parts of this question must be completed in order. This part will be available when you complete the part above. Question 1 of 5 /10 Current Attempt in Progress Match the terms with the following descriptions: a. Partners have limited liability. b. Partners have unlimited liability. c. It is the basis for dividing profit and loss. d. Partnership assets and capital increase with the change in partners. e. Partnership assets and total capital stay the same with the change in partners. f. Actions of partners are binding on all other partners. g. It is a compensation for differences in personal effort put into the partnership. h. Partnership is changed by the addition or withdrawal of a partner. i. There is a debit balance in a partner's capital account. j. Partnership is ended. eTextbook and Media Save for Later Admission by investment Capital deficiency General partnership Limited liability partnership Mutual agency Partnership dissolution Partnership liquidation Profit and loss ratio Salary allowance Withdrawal by payment from partners' personal assets Suzy Allen has owned and operated a proprietorship for several years. On January 1 , she decides to terminate this business and become a partner in the firm of Allen and King. Allen's investment in the partnership consists of $14,160 in cash and the following assets of the proprietorship: accounts receivable $16,520 less allowance for doubtful accounts of $2,360, and equipment $35,400 less accumulated depreciation of $4,720. It is agreed that the allowance for doubtful accounts should be $3,540 for the partnership. The fair value of the equipment is $27,730. Journalize Allen's admission to the firm of Allen and King. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) On December 31,2024 , capital balances of the partners in Sunland Maple are R. Lee $48,000; S. Hall $37,330; and T. Young $26,670. The partners share profit in a 5:3:2 ratio, respectively. Young decides that she is going to leave the partnership. Journalize the withdrawal of Young assuming: (a) Lee and Hall both pay Young $18,130 from their personal assets to each receive 50% of Young's equity. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) ts: 0 of 3 used The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started