Answered step by step

Verified Expert Solution

Question

1 Approved Answer

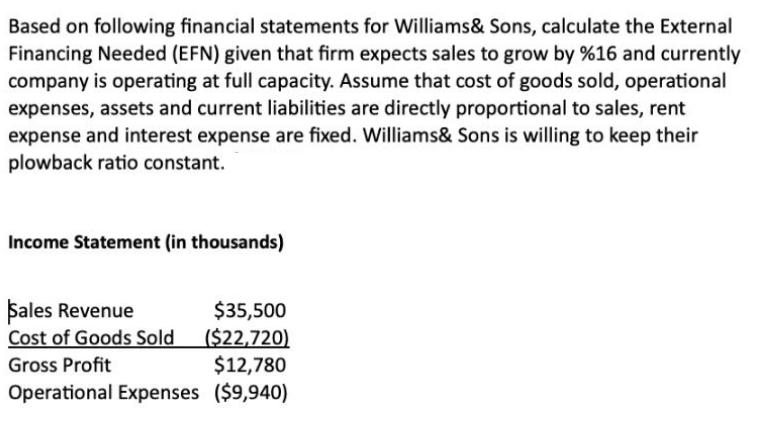

Based on following financial statements for Williams& Sons, calculate the External Financing Needed (EFN) given that firm expects sales to grow by %16 and

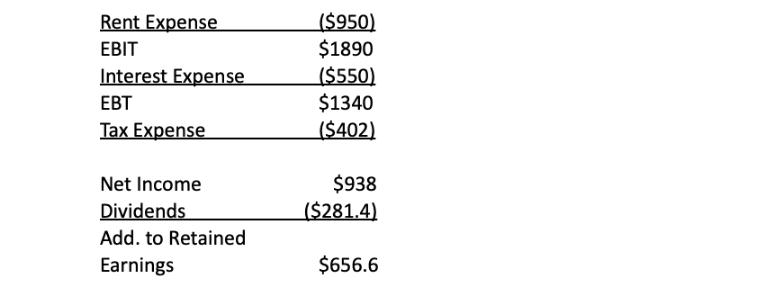

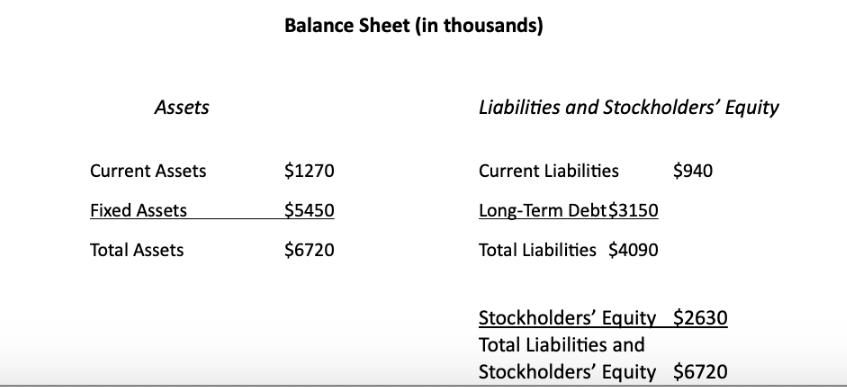

Based on following financial statements for Williams& Sons, calculate the External Financing Needed (EFN) given that firm expects sales to grow by %16 and currently company is operating at full capacity. Assume that cost of goods sold, operational expenses, assets and current liabilities are directly proportional to sales, rent expense and interest expense are fixed. Williams& Sons is willing to keep their plowback ratio constant. Income Statement (in thousands) Sales Revenue Cost of Goods Sold Gross Profit Operational Expenses $35,500 ($22,720) $12,780 ($9,940) Rent Expense EBIT Interest Expense EBT Tax Expense Net Income Dividends Add. to Retained Earnings ($950) $1890 ($550) $1340 ($402) $938 ($281.4) $656.6 Assets Current Assets Fixed Assets Total Assets Balance Sheet (in thousands) $1270 $5450 $6720 Liabilities and Stockholders' Equity Current Liabilities $940 Long-Term Debt $3150 Total Liabilities $4090 Stockholders' Equity $2630 Total Liabilities and Stockholders' Equity $6720

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Income Statement salesrevenue 35500 costofgoodssold 22720 grossprofit salesrevenue costofgoodssold o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started