Answered step by step

Verified Expert Solution

Question

1 Approved Answer

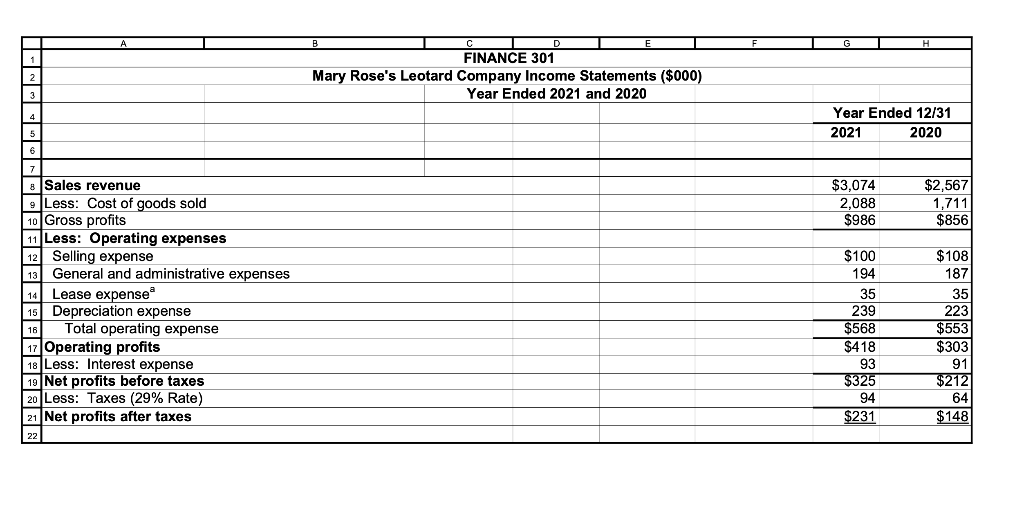

Based on the enclosed Balance Sheet and Income Statement, please determine all the firms ratios, this should be done in excel as well if someone

Based on the enclosed Balance Sheet and Income Statement, please determine all the firms ratios, this should be done in excel as well if someone can explain how to do it.

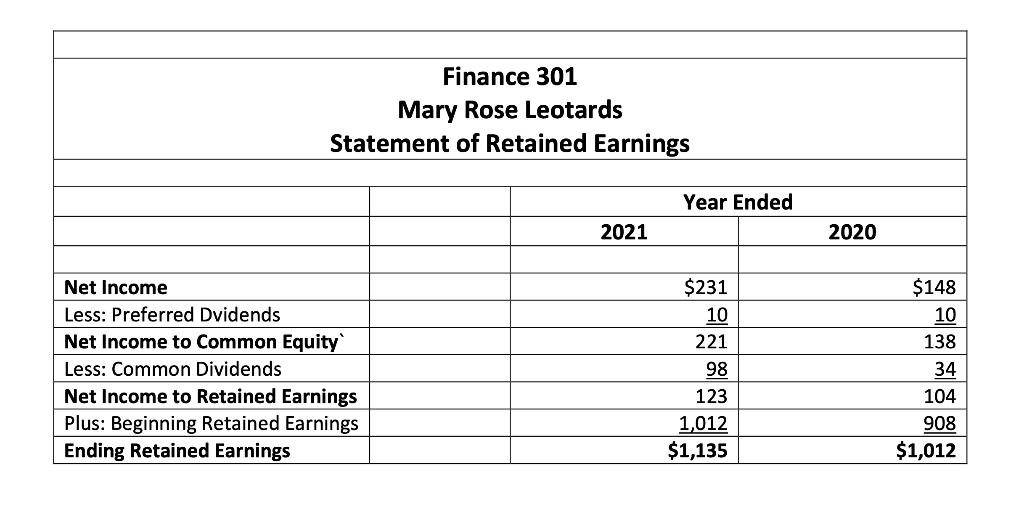

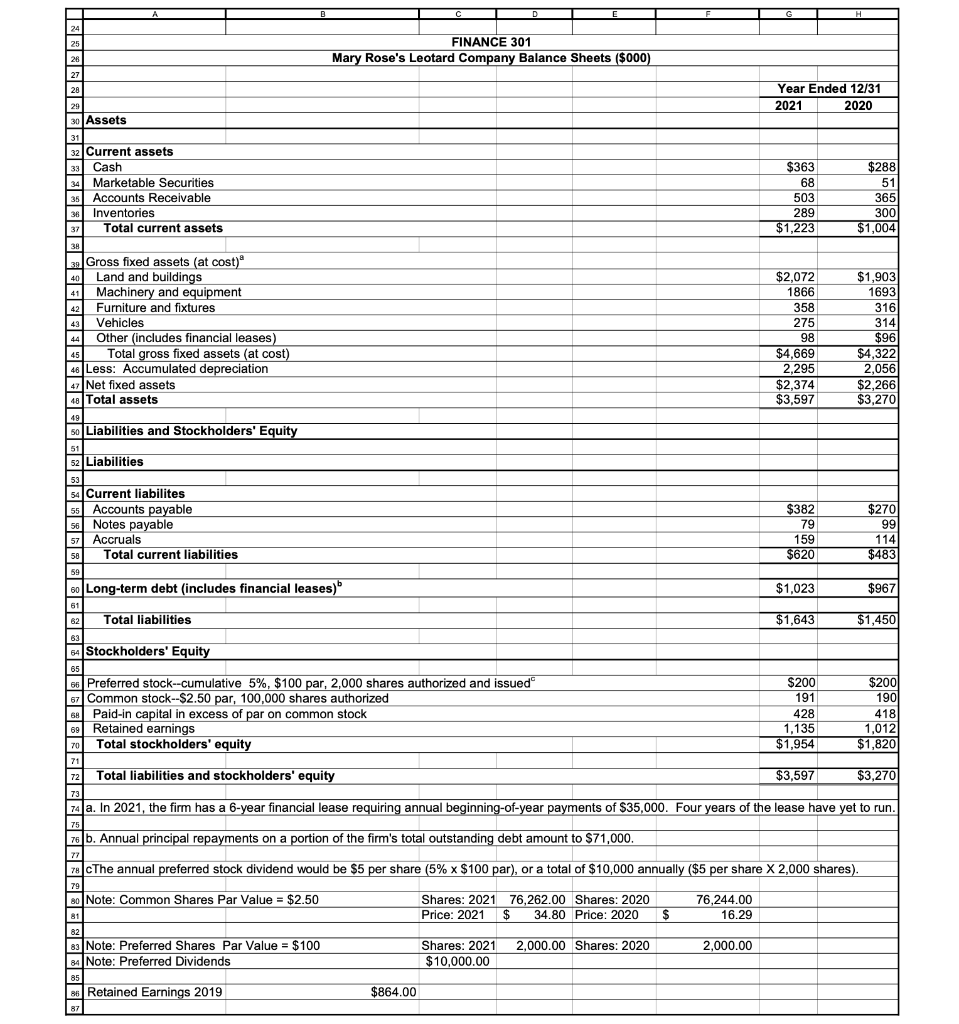

FINANCE 301 Mary Rose's Leotard Company Income Statements ($000) Year Ended 2021 and 2020 -- Year Ended 12/31 2021 2020 $3,074 2,088 $986 $2,567 1,711 $856 Sales revenue Less: Cost of goods sold 10 Gross profits 11 Less: Operating expenses 12 Selling expense 13 General and administrative expenses 14 Lease expense 15 Depreciation expense Total operating expense 17 Operating profits 18 Less: Interest expense Net profits before taxes 20 Less: Taxes (29% Rate) 21 Net profits after taxes $100 194 35 239 $568 $418 93 $325 94 $231 $108 187 35 223 $553 $303 91 $212 64 $148 Finance 301 Mary Rose Leotards Statement of Retained Earnings Year Ended 2021 2020 Net Income Less: Preferred Dvidends Net Income to Common Equity Less: Common Dividends Net Income to Retained Earnings Plus: Beginning Retained Earnings Ending Retained Earnings $231 10 221 98 123 1,012 $1,135 $148 10 138 34 104 908 $1,012 D . 24 25 FINANCE 301 Mary Rose's Leotard Company Balance Sheets ($000) 26 27 28 Year Ended 12/31 2021 2020 $363 68 503 289 $1,223 $2881 51 365 300 $1,004 29 30 Assets 31 32 Current assets 33 Cash 34 Marketable Securities 35 Accounts Receivable 36 Inventories 37 Total current assets 38 Gross fixed assets (at cost) 40 Land and buildings 41 Machinery and equipment 42 Furniture and fixtures 43 Vehicles Other (includes financial leases) 45 Total gross fixed assets (at cost) 46 Less: Accumulated depreciation Net fixed assets 48 Total assets 49 Liabilities and Stockholders' Equity 51 52 Liabilities 53 54 Current liabilites 55 Accounts payable 56 Notes payable 57 Accruals 58 Total current liabilities 44 $2,072 $ 1866 358 275 98 $4,669 2.295 $2,374 $3,597 $1,903 1693 316 314 $96 $4,322 2,056 $2,266 $3,270 $382 79 159 $620 $270 99 114 $483 59 60 Long-term debt (includes financial leases) $1,023 $967 61 62 Total liabilities $1,643 $1,450 63 54 Stockholders' Equity 65 70 72 Preferred stock--cumulative 5%, $100 par, 2,000 shares authorized and issued $200 $200 Common stock--$2.50 par, 100,000 shares authorized 191 190 Paid-in capital in excess of par on common stock 428 418 69 Retained earnings 1,135 1,012 Total stockholders' equity $1.954 $1,820 71 Total liabilities and stockholders' equity $3,597 $3,270 73 74 a. In 2021, the firm has a 6-year financial lease requiring annual beginning-of-year payments of $35,000. Four years of the lease have yet to run. 75 b. Annual principal repayments on a portion of the firm's total outstanding debt amount to $71,000. 77 The annual preferred stock dividend would be $5 per share (5% x $100 par), or a total of $10,000 annually ($5 per share X 2,000 shares). 79 Note: Common Shares Par Value = $2.50 Shares: 2021 76,262.00 Shares: 2020 76,244.00 81 Price: 2021 $ 34.80 Price: 2020 $ 16.29 82 83 Note: Preferred Shares Par Value = $100 Shares: 2021 2,000.00 Shares: 2020 2,000.00 34 Note: Preferred Dividends $10,000.00 85 36 Retained Earnings 2019 $864.00 87Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started