Answered step by step

Verified Expert Solution

Question

1 Approved Answer

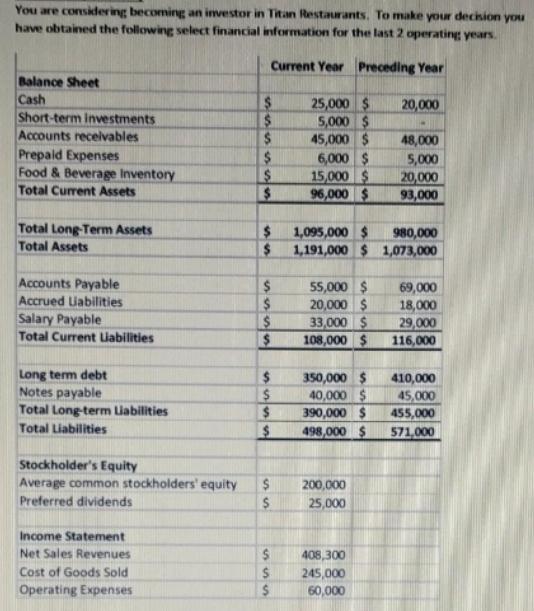

You are considering becoming an investor in Titan Restaurants. To make your decsion you have obtained the following select financial information for the last

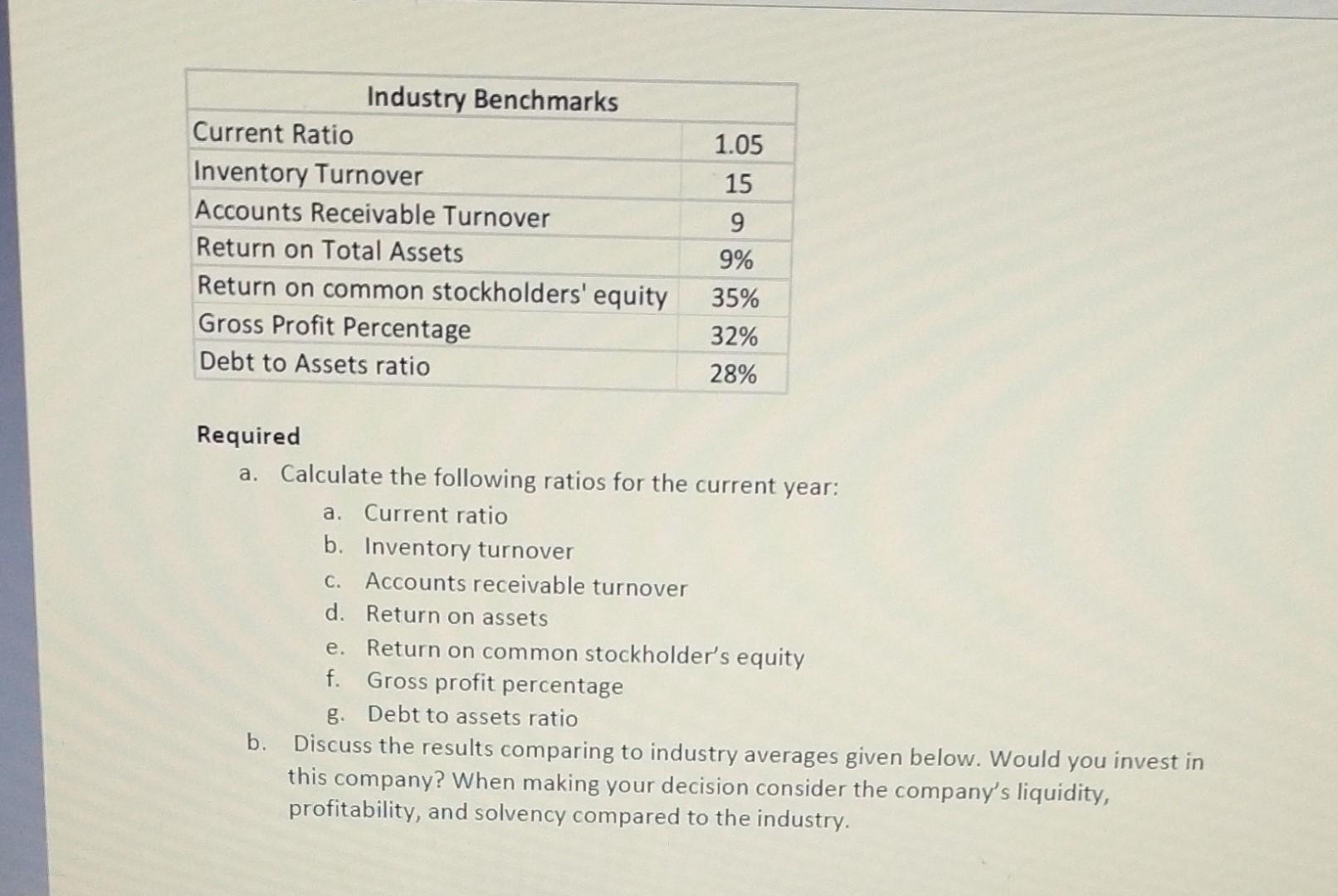

You are considering becoming an investor in Titan Restaurants. To make your decsion you have obtained the following select financial information for the last 2 operating years. Current Year Preceding Year Balance Sheet Cash Short-term Investments Accounts receivables Prepaid Expenses Food & Beverage Inventory Total Current Assets 25,000 $ 5,000 $ 45,000 $ 6,000 $ 15,000 $ 96,000 $ 20,000 $. 48,000 5,000 20,000 93,000 Total Long-Term Assets Total Assets 24 1,095,000 $ 980,000 1,191,000 $ 1,073,000 Accounts Payable Accrued Uabilities Salary Payable Total Current Liabilities 55,000 $ 20,000 $ 33,000 $ 108,000 $ 69,000 2$ 18,000 29,000 116,000 Long term debt Notes payable Total Long-term Liabilities 350,000 $ 24 40,000 $ 390,000 $ 498,000 $ 410,000 45,000 455,000 571,000 Total Liabilities Stockholder's Equity Average common stockholders' equity 200,000 Preferred dividends 25,000 Income Statement Net Sales Revenues 408,300 Cost of Goods Sold 245,000 Operating Expenses 60,000 %24 SSS Industry Benchmarks Current Ratio 1.05 Inventory Turnover 15 Accounts Receivable Turnover 9 Return on Total Assets 9% Return on common stockholders' equity 35% Gross Profit Percentage 32% Debt to Assets ratio 28% Required a. Calculate the following ratios for the current year: a. Current ratio b. Inventory turnover C. Accounts receivable turnover d. Return on assets e. Return on common stockholder's equity f. Gross profit percentage g. Debt to assets ratio b. Discuss the results comparing to industry averages given below. Would you invest in this company? When making your decision consider the company's liquidity, profitability, and solvency compared to the industry.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

2 Current Industry Current Ratio Current AssetsCurrent Liabilities 9600010...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started