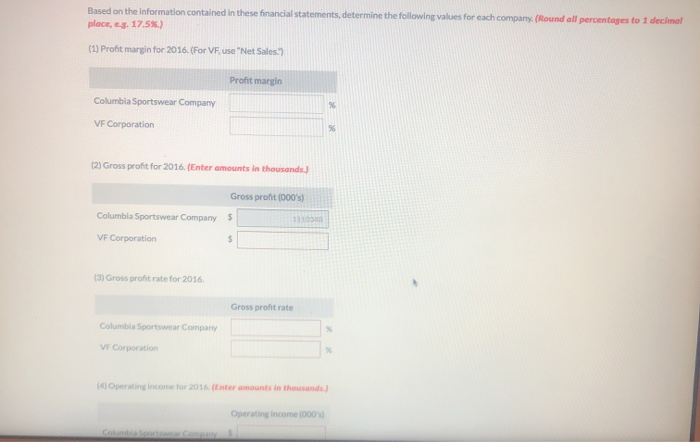

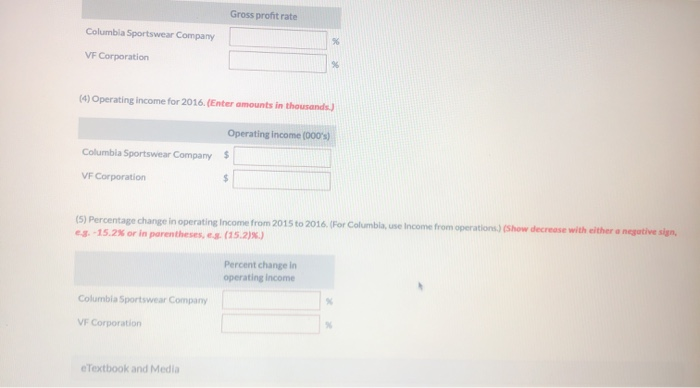

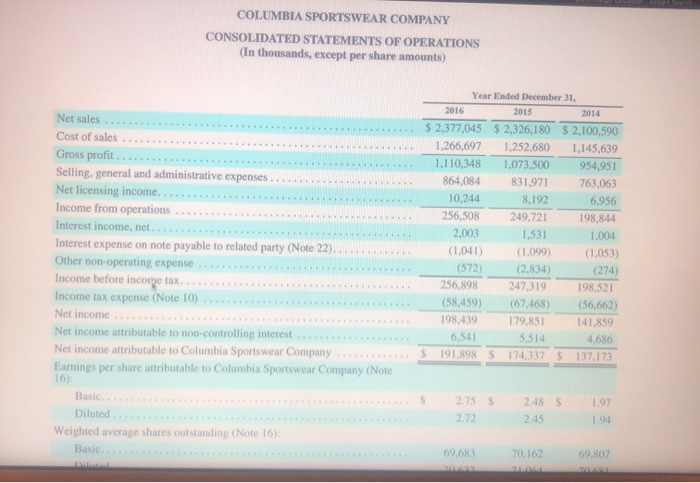

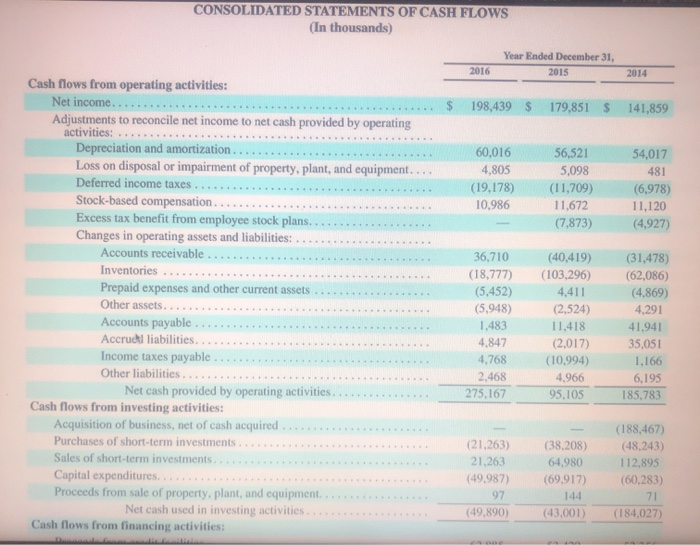

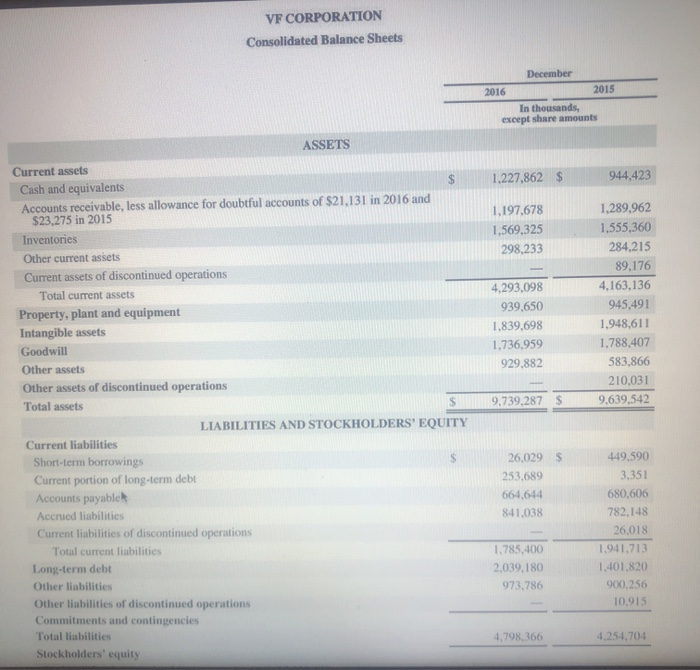

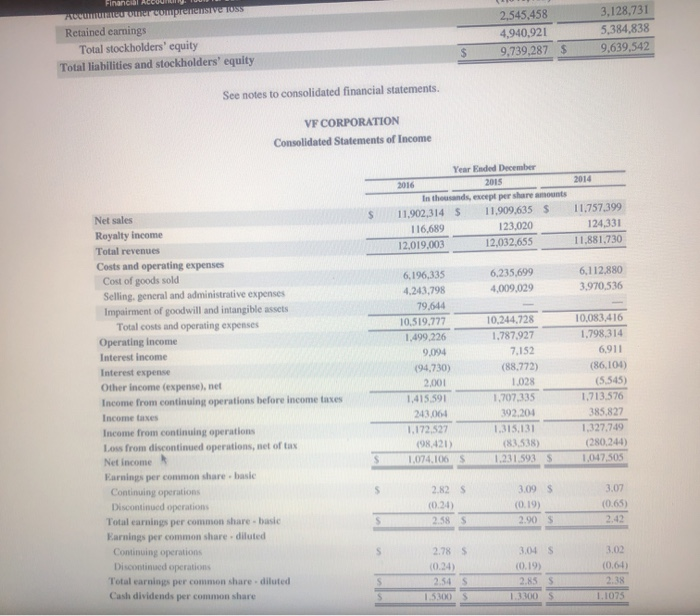

Based on the information contained in these financial statements, determine the following values for each company (Round all percentages to 1 decimal place, eg. 17.5%) (1) Profit margin for 2016. (For VF use "Net Sales) Profit margin Columbia Sportswear Company VF Corporation (2) Gross profit for 2016. (Enter amounts in thousands) Gross profit (000's) Columbia Sportswear Company VF Corporation (3) Gross profit rate for 2016, Gross profitrate Columbia Sportswear Company VE Corporation (4) Operating income for 2016 (Enter amounts in thousands) Operating income 1000 Gross profit rate Columbia Sportswear Company VF Corporation (4) Operating income for 2016. (Enter amounts in thousands Operating income (000's) S Columbia Sportswear Company VF Corporation (5) Percentage change in operating Income from 2015 to 2016. (For Columbia, use Income from operations.) (Show decrease with either a negative sign, .-15.2% or in parentheses, e. (15.2).) Percent change in operating income Columbia Sportswear Company VF Corporation e Textbook and Media COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Net sales .... Cost of sales ...... Gross profit.......... . Selling, general and administrative expenses.... Net licensing income........................ Income from operations ..... Interest income, net.. Interest expense on note payable to related party (Note 22), Other non-operating expense Income before income tax.. Income tax expense (Note 10) Net income Net income attributable to non-controlling interest Net income attributable to Columbia Sportswear Company Earnings per share attributable to Columbia Sportswear Company (Note 16) Year Ended December 31, 2016 2015 ... $2,377,045 $ 2,326,180 $2,100,590 1,266,697 1.252.680 1.145.639 1.110,348 1,073,500 954,951 864,084 831,971 763.063 10.244 8.192 6 ,956 256,508 249,721 198,844 2,003 1.531 1.004 (1.041) (1,099) (1.053) (572) 2,834) 256.898 247,319 198.521 (58,459) (67,468) (56,662) 198419 179.851 141.859 5.514 4.686 S 191.9 S 174.137 S 37.173 $ 2.75 s 2.48 s 1.97 1.94 Weighted average shares outstanding Note 16) 69.683 70,162 6 9.807 VF CORPORATION Consolidated Balance Sheets December 2016 In thousands, except share amounts ASSETS 1.227,862 $ 944,423 1,197,678 1,569,325 298,233 4,293,098 939,650 1,839,698 1.736,959 929.882 1,289,962 1,555,360 284,215 89,176 4,163,136 945,491 1,948,611 1.788,407 583,866 210,031 9,639,542 9,739,287 $ Current assets Cash and equivalents Accounts receivable, less allowance for doubtful accounts of $21,131 in 2016 and $23.275 in 2015 Inventories Other current assets Current assets of discontinued operations Total current assets Property, plant and equipment Intangible assets Goodwill Other assets Other assets of discontinued operations Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Short-term borrowings Current portion of long-term debt Accounts payable Accrued liabilities Current liabilities of discontinued operations Total current liabilities Long-term debt Other liabilities Other liabilities of discontinued operations Commitments and contingencies Total liabilities Stockholders' equity $ 26,029 253,689 664.644 841.038 449,590 3,351 680,606 782,148 26.018 1.941.713 1.401,820 900.256 10,915 1.785,400 2,039,180 973.786 4,798,366 4.254,704 Financial ACCOUNT HUM F er comprentensive TOSS Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 2,545,458 4,940,921 9,739,287 $ 3.128,731 5,384,838 9,639,542 $ See notes to consolidated financial statements. VF CORPORATION Consolidated Statements of Income Year Ended December 2016 In thousands, except per share amounts 11,902,314 $ 11.909,635 $ 116,689 123,020 12.019.003 12,032,655 11.757,399 124,331 11.881.730 6,235,699 4,009,029 6,112,880 3.970,536 Net sales Royalty income Total revenues Costs and operating expenses Cost of goods sold Selling general and administrative expenses Impairment of goodwill and intangible assets Total costs and operating expenses Operating Income Interest income Interest expense Other income (expense), nel Income from continuing operations before income taxes Income taxes Income from continuing operations Loss from discontinued operations, net of tax Net Income Earnings per common share. baste Continuing operations Discontinued operations Total earnings per common share basic Earnings per common share-diluted Continuing operations Discontinued operations Total earnings per common share. diluted Cash dividends per common share 6,196,335 4.243,798 79.644 10.519.777 1,499,226 9.094 (94.730) 2001 1.415.591 243064 1.17527 10,244.728 1.787.927 7.152 (88.772) 1.028 1.707,335 12204 1.315.131 ( 338) 1.211 501 S 10.083,416 1.798,314 6,911 (86,104) (5.545) 1.713.576 385.827 1327.749 OR-21) (280.244) 1. 02505 1.074.106 S 2.82 $ 3.09 (0.19) 2.90 3.07 (0.65) 258S S 2.78 S (0.64 3.04 (0.19) 2.85 1.3300 S S SM) S 1.1075