Based on the characteristics below and creating a proforma and 10 year Discounted cash Flow analysis what would the answers to the questions below be.

Based on the characteristics below and creating a proforma and 10 year Discounted cash Flow analysis what would the answers to the questions below be.

1. Assume to cost of capital for the equity portion of the capital stack is 25% and the corporate tax rate is 21%. What is the weighted average cost of capital (WACC)?

- 2. What is the approximate Debt Service Coverage Ratio at the end of year 7?

3. What are the approximate percentages of present value allocated between leveraged cash flow from operations and leveraged cash flow from sale, respectively? (i.e., PV Ops and PV Sale). Assume a discount rate of 20%

- 4. In what year is the total amount of the initial equity investment returned using the levered free cash flow (i.e., in what year is the cumulative levered free cash flow first positive)?

- 5. At a 20% levered discount rate, should the project be accepted?

- 6. What is the approximate total undiscounted sum of cash flow from operations?

- 7. What is the approximate primary loan payoff value in year 10?

- 8. What is the approximate gross sale value in year 10?

- 9. What is the maximum leveraged discount rate you can use in order to accept this deal based on the Net Present Value criterion?

- 10. Assuming all other inputs remain as modeled in the write up instructions, rank the following options shown below from highest to lowest increase to NPV?

- Decreasing the NPV discount rate from 20% to 15%

- Increasing the Year over Year rent escalation from 3% to 5%

- Extending the primary loan from 20 years to 30 years

- Increasing the bank LTV from 70% to 90%

- Decreasing the spread on the exit cap from +150bps to zero bps

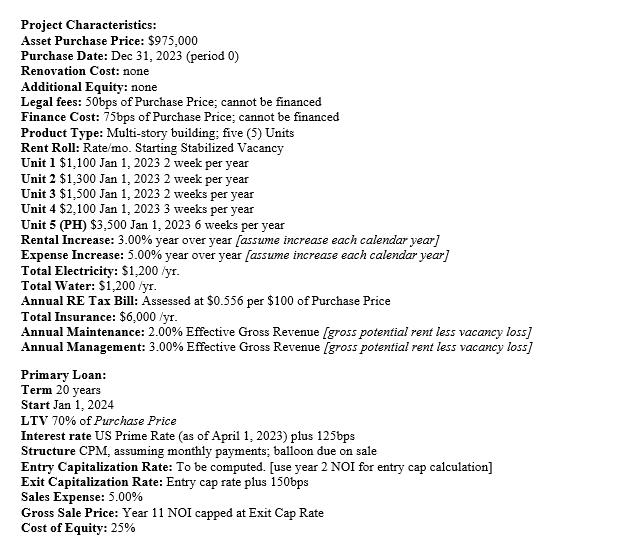

Project Characteristics: Asset Purchase Price: $975,000 Purchase Date: Dec 31, 2023 (period 0) Renovation Cost: none Additional Equity: none Legal fees: 50bps of Purchase Price; cannot be financed Finance Cost: 75bps of Purchase Price; cannot be financed Product Type: Multi-story building; five (5) Units Rent Roll: Rate/mo. Starting Stabilized Vacancy Unit 1 $1,100 Jan 1, 2023 2 week per year Unit 2 $1,300 Jan 1, 2023 2 week per year Unit 3 $1,500 Jan 1, 2023 2 weeks per year Unit 4 $2,100 Jan 1, 2023 3 weeks per year Unit 5 (PH) $3,500 Jan 1, 2023 6 weeks per year Rental Increase: 3.00% year over year [assume increase each calendar year] Expense Increase: 5.00% year over year [assume increase each calendar year] Total Electricity: $1,200/yr. Total Water: $1,200/yr. Annual RE Tax Bill: Assessed at $0.556 per $100 of Purchase Price Total Insurance: $6,000/yr. Annual Maintenance: 2.00% Effective Gross Revenue [gross potential rent less vacancy loss] Annual Management: 3.00% Effective Gross Revenue [gross potential rent less vacancy loss] Primary Loan: Term 20 years Start Jan 1, 2024 LTV 70% of Purchase Price Interest rate US Prime Rate (as of April 1, 2023) plus 125bps Structure CPM, assuming monthly payments; balloon due on sale Entry Capitalization Rate: To be computed. [use year 2 NOI for entry cap calculation] Exit Capitalization Rate: Entry cap rate plus 150bps Sales Expense: 5.00% Gross Sale Price: Year 11 NOI capped at Exit Cap Rate Cost of Equity: 25%

Step by Step Solution

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions 1 WACC Debt Ratio Debt Cost Equity Ratio Cost of Equity 1 Tax ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards