Question

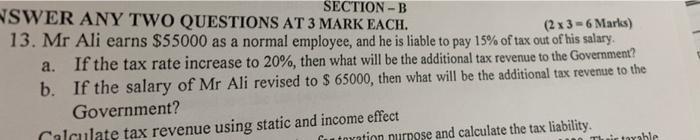

SECTION-B NSWER ANY TWO QUESTIONS AT 3 MARK EACH. (2 x 3-6 Marks) 13. Mr Ali earns $55000 as a normal employee, and he

SECTION-B NSWER ANY TWO QUESTIONS AT 3 MARK EACH. (2 x 3-6 Marks) 13. Mr Ali earns $55000 as a normal employee, and he is liable to pay 15% of tax out of his salary. If the tax rate increase to 20%, then what will be the additional tax revenue to the Government? If the salary of Mr Ali revised to $ 65000, then what will be the additional tax revenue to the Government? a. b. Calculate tax revenue using static and income effect utoration purpose and calculate the tax liability. Their tarable

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a If the tax rate increase to 20 then what will be the additional tax revenue to the Government a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Warren, Reeve, Duchac

12th Edition

1133952410, 9781133952411, 978-1133952428

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App