Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? ? Comprehensive Problem Cost Volume Profit Analysis Based in Italy, Datura, Ltd., is an international importer-exporter of pottery with distribution centers in the United

?

?

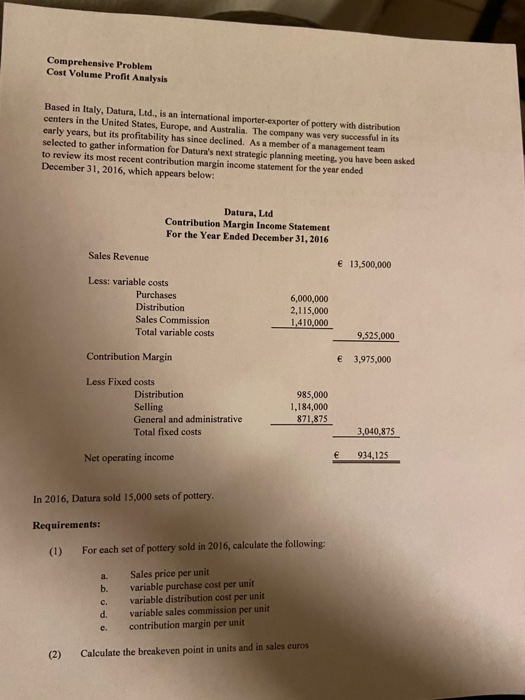

Comprehensive Problem Cost Volume Profit Analysis Based in Italy, Datura, Ltd., is an international importer-exporter of pottery with distribution centers in the United States, Europe, and Australia. The company was very successful in its early years, but its profitability has since declined. As a member of a management team selected to gather information for Datura's next strategic planning meeting, you have been asked to review its most recent contribution margin income statement for the year ended December 31, 2016, which appears below: Sales Revenue Less: variable costs Purchases Distribution (2) Datura, Ltd Contribution Margin Income Statement For the Year Ended December 31, 2016 Contribution Margin Less Fixed costs Requirements: (1) Sales Commission Total variable costs Net operating income In 2016, Datura sold 15,000 sets of pottery. a. b. Distribution Selling General and administrative Total fixed costs C. d. e. 6,000,000 2,115,000 1,410,000 For each set of pottery sold in 2016, calculate the following: Sales price per unit variable purchase cost per unit variable distribution cost per unit variable sales commission per unit contribution margin per unit Calculate the breakeven point in units and in sales euros 985,000 1,184,000 871,875 13,500,000 9,525,000 3,975,000 3,040,875 934,125 (3) Historically, Datura's total variable costs have been approximately 60% of sales. What is the ratio of variable costs to sales in 2016? (5) (6) How would fixed costs had been affected if Datura sold only 14,000 sets of pottery in 2016? How many sets of pottery would Datura have to sell to realize a net operating income of 2,500,000? What is the degree of operating leverage for Datura in 2016? What would happen if sales saw an increase of 8% in 2017?

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 a Selling price per unit Total salesTotal units 13500000 15000 900 euros b Variable purchase cost per unit total purchase cost total units 600000015...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started