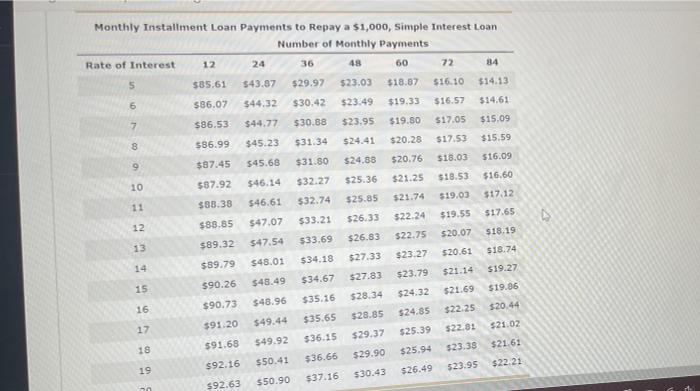

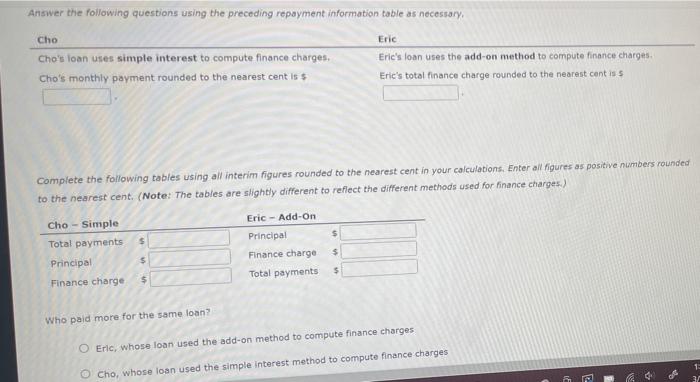

Monthly Installment Loan Payments to Repay a $1,000, Simple Interest Loan Number of Monthly Payments Rate of Interest 12 24 36 48 60 72 84 5 585.61 $43.87 $29.97 $23.03 $18.87 $16.10 $14.13 586.07 $44.32 6 $30.42 $23.49 $19.33 $16.57 $14.61 $86.53 7 $44.77 $30.88 $23.95 $19.80 $17.05 $15.09 586.99 345.23 $24.41 $31.34 8 $20.28 $15.59 $17.53 $24.88 $20.76 $18.03 $16.09 9 $87.45 $45.68 $31.80 $25.36 $32.27 $21.25 $18.53 $16.60 $46.14 10 587.92 $21.74 $17.12 $19.03 $25.85 $88.38 11 $46.61 $17.65 $19.55 $32.74 $33.21 $33.69 $26.33 $47.07 $88.85 12 $22.24 $22.75 $20.07 $18.19 $26.83 $89.32 547.54 $20.61 $23.27 $34.18 $27.33 $48.01 $89.79 $18.74 $19.27 14 $27.83 $34.67 390.26 $48.49 $23.79 $24.32 $21.14 $21.69 15 $19.86 $28.34 $48.96 $90.73 16 $22.25 $20.44 $35.16 $35.65 $36.15 $28.85 $49.44 $91.20 $24.85 $25.39 17 $22.8: $21.02 $49.92 $29.37 591.68 18 $21.61 $23.38 $25.94 $36.66 $92.16 $50.41 $29.90 $30.43 19 $22.22 $23.95 $26.49 $37.16 $50.90 592.63 Answer the following questions using the preceding repayment information table as necessary Cho Cho's loan uses simple interest to compute finance charges. Cho's monthly payment rounded to the nearest cent is $ Eric Eric's loan uses the add-on method to compute finance charges Eric's total finance charge rounded to the nearest cont iss Complete the following tables using all interim figures rounded to the nearest cent in your calculations. Enter all figures as positive numbers rounded to the nearest cent. (Note: The tables are slightly different to reflect the different methods used for finance charges.) Eric - Add-On Principal Finance charge $ Cho - simple Total payments Principal Finance charge S $ $ Total payments $ $ Who paid more for the same loan? O Eric, whose loan used the add-on method to compute finance charges Cho, whose loan used the simple interest method to compute finance charges Monthly Installment Loan Payments to Repay a $1,000, Simple Interest Loan Number of Monthly Payments Rate of Interest 12 24 36 48 60 72 84 5 585.61 $43.87 $29.97 $23.03 $18.87 $16.10 $14.13 586.07 $44.32 6 $30.42 $23.49 $19.33 $16.57 $14.61 $86.53 7 $44.77 $30.88 $23.95 $19.80 $17.05 $15.09 586.99 345.23 $24.41 $31.34 8 $20.28 $15.59 $17.53 $24.88 $20.76 $18.03 $16.09 9 $87.45 $45.68 $31.80 $25.36 $32.27 $21.25 $18.53 $16.60 $46.14 10 587.92 $21.74 $17.12 $19.03 $25.85 $88.38 11 $46.61 $17.65 $19.55 $32.74 $33.21 $33.69 $26.33 $47.07 $88.85 12 $22.24 $22.75 $20.07 $18.19 $26.83 $89.32 547.54 $20.61 $23.27 $34.18 $27.33 $48.01 $89.79 $18.74 $19.27 14 $27.83 $34.67 390.26 $48.49 $23.79 $24.32 $21.14 $21.69 15 $19.86 $28.34 $48.96 $90.73 16 $22.25 $20.44 $35.16 $35.65 $36.15 $28.85 $49.44 $91.20 $24.85 $25.39 17 $22.8: $21.02 $49.92 $29.37 591.68 18 $21.61 $23.38 $25.94 $36.66 $92.16 $50.41 $29.90 $30.43 19 $22.22 $23.95 $26.49 $37.16 $50.90 592.63 Answer the following questions using the preceding repayment information table as necessary Cho Cho's loan uses simple interest to compute finance charges. Cho's monthly payment rounded to the nearest cent is $ Eric Eric's loan uses the add-on method to compute finance charges Eric's total finance charge rounded to the nearest cont iss Complete the following tables using all interim figures rounded to the nearest cent in your calculations. Enter all figures as positive numbers rounded to the nearest cent. (Note: The tables are slightly different to reflect the different methods used for finance charges.) Eric - Add-On Principal Finance charge $ Cho - simple Total payments Principal Finance charge S $ $ Total payments $ $ Who paid more for the same loan? O Eric, whose loan used the add-on method to compute finance charges Cho, whose loan used the simple interest method to compute finance charges