Answered step by step

Verified Expert Solution

Question

1 Approved Answer

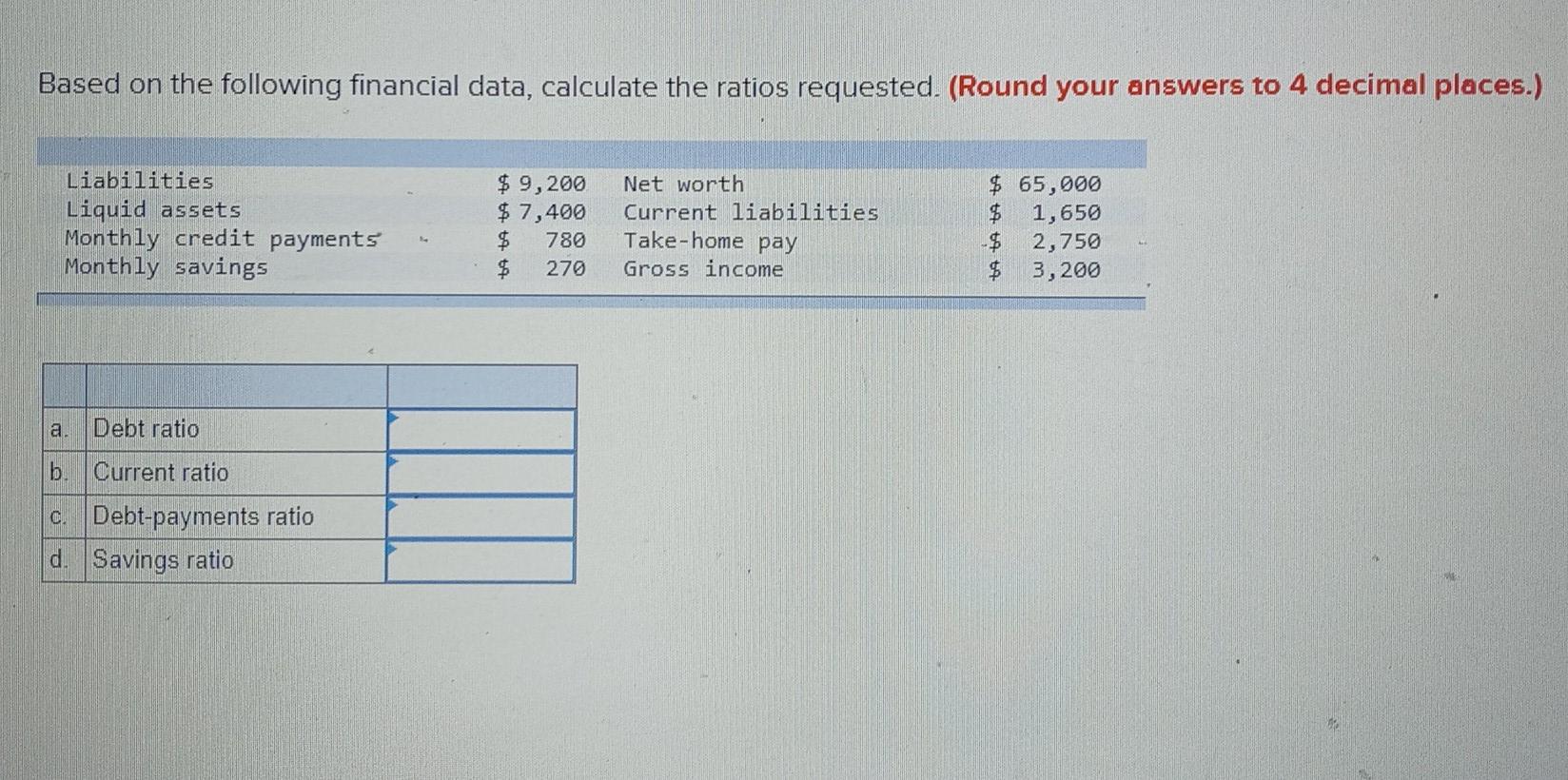

Based on the following financial data, calculate the ratios requested. (Round your answers to 4 decimal places.) Liabilities Liquid assets Monthly credit payments Monthly savings

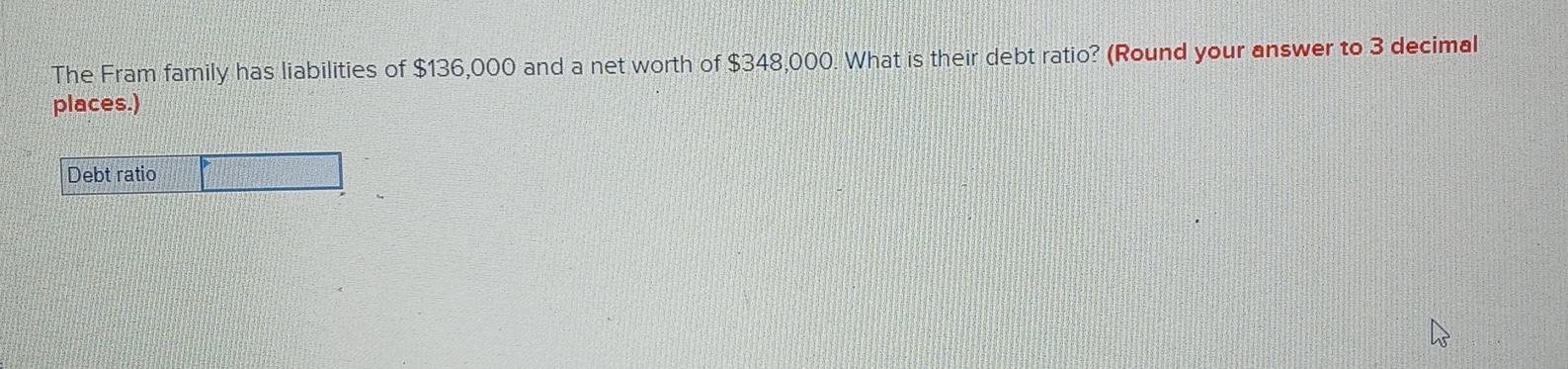

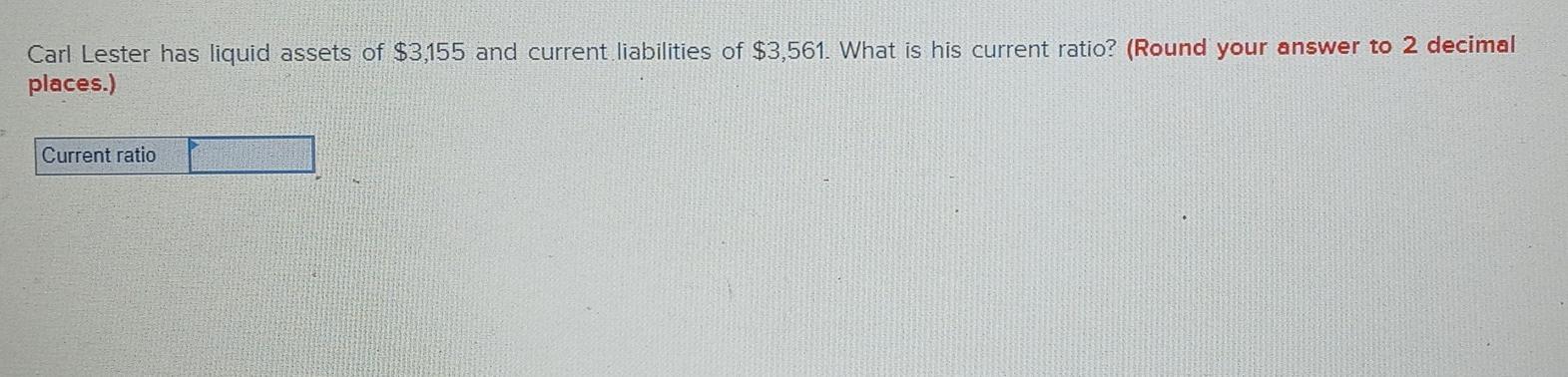

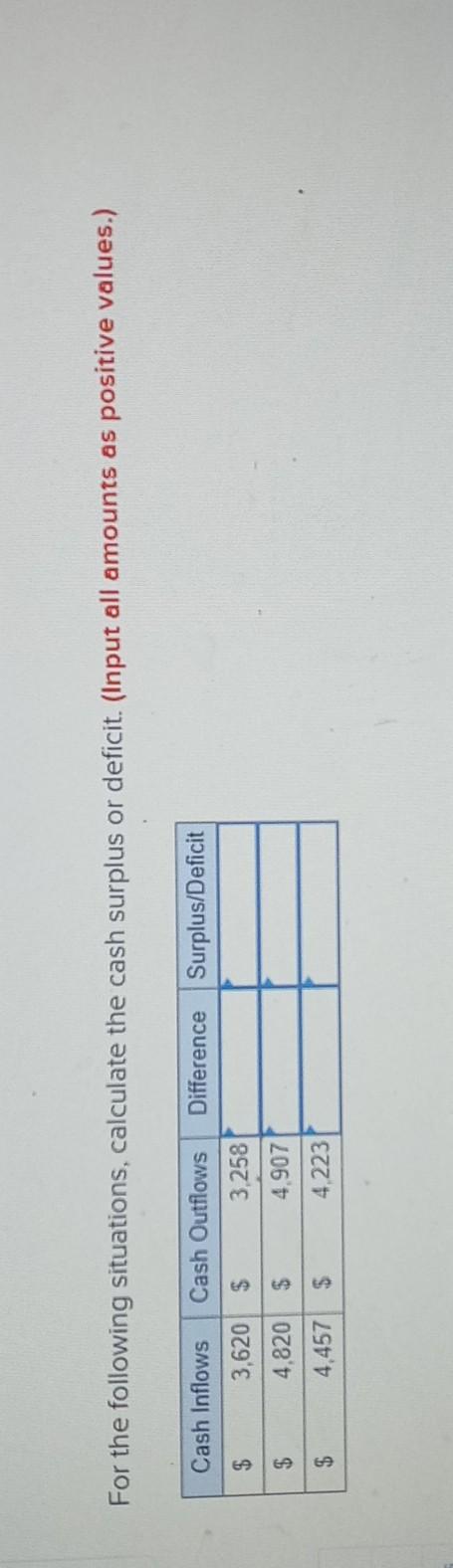

Based on the following financial data, calculate the ratios requested. (Round your answers to 4 decimal places.) Liabilities Liquid assets Monthly credit payments Monthly savings $ 9,200 $ 7,400 $ 780 $ 270 Net worth Current liabilities Take-home pay Gross income $ 65,000 $ 1,650 $ 2,750 $ 3,200 a. Debt ratio b Current ratio Debt-payments ratio d. Savings ratio The Fram family has liabilities of $136,000 and a net worth of $348,000. What is their debt ratio? (Round your answer to 3 decimal places.) Debt ratio E Carl Lester has liquid assets of $3,155 and current liabilities of $3,561. What is his current ratio? (Round your answer to 2 decimal places.) Current ratio For the following situations, calculate the cash surplus or deficit. (Input all amounts as positive values.) Difference Surplus/Deficit Cash Inflows Cash Outflows $ 3,620 $ 3,258 $ 4,820 $ 4.907 $ 4,457 $ 4.223

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started