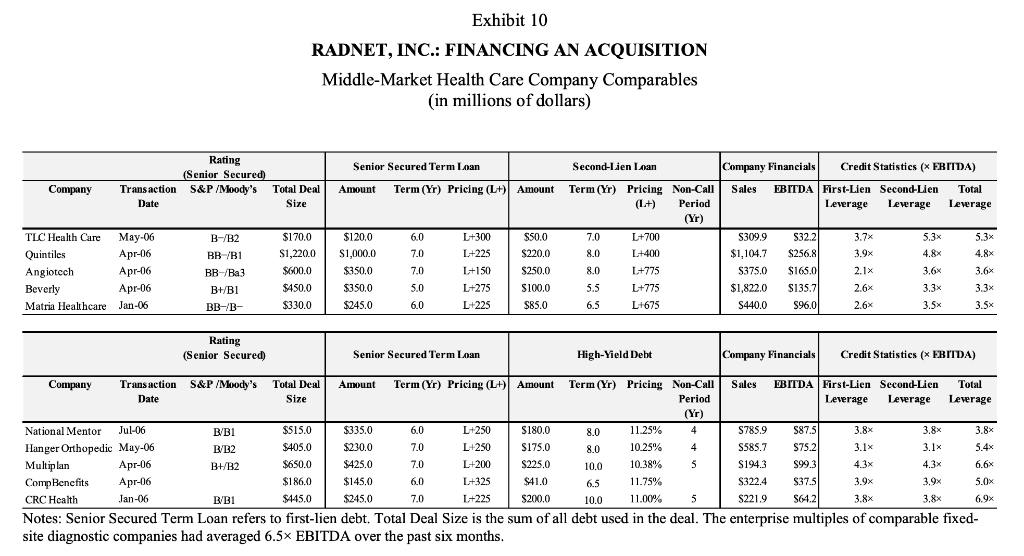

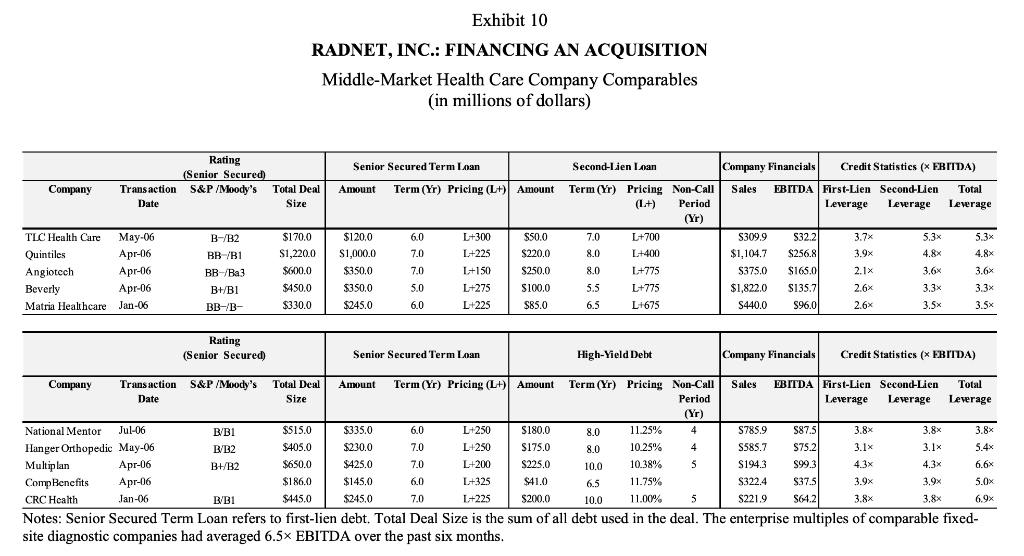

Based on information from Exhibit 10, do you think the financing option provided by GE (first-lien debt + second-lien debt) is a reasonable one? Why?

Exhibit 10 RADNET, INC.: FINANCING AN ACQUISITION Middle-Market Health Care Company Comparables (in millions of dollars) Rating Senior Secured Term Loan Company (Senior Secured) S&P /Moody's Total Deal Size Transaction Date Amount Term (Yr) Pricing (L+) Amount TLC Health Care May-06 - Quintiles Apr-06 Angiotech Apr-06 Beverly Apr-06 Matria Healthcare Jan-06 6.0 7.0 B-/B2 BB-/B1 BB-/Ba3 BHB1 BB-B- $170.0 $1,220.0 $600.0 $450.0 $330.0 $120,0 $1,000,0 $350,0 L+300 L+225 L+150 L+275 SS0.0 $220,0 $250,0 $100,0 Second-Lien Loan Company Financials Credit Statistics (X EBITDA) Term (Yr) Pricing Non-Call Sales EBITDA First-Lien Second-Lien Total (L+) Period Leverage Leverage Leverage (Yr) 7.0 L+700 $309.9 $32.2 3.7x 5.3% 5.3x 8.0 L+400 $1,104.7 $256.8 3.9x 4.8% 4.8% 8.0 L+775 S375.0 $165.0 2.1 x 3.6% 3.6% 5.5 L+775 $1,822.0 S135.7 2.6x 3.3% 3.3% 6.5 L+675 S440.0 S96.0 2.6x 3.5x 3.5x 7.0 $350.0 $245.0 5.0 6.0 L+225 $85.0 Rating (Senior Secured) Senior Secured Term Loan High-Yield Debt Company Financials Credit Statistics (X EBITDA) Company Transaction S&P /Moody's Total Deal Amount Term (Yr) Pricing (L+) Amount Term (Yr) Pricing Non-Call Saules EBITDA First-Lien Second-Lien Total Date Size Period Leverage Leverage Leverage (Yr) National Mentor Jul-06 B/BI $S15.0 $335.0 6.0 L+250 S180,0 8.0 11.25% 4 S785.9 587. 3.8% 3.8% 3.8% Hanger Orthopedic May-06 B/B2 $405.0 $230,0 7.0 L+250 $175.0 8.0 10.25% 4 S585.7 S75.2 3.1x 3.1% 5.4x Multiplan Apr-06 B+/B2 $650.0 $425.0 7.0 L+200 $225,0 10.0 10.38% 5 S194.3 $99.3 4.3x 4.3x 6.6% Comp Benefits Apr-06 $186.0 $145.0 6.0 L+325 $41.0 6.5 11.75% S322.4 $37.5 3.9% 3.9x 5.OX CRC Health Jan-06 B/B1 $145.0 $245.0 7.0 L+225 $200.0 10.0 11.00% 5 5 S221.9 5612 3.8% 3.8% 6.9x Notes: Senior Secured Term Loan refers to first-lien debt. Total Deal Size is the sum of all debt used in the deal. The enterprise multiples of comparable fixed- site diagnostic companies had averaged 6.5x EBITDA over the past six months. Exhibit 10 RADNET, INC.: FINANCING AN ACQUISITION Middle-Market Health Care Company Comparables (in millions of dollars) Rating Senior Secured Term Loan Company (Senior Secured) S&P /Moody's Total Deal Size Transaction Date Amount Term (Yr) Pricing (L+) Amount TLC Health Care May-06 - Quintiles Apr-06 Angiotech Apr-06 Beverly Apr-06 Matria Healthcare Jan-06 6.0 7.0 B-/B2 BB-/B1 BB-/Ba3 BHB1 BB-B- $170.0 $1,220.0 $600.0 $450.0 $330.0 $120,0 $1,000,0 $350,0 L+300 L+225 L+150 L+275 SS0.0 $220,0 $250,0 $100,0 Second-Lien Loan Company Financials Credit Statistics (X EBITDA) Term (Yr) Pricing Non-Call Sales EBITDA First-Lien Second-Lien Total (L+) Period Leverage Leverage Leverage (Yr) 7.0 L+700 $309.9 $32.2 3.7x 5.3% 5.3x 8.0 L+400 $1,104.7 $256.8 3.9x 4.8% 4.8% 8.0 L+775 S375.0 $165.0 2.1 x 3.6% 3.6% 5.5 L+775 $1,822.0 S135.7 2.6x 3.3% 3.3% 6.5 L+675 S440.0 S96.0 2.6x 3.5x 3.5x 7.0 $350.0 $245.0 5.0 6.0 L+225 $85.0 Rating (Senior Secured) Senior Secured Term Loan High-Yield Debt Company Financials Credit Statistics (X EBITDA) Company Transaction S&P /Moody's Total Deal Amount Term (Yr) Pricing (L+) Amount Term (Yr) Pricing Non-Call Saules EBITDA First-Lien Second-Lien Total Date Size Period Leverage Leverage Leverage (Yr) National Mentor Jul-06 B/BI $S15.0 $335.0 6.0 L+250 S180,0 8.0 11.25% 4 S785.9 587. 3.8% 3.8% 3.8% Hanger Orthopedic May-06 B/B2 $405.0 $230,0 7.0 L+250 $175.0 8.0 10.25% 4 S585.7 S75.2 3.1x 3.1% 5.4x Multiplan Apr-06 B+/B2 $650.0 $425.0 7.0 L+200 $225,0 10.0 10.38% 5 S194.3 $99.3 4.3x 4.3x 6.6% Comp Benefits Apr-06 $186.0 $145.0 6.0 L+325 $41.0 6.5 11.75% S322.4 $37.5 3.9% 3.9x 5.OX CRC Health Jan-06 B/B1 $145.0 $245.0 7.0 L+225 $200.0 10.0 11.00% 5 5 S221.9 5612 3.8% 3.8% 6.9x Notes: Senior Secured Term Loan refers to first-lien debt. Total Deal Size is the sum of all debt used in the deal. The enterprise multiples of comparable fixed- site diagnostic companies had averaged 6.5x EBITDA over the past six months