Answered step by step

Verified Expert Solution

Question

1 Approved Answer

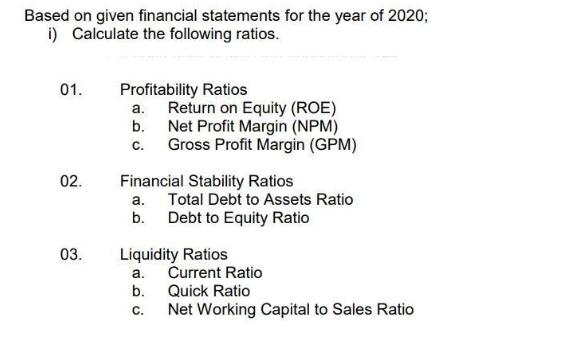

Based on given financial statements for the year of 2020; i) Calculate the following ratios. 01. 02. 03. Profitability Ratios a. b. c. Financial

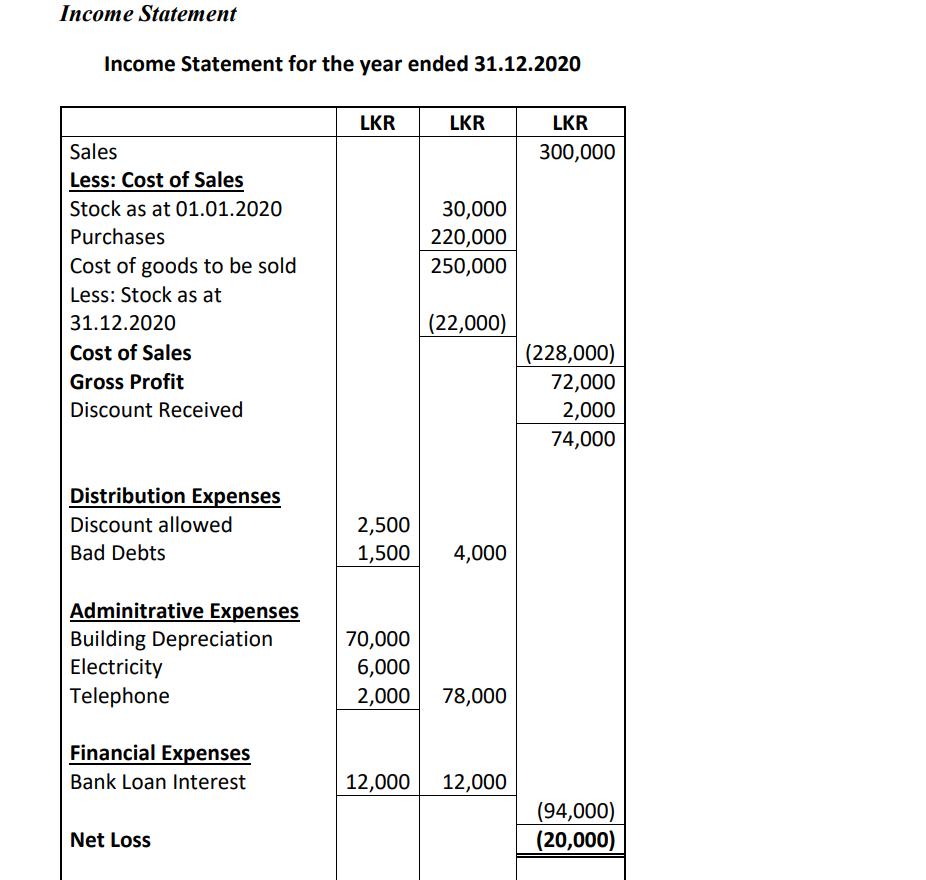

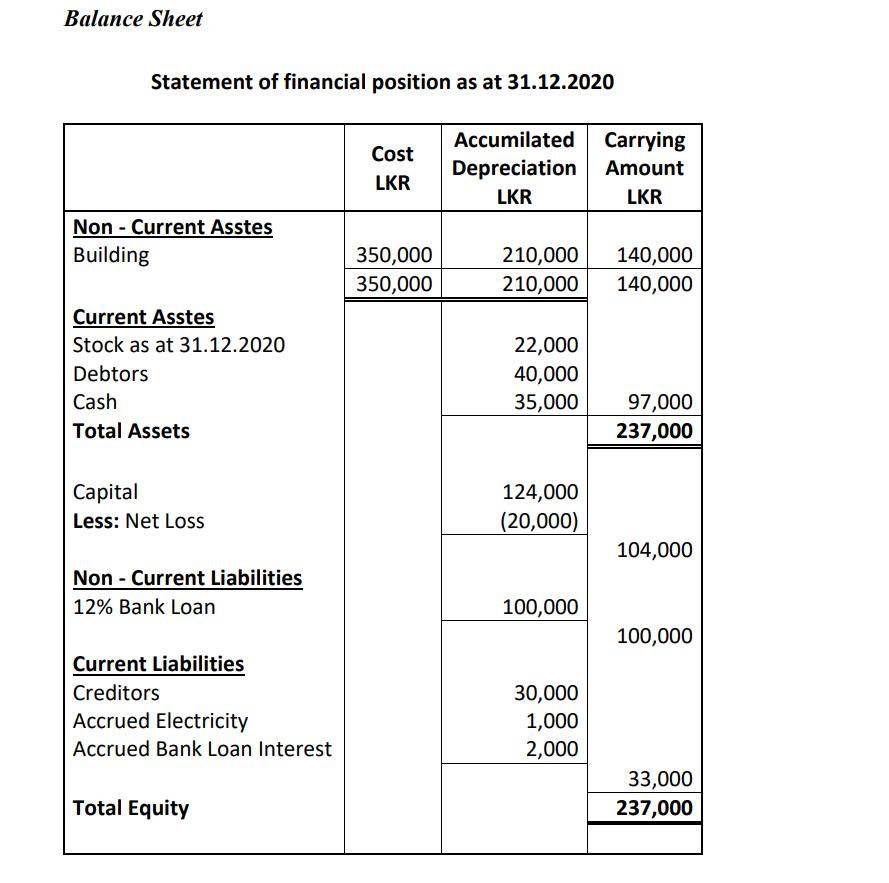

Based on given financial statements for the year of 2020; i) Calculate the following ratios. 01. 02. 03. Profitability Ratios a. b. c. Financial Stability Ratios a. b. Return on Equity (ROE) Net Profit Margin (NPM) Gross Profit Margin (GPM) a. b. C. Total Debt to Assets Ratio Debt to Equity Ratio Liquidity Ratios Current Ratio Quick Ratio Net Working Capital to Sales Ratio Income Statement Income Statement for the year ended 31.12.2020 Sales Less: Cost of Sales Stock as at 01.01.2020 Purchases Cost of goods to be sold Less: Stock as at 31.12.2020 Cost of Sales Gross Profit Discount Received Distribution Expenses Discount allowed Bad Debts Adminitrative Expenses Building Depreciation Electricity Telephone Financial Expenses Bank Loan Interest Net Loss LKR 2,500 1,500 LKR 30,000 220,000 250,000 (22,000) 4,000 70,000 6,000 2,000 78,000 12,000 12,000 LKR 300,000 (228,000) 72,000 2,000 74,000 (94,000) (20,000) Balance Sheet Statement of financial position as at 31.12.2020 Non-Current Asstes Building Current Asstes Stock as at 31.12.2020 Debtors Cash Total Assets Capital Less: Net Loss Non Current Liabilities 12% Bank Loan Current Liabilities Creditors Accrued Electricity Accrued Bank Loan Interest Total Equity Cost LKR 350,000 350,000 Accumilated Carrying Depreciation Amount LKR LKR 210,000 140,000 210,000 140,000 22,000 40,000 35,000 124,000 (20,000) 100,000 30,000 1,000 2,000 97,000 237,000 104,000 100,000 33,000 237,000

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of the ratios are given below 01 Profitability Ratios a Return on EquityROE Net Income S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started