Question

Bark River Machine and Tool Company Market Price, January 1 $60.00 Dividend, December 31 $2.00 Market Price, December 31 $65.00 Broker Commission, per Share

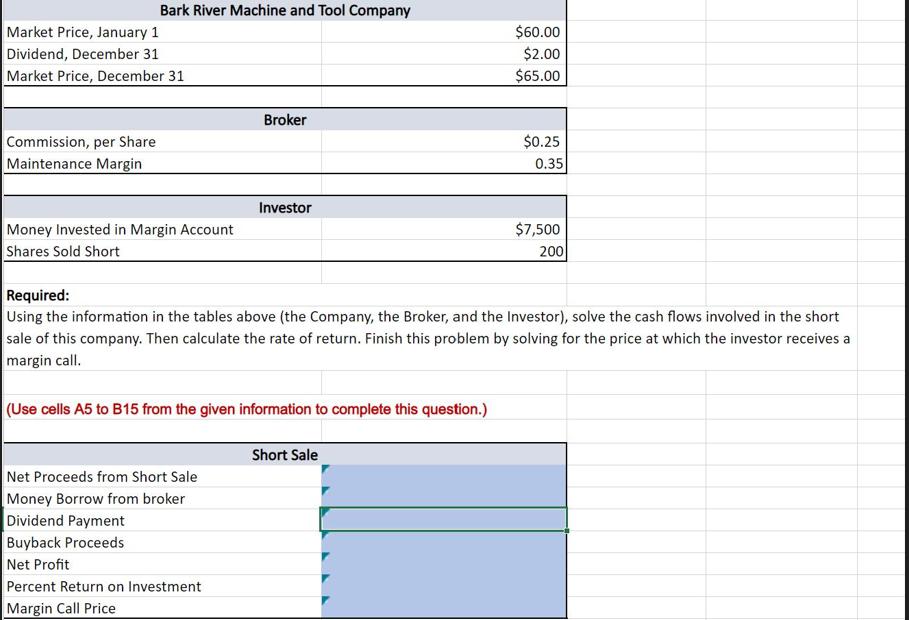

Bark River Machine and Tool Company Market Price, January 1 $60.00 Dividend, December 31 $2.00 Market Price, December 31 $65.00 Broker Commission, per Share Maintenance Margin Investor Money Invested in Margin Account Shares Sold Short $0.25 0.35 $7,500 200 Required: Using the information in the tables above (the Company, the Broker, and the Investor), solve the cash flows involved in the short sale of this company. Then calculate the rate of return. Finish this problem by solving for the price at which the investor receives a margin call. (Use cells A5 to B15 from the given information to complete this question.) Net Proceeds from Short Sale Money Borrow from broker Dividend Payment Buyback Proceeds Net Profit Percent Return on Investment Margin Call Price Short Sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App