Question

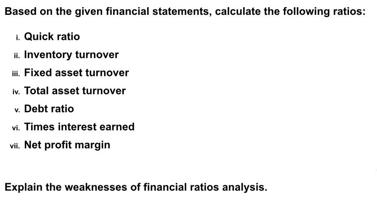

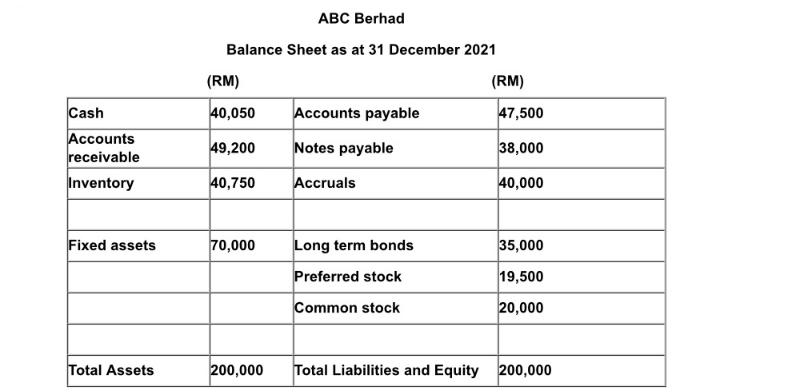

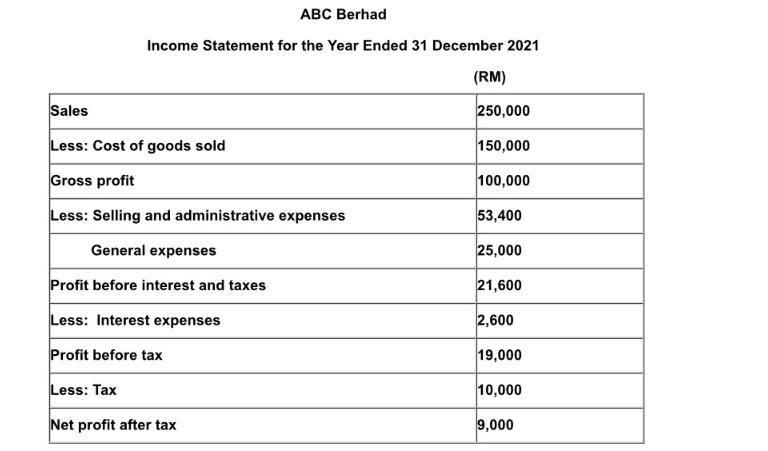

Based on the given financial statements, calculate the following ratios: L Quick ratio Inventory turnover Fixed asset turnover iv. Total asset turnover v. Debt

Based on the given financial statements, calculate the following ratios: L Quick ratio Inventory turnover Fixed asset turnover iv. Total asset turnover v. Debt ratio vi. Times interest earned vii. Net profit margin Explain the weaknesses of financial ratios analysis. Based on the given financial statements, calculate the following ratios: L Quick ratio Inventory turnover Fixed asset turnover iv. Total asset turnover v. Debt ratio vi. Times interest earned vii. Net profit margin Explain the weaknesses of financial ratios analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculate the requested financial ratios as follows 1 Quick Ratio Quick Ratio also known as the AcidTest Ratio Cash Accounts Receivable Current Liabilities Given Cash given RM 40050 Accounts Receivabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory And Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

3rd Canadian Edition

017658305X, 978-0176583057

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App