Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the following data, please calculate equity value of ABS company assuming that EBIT and FCFF will grow in stable g rate: a.

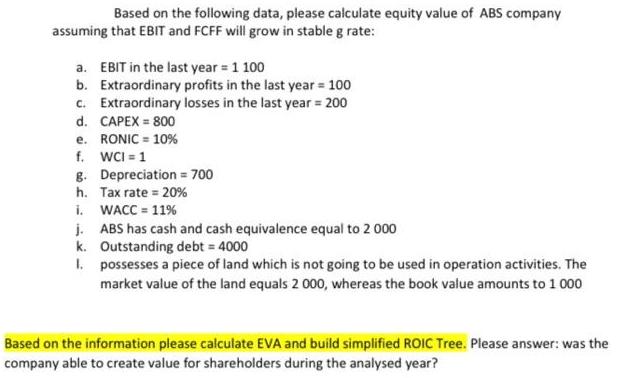

Based on the following data, please calculate equity value of ABS company assuming that EBIT and FCFF will grow in stable g rate: a. EBIT in the last year = 1 100 b. Extraordinary profits in the last year = 100 c. Extraordinary losses in the last year = 200 CAPEX = 800 d. e. RONIC = 10% f. WCI=1 8. Depreciation = 700 h. Tax rate = 20% i. WACC = 11% j. ABS has cash and cash equivalence equal to 2 000 k. Outstanding debt = 4000 1. possesses a piece of land which is not going to be used in operation activities. The market value of the land equals 2 000, whereas the book value amounts to 1 000 Based on the information please calculate EVA and build simplified ROIC Tree. Please answer: was the company able to create value for shareholders during the analysed year?

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Equity value of ABS company EBIT 1 100 Extraordinary profi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started