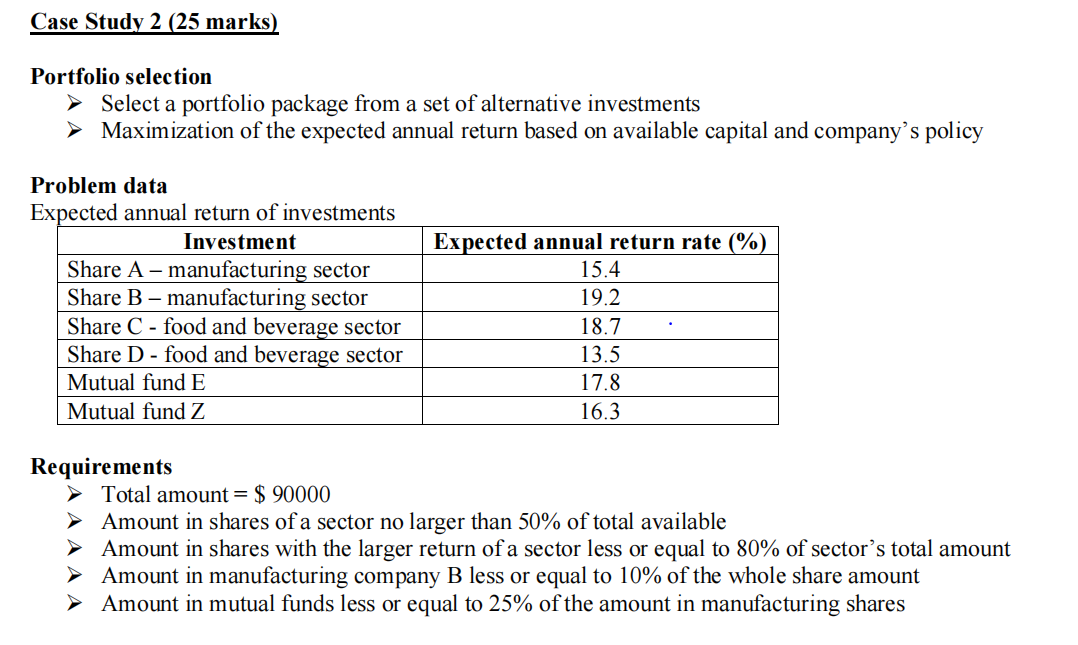

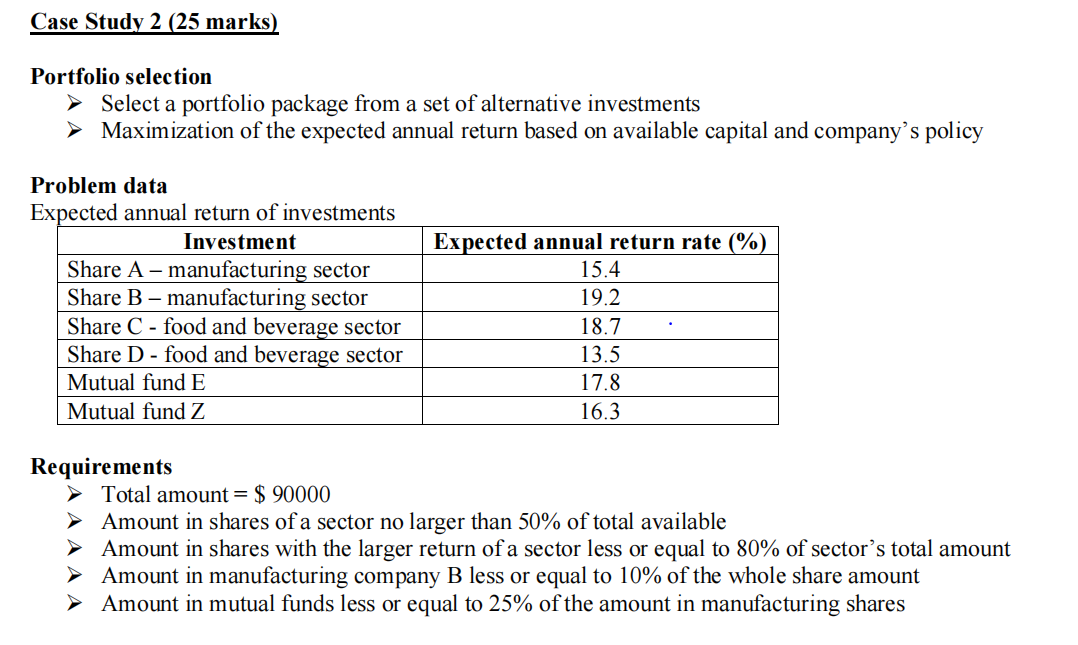

Based on the following case studies, students need to List down the optimization problem ; Define the decision variables ; Develop the objective function and constraints ; Develop a mathematical model that can be used to solve the optimization problem for each case study. Students need to solve the mathematical model by using Microsoft Excels Solver, find the optimal solution and interpret the result. Students also need to conduct sensitivity analysis and interpret the solution. Case Study 2 (25 marks) Portfolio selection Select a portfolio package from a set of alternative investments > Maximization of the expected annual return based on available capital and company's policy Problem data Expected annual return of investments Investment Share A manufacturing sector Share B - manufacturing sector Share C - food and beverage sector Share D - food and beverage sector Mutual fund E Mutual fund Z Expected annual return rate (%) 15.4 19.2 18.7 13.5 17.8 16.3 Requirements Total amount = $ 90000 Amount in shares of a sector no larger than 50% of total available Amount in shares with the larger return of a sector less or equal to 80% of sector's total amount > Amount in manufacturing company B less or equal to 10% of the whole share amount > Amount in mutual funds less or equal to 25% of the amount in manufacturing shares Based on the following case studies, students need to List down the optimization problem ; Define the decision variables ; Develop the objective function and constraints ; Develop a mathematical model that can be used to solve the optimization problem for each case study. Students need to solve the mathematical model by using Microsoft Excels Solver, find the optimal solution and interpret the result. Students also need to conduct sensitivity analysis and interpret the solution. Case Study 2 (25 marks) Portfolio selection Select a portfolio package from a set of alternative investments > Maximization of the expected annual return based on available capital and company's policy Problem data Expected annual return of investments Investment Share A manufacturing sector Share B - manufacturing sector Share C - food and beverage sector Share D - food and beverage sector Mutual fund E Mutual fund Z Expected annual return rate (%) 15.4 19.2 18.7 13.5 17.8 16.3 Requirements Total amount = $ 90000 Amount in shares of a sector no larger than 50% of total available Amount in shares with the larger return of a sector less or equal to 80% of sector's total amount > Amount in manufacturing company B less or equal to 10% of the whole share amount > Amount in mutual funds less or equal to 25% of the amount in manufacturing shares