Question

Based on the above, when the company produces 24,000 units, total variable costs will be calculated as follows: * 600,000 + 768,000 + 384,000 600,000

Based on the above, when the company produces 24,000 units, total variable costs will be calculated as follows: *

600,000 + 768,000 + 384,000

600,000 + 768,000 + (553,200 1,200) + 384,000 + (288,950 950)

600,000 + 768,000 + (553,200 1,200) + (288,950 950)

None of the above

Based on the above, total fixed costs was: *

$67,150

$65,000

$66,200

None of the above

Based on the above, total direct costs per unit was: *

$108

$32

$57

None of the above

Based on the above, calculate the total expected cost when the company produces 60,000 units: *

$5,222,150

$6,547,150

$3,487,150

None of the above

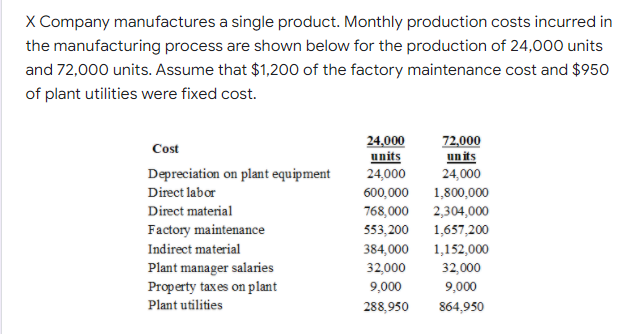

X Company manufactures a single product. Monthly production costs incurred in the manufacturing process are shown below for the production of 24,000 units and 72,000 units. Assume that $1,200 of the factory maintenance cost and $950 of plant utilities were fixed cost. Cost Depreciation on plant equipment Direct labor Direct material Factory maintenance Indirect material Plant manager salaries Property taxes on plant Plant utilities 24,000 units 24,000 600,000 768,000 553,200 384,000 32,000 9,000 288,950 72,000 units 24,000 1,800,000 2,304,000 1,657,200 1,152,000 32,000 9,000 864,950Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started