Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the information given, what is the preferred project based on the payback period method? The financial manager of Levi Limited is considering borrowing

- Based on the information given, what is the preferred project based on the payback period method?

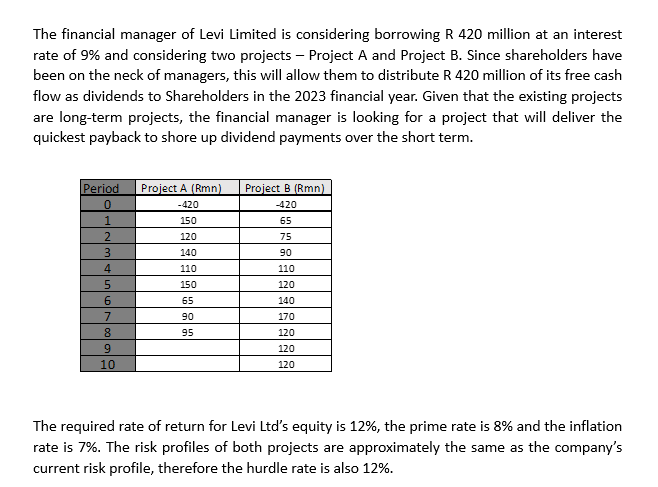

The financial manager of Levi Limited is considering borrowing R 420 million at an interest rate of 9% and considering two projects - Project A and Project B. Since shareholders have been on the neck of managers, this will allow them to distribute R 420 million of its free cash flow as dividends to Shareholders in the 2023 financial year. Given that the existing projects are long-term projects, the financial manager is looking for a project that will deliver the quickest payback to shore up dividend payments over the short term. The required rate of return for Levi Ltd's equity is 12%, the prime rate is 8% and the inflation rate is 7%. The risk profiles of both projects are approximately the same as the company's current risk profile, therefore the hurdle rate is also 12%

The financial manager of Levi Limited is considering borrowing R 420 million at an interest rate of 9% and considering two projects - Project A and Project B. Since shareholders have been on the neck of managers, this will allow them to distribute R 420 million of its free cash flow as dividends to Shareholders in the 2023 financial year. Given that the existing projects are long-term projects, the financial manager is looking for a project that will deliver the quickest payback to shore up dividend payments over the short term. The required rate of return for Levi Ltd's equity is 12%, the prime rate is 8% and the inflation rate is 7%. The risk profiles of both projects are approximately the same as the company's current risk profile, therefore the hurdle rate is also 12% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started