Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barney, the chief financial officer of Bee Home, a publicly traded chain of flower shops, is discussing financing options with the other managers of

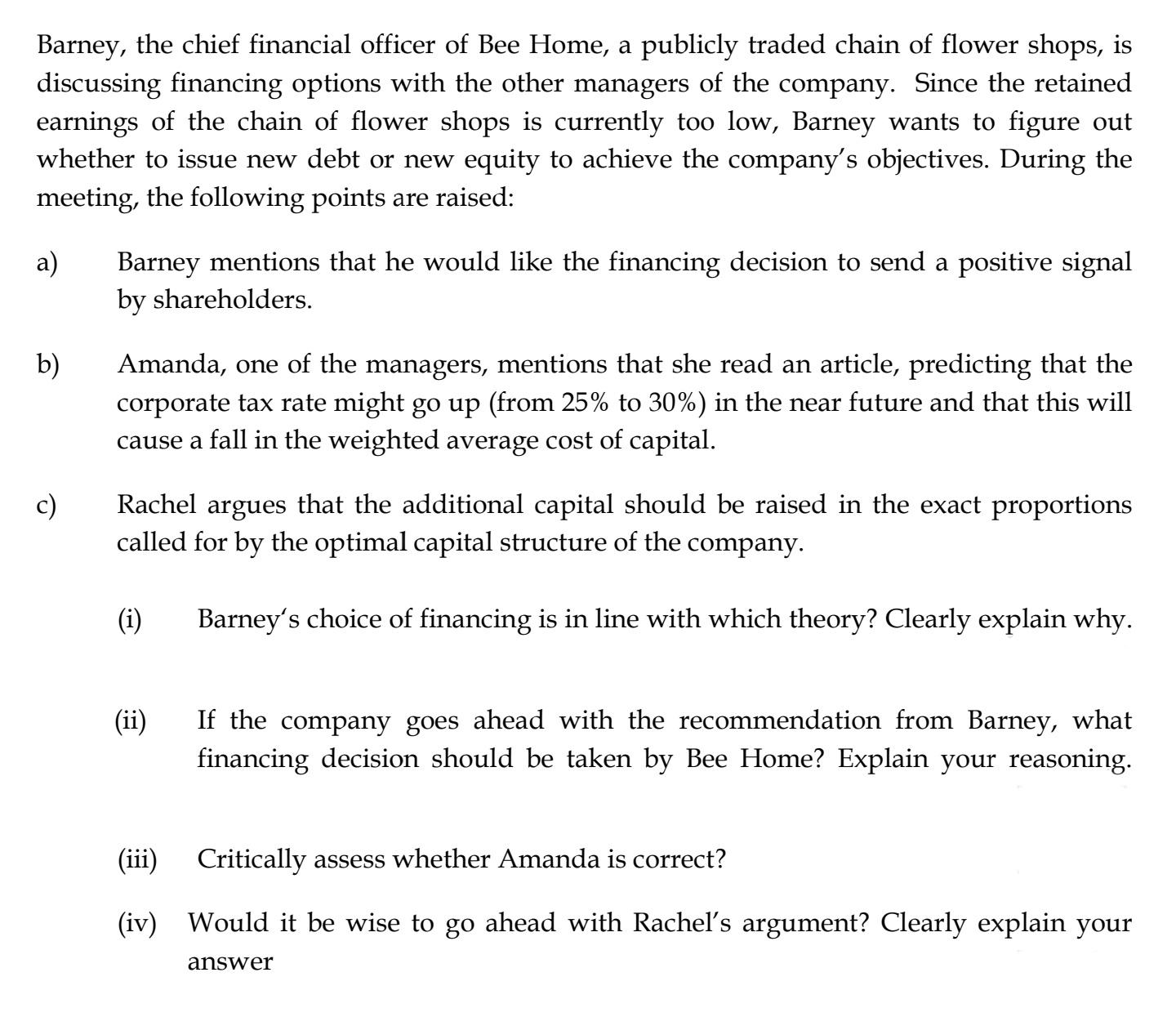

Barney, the chief financial officer of Bee Home, a publicly traded chain of flower shops, is discussing financing options with the other managers of the company. Since the retained earnings of the chain of flower shops is currently too low, Barney wants to figure out whether to issue new debt or new equity to achieve the company's objectives. During the meeting, the following points are raised: a) Barney mentions that he would like the financing decision to send a positive signal by shareholders. b) Amanda, one of the managers, mentions that she read an article, predicting that the corporate tax rate might go up (from 25% to 30%) in the near future and that this will cause a fall in the weighted average cost of capital. Rachel argues that the additional capital should be raised in the exact proportions called for by the optimal capital structure of the company. Barney's choice of financing is in line with which theory? Clearly explain why. (i) (ii) If the company goes ahead with the recommendation from Barney, what financing decision should be taken by Bee Home? Explain your reasoning. (iii) (iv) Critically assess whether Amanda is correct? Would it be wise to go ahead with Rachel's argument? Clearly explain your answer

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

i Barneys choice of financing is in line with the signaling theory The signaling theory suggests tha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started