Answered step by step

Verified Expert Solution

Question

1 Approved Answer

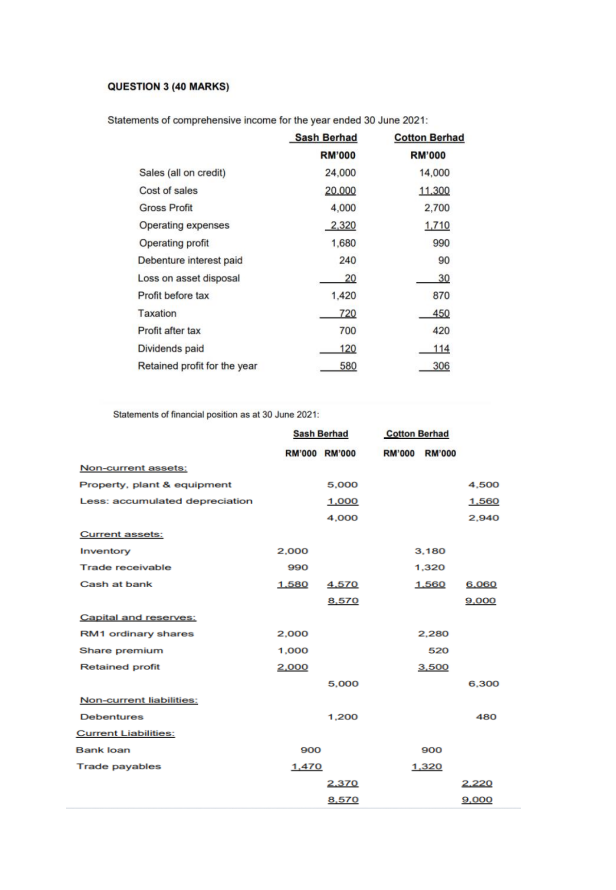

Based on the financial statements above, calculate the following financial ratios for both Sash Berhad and Cotton Berhad: (i) Gross profit margin (ii) Operating profit

Based on the financial statements above, calculate the following financial ratios for both Sash Berhad and Cotton Berhad:

(i) Gross profit margin

(ii) Operating profit margin

(iii) Net profit margin

(iv) Current ratio

(v) Quick ratio

(vi) Receivables collection period

(vii) Inventory turnover period

(viii) Payables payment period

(ix) Debt-to-equity ratio

(x) Interest cover

QUESTION 3 (40 MARKS) Statements of comprehensive income for the year ended 30 June 2021: Sash Berhad Cotton Berhad RM'000 RM'000 Sales (all on credit) 24,000 14,000 Cost of sales 20.000 11.300 Gross Profit 4,000 2,700 Operating expenses 2320 1.710 Operating profit Debenture interest paid Loss on asset disposal 20 Profit before tax 1,420 Taxation 720 Profit after tax Dividends paid Retained profit for the year 580 306 990 1.680 240 90 700 989891 120 Cotton Berhad RM'000 RM 000 4.500 1.560 2.940 3.180 1,320 1.500 6.060 9.000 Statements of financial position as at 30 June 2021: Sash Berhad RM'000 RM 000 Non-current assets: Property, plant & equipment 5,000 Less: accumulated depreciation 1.000 4,000 Current assets: Inventory 2.000 Trade receivable 990 Cash at bank 1.580 4.570 8.570 Capital and reserves: RM1 ordinary shares 2.000 Share premium 1.000 Retained profit 2.000 5.000 Non-current liabilities: Debentures 1,200 Current Liabilities: Bank loan 900 Trade payables 1.470 2.370 8.570 2.280 520 3.500 6.300 480 900 1.320 2.220 9.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started