Answered step by step

Verified Expert Solution

Question

1 Approved Answer

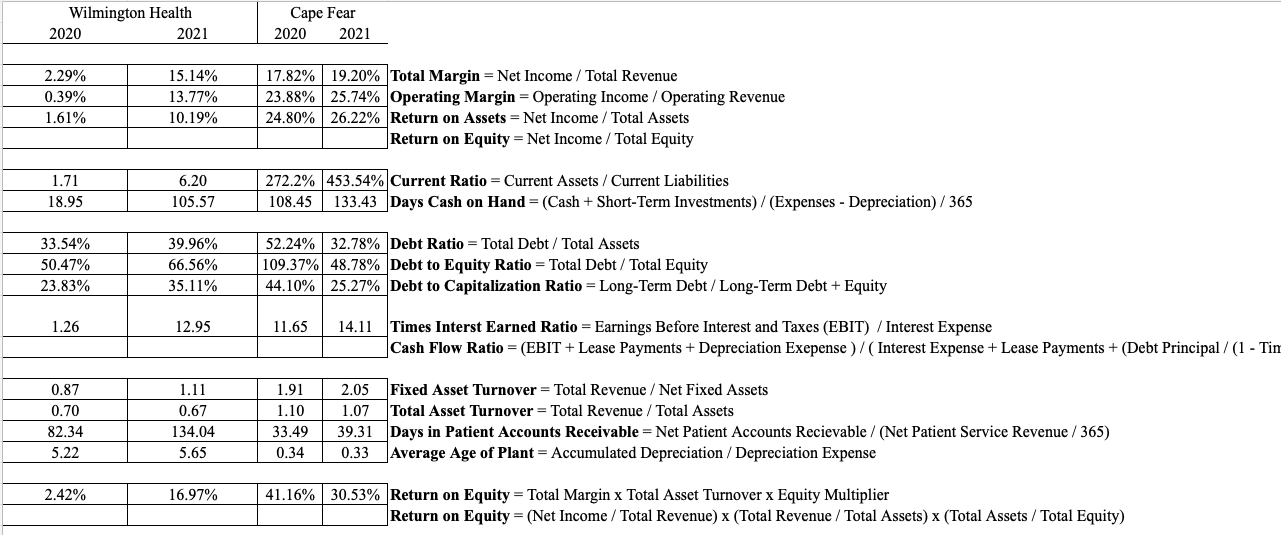

Based on the information given answer the following: What Cape Fear could do to improve operations for 2022, and how their operations differ from Wilmington

Based on the information given answer the following:

What Cape Fear could do to improve operations for 2022, and how their operations differ from Wilmington Health. Do not repeat information given in the problem or give formulas or numbers. This question requires you to think and reason like a manager.

Wilmington Health 2020 Cape Fear 2021 2020 2021 2.29% 0.39% 1.61% 15.14% 13.77% 10.19% 1.71 18.95 6.20 105.57 33.54% 50.47% 23.83% 39.96% 66.56% 17.82% 19.20% Total Margin = Net Income / Total Revenue 23.88% 25.74% Operating Margin = Operating Income/Operating Revenue 24.80% 26.22% Return on Assets = Net Income / Total Assets Return on Equity = Net Income / Total Equity 272.2% 453.54% Current Ratio = Current Assets / Current Liabilities 108.45 52.24% 32.78% Debt Ratio = Total Debt / Total Assets 133.43 Days Cash on Hand = (Cash + Short-Term Investments)/ (Expenses - Depreciation) / 365 109.37% 48.78% Debt to Equity Ratio = Total Debt/ Total Equity 35.11% 44.10% 25.27% Debt to Capitalization Ratio = Long-Term Debt / Long-Term Debt + Equity 1.26 12.95 11.65 14.11 Times Interst Earned Ratio = Earnings Before Interest and Taxes (EBIT)/ Interest Expense Cash Flow Ratio = (EBIT + Lease Payments + Depreciation Exepense) / (Interest Expense + Lease Payments + (Debt Principal / (1 - Tim Fixed Asset Turnover = Total Revenue / Net Fixed Assets 0.87 1.11 0.70 0.67 1.91 1.10 2.05 1.07 Total Asset Turnover = Total Revenue / Total Assets 82.34 134.04 33.49 39.31 5.22 5.65 0.34 0.33 2.42% 16.97% Days in Patient Accounts Receivable = Net Patient Accounts Recievable / (Net Patient Service Revenue / 365) Average Age of Plant = Accumulated Depreciation / Depreciation Expense 41.16% 30.53% Return on Equity = Total Margin x Total Asset Turnover x Equity Multiplier Return on Equity = (Net Income / Total Revenue) x (Total Revenue / Total Assets) x (Total Assets/Total Equity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided here are some considerations for Cape Fear to improve operations in 2022 and how their operations differ from Wilmin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started