Answered step by step

Verified Expert Solution

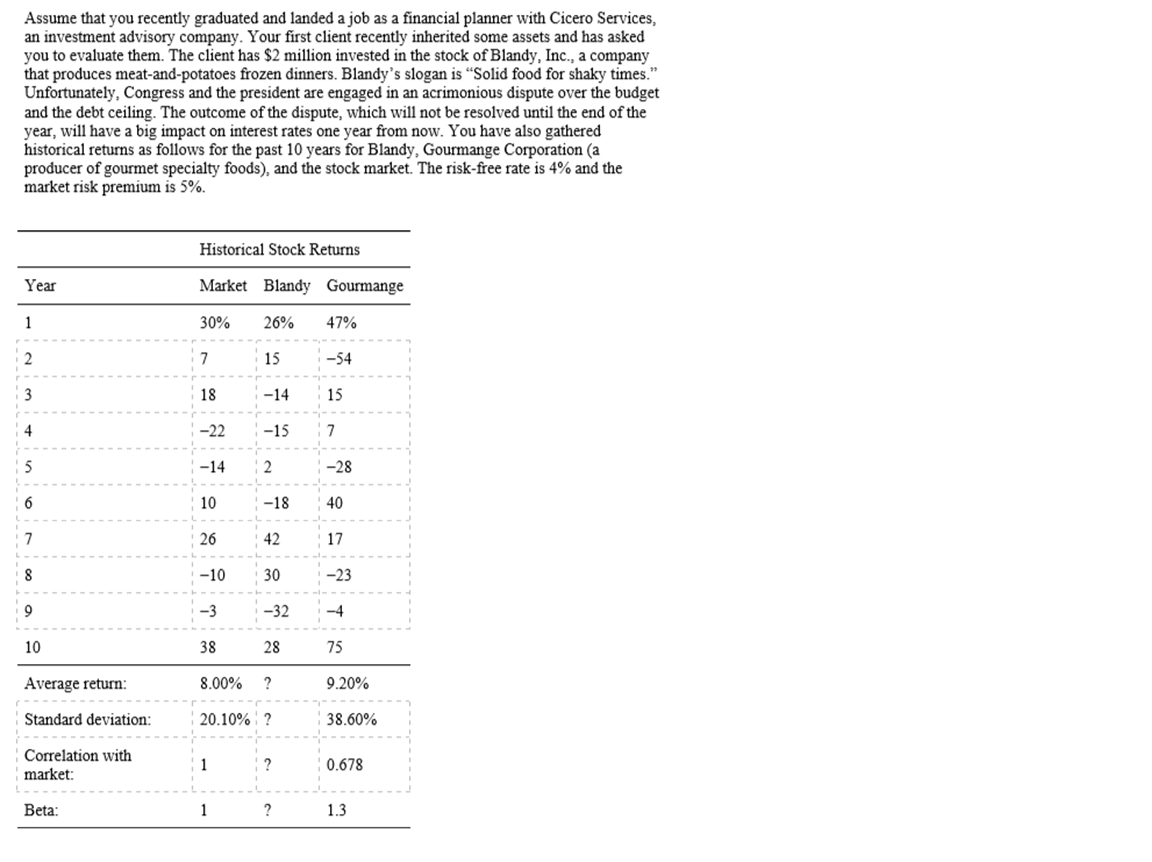

Question

1 Approved Answer

Based on the information provided above, complete the following: Suppose an investor starts with a portfolio consisting of one randomly selected stock. How to measure

Based on the information provided above, complete the following:

- Suppose an investor starts with a portfolio consisting of one randomly selected stock. How to measure the risk and return given different scenarios for a particular stock? What are the criteria the investor should consider to choose a single stock to invest? As more and more randomly selected stocks are added to the portfolio, what happens to the portfolios risk? How does correlation affect your portfolio return and risk? Calculate the numbers with questions marks and the estimated correlation between Blandy and Gourmange using the data in the above Table. Does this explain why the portfolio standard deviation was less than Blandys standard deviation?

- If you decided to hold a one-stock portfolio and consequently were exposed to more risk than diversified investors, could you expect to be compensated for all of your risk; that is, could you earn a risk premium on that part of your risk that you could have eliminated by diversifying? According to the Capital Asset Pricing Model, what measures the amount of risk that an individual stock contributes to a well-diversified portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started