Question

Barton Ltd manufactures and sells garden ornaments. It prepares accounts to 31 December. The income statement for the year ended 31 December 2020 is as

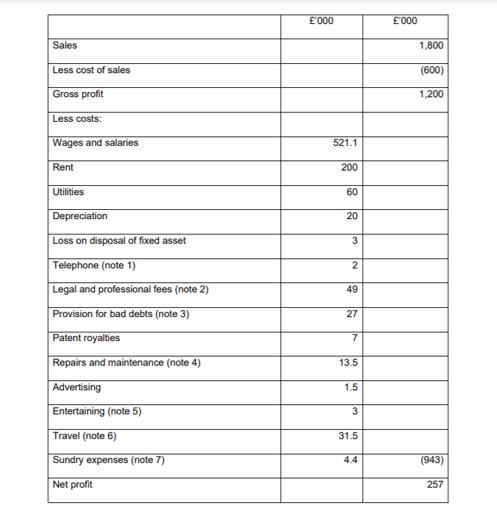

Barton Ltd manufactures and sells garden ornaments. It prepares accounts to 31 December. The income statement for the year ended 31 December 2020 is as follows:

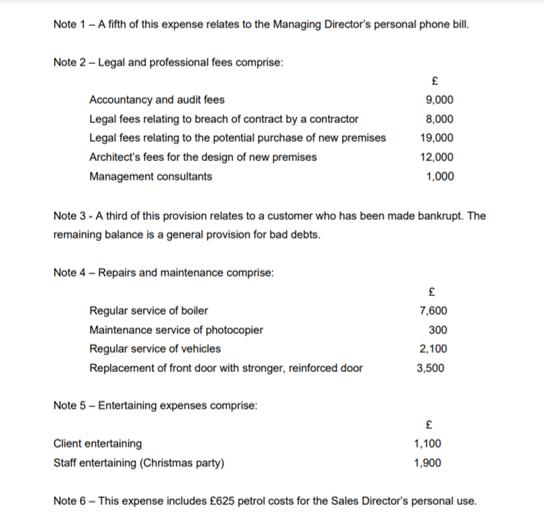

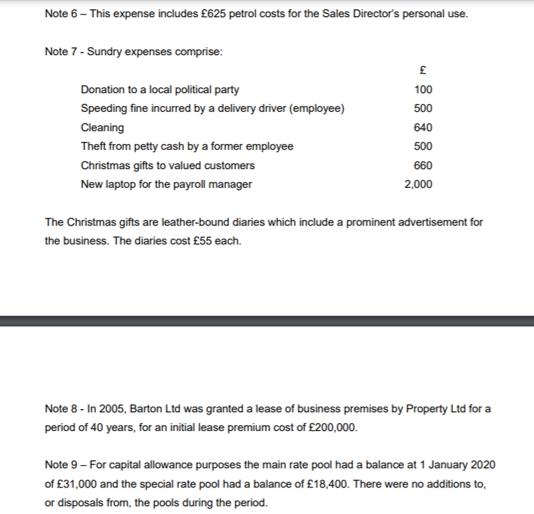

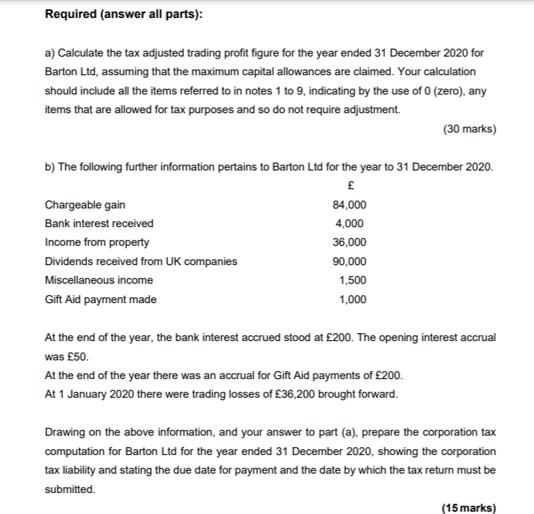

Sales Less cost of sales Gross profit Less costs: Wages and salaries Rent Utilities Depreciation Loss on disposal of fixed asset Telephone (note 1) Legal and professional fees (note 2) Provision for bad debts (note 3) Patent royalties Repairs and maintenance (note 4) Advertising Entertaining (note 5) Travel (note 6) Sundry expenses (note 7) Net profit '000 521.1 200 60 20 3 2 49 27 7 13.5 1.5 3 31.5 4.4 '000 1,800 (600) 1,200 (943) 257

Step by Step Solution

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Question CALCULATION OF TAXABLE BUSINESS INCOME AND CORPORATION TAX THEREON OF BARTON LTD AS ON 31 DECEMBER 2020 N et profit as per income statement 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Managerial Finance

Authors: Lawrence J. Gitman, Chad J. Zutter

14th edition

133507696, 978-0133507690

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App