Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the Finical accounting theory( William R. Scott)Ch1-CH5 This question lose a part I just need the explain Oak Ltd. and Ash Ltd. operate

Based on the Finical accounting theory( William R. Scott)Ch1-CH5

This question lose a part I just need the explain

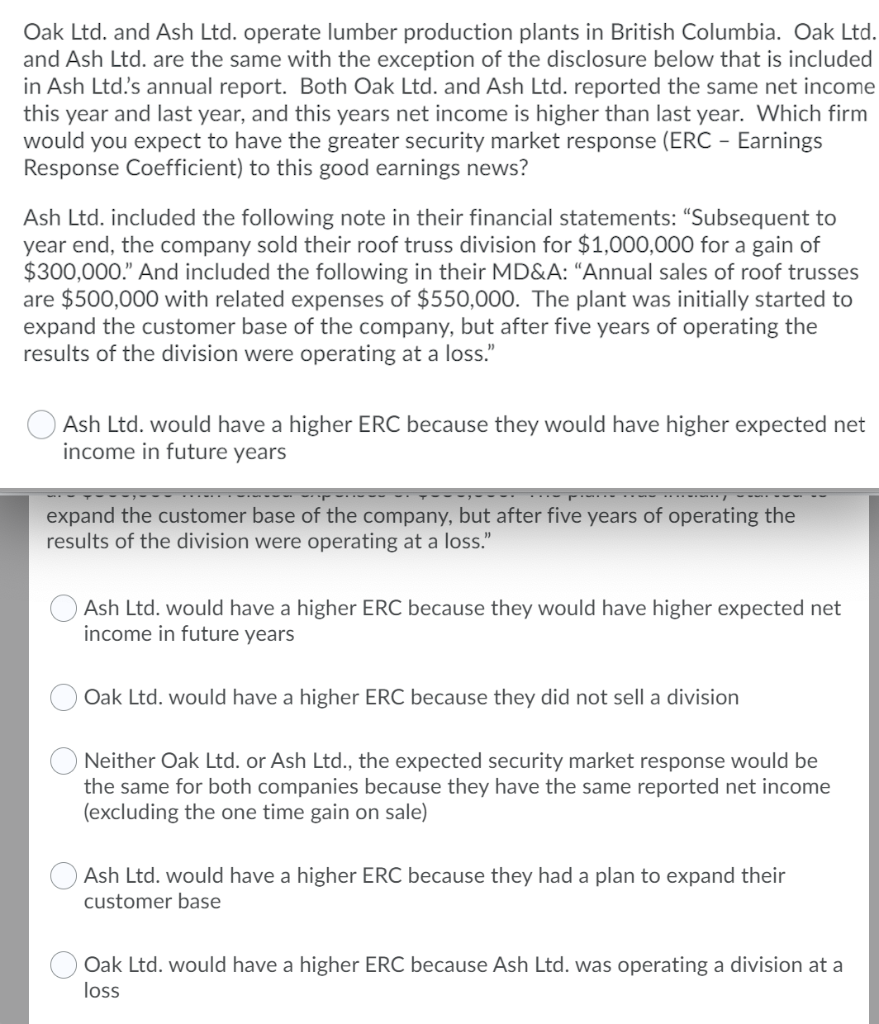

Oak Ltd. and Ash Ltd. operate lumber production plants in British Columbia. Oak Ltd. and Ash Ltd. are the same with the exception of the disclosure below that is included in Ash Ltd.s annual report. Both Oak Ltd. and Ash Ltd. reported the same net income this year and last year, and this years net income is higher than last year. Which firm would you expect to have the greater security market response (ERC - Earnings Response Coefficient) to this good earnings news? Ash Ltd. included the following note in their financial statements: Subsequent to year end, the company sold their roof truss division for $1,000,000 for a gain of $300,000. And included the following in their MD&A: Annual sales of roof trusses are $500,000 with related expenses of $550,000. The plant was initially started to expand the customer base of the company, but after five years of operating the results of the division were operating at a loss. Ash Ltd. would have a higher ERC because they would have higher expected net income in future years expand the customer base of the company, but after five years of operating the results of the division were operating at a loss. Ash Ltd. would have a higher ERC because they would have higher expected net income in future years Oak Ltd. would have a higher ERC because they did not sell a division Neither Oak Ltd. or Ash Ltd., the expected security market response would be the same for both companies because they have the same reported net income (excluding the one time gain on sale) Ash Ltd. would have a higher ERC because they had a plan to expand their customer base Oak Ltd. would have a higher ERC because Ash Ltd. was operating a division at a loss Oak Ltd. and Ash Ltd. operate lumber production plants in British Columbia. Oak Ltd. and Ash Ltd. are the same with the exception of the disclosure below that is included in Ash Ltd.s annual report. Both Oak Ltd. and Ash Ltd. reported the same net income this year and last year, and this years net income is higher than last year. Which firm would you expect to have the greater security market response (ERC - Earnings Response Coefficient) to this good earnings news? Ash Ltd. included the following note in their financial statements: Subsequent to year end, the company sold their roof truss division for $1,000,000 for a gain of $300,000. And included the following in their MD&A: Annual sales of roof trusses are $500,000 with related expenses of $550,000. The plant was initially started to expand the customer base of the company, but after five years of operating the results of the division were operating at a loss. Ash Ltd. would have a higher ERC because they would have higher expected net income in future years expand the customer base of the company, but after five years of operating the results of the division were operating at a loss. Ash Ltd. would have a higher ERC because they would have higher expected net income in future years Oak Ltd. would have a higher ERC because they did not sell a division Neither Oak Ltd. or Ash Ltd., the expected security market response would be the same for both companies because they have the same reported net income (excluding the one time gain on sale) Ash Ltd. would have a higher ERC because they had a plan to expand their customer base Oak Ltd. would have a higher ERC because Ash Ltd. was operating a division at a lossStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started