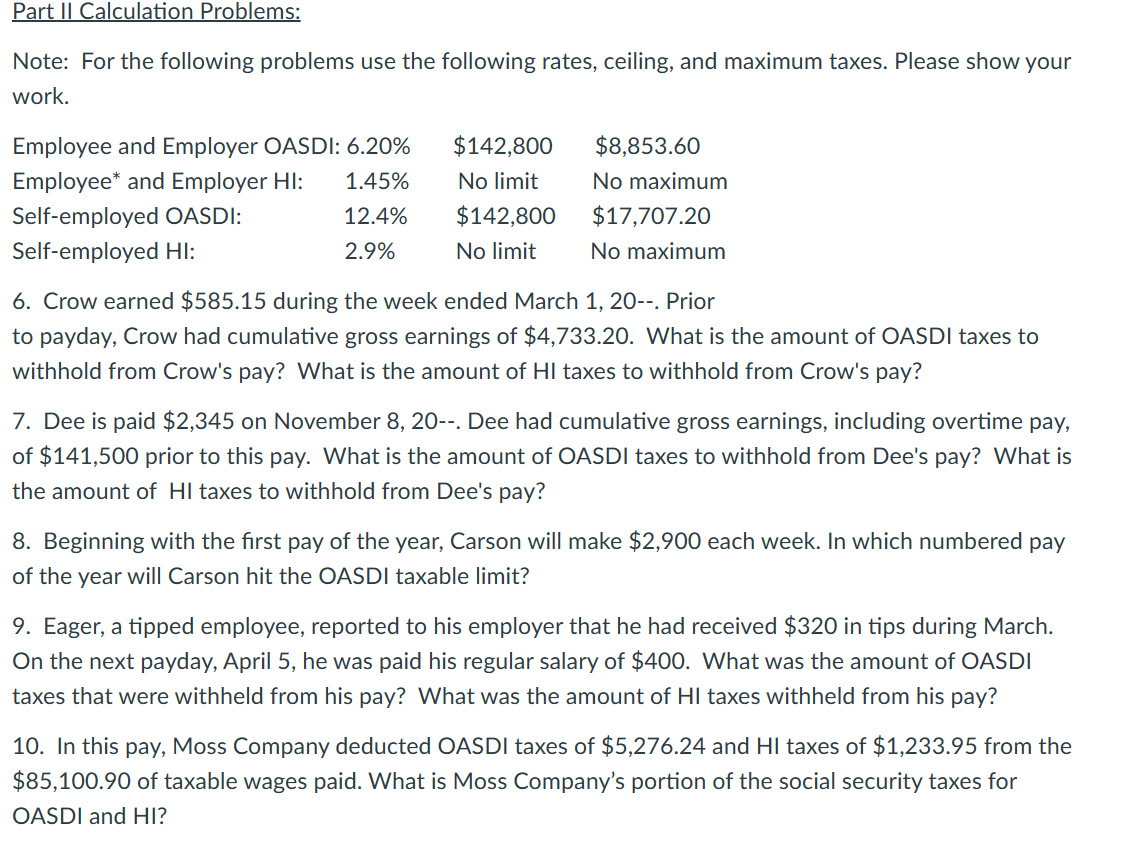

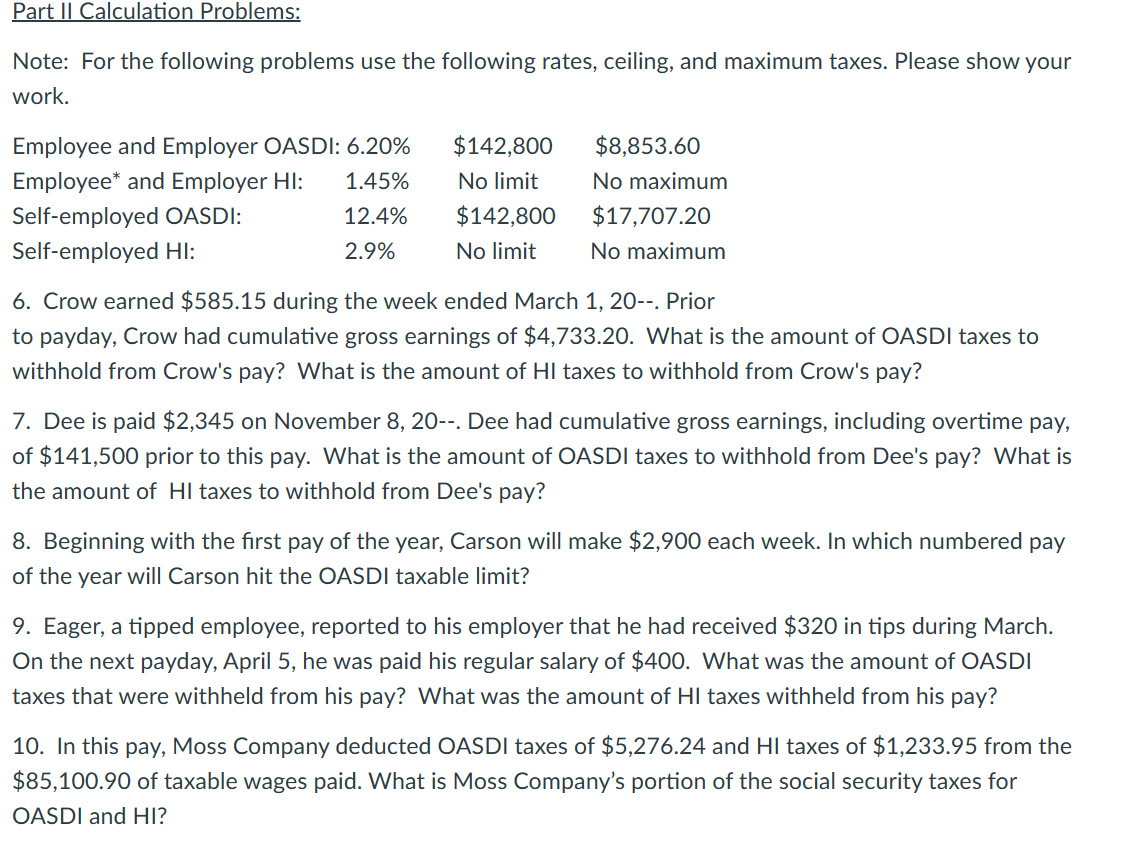

Based on the module assignments and readings, please complete the following mastery assignment. You will be graded against the rubric provided. Part I Theory Questions: Using a minimum of a paragraph on each item, thoroughly answer the following: 1. Identify, for social security purposes, those persons covered under the law and those services that make up employment. 2. Identify the types of compensation that are defined as wages. 3. What are the current tax rates and wage base for FICA and SECA purposes? 4. Describe the different requirements and procedures for depositing FICA taxes and income taxes withheld from employees' wages. 5. How do different Social Security requirements affect your place of work or prospective career? Part II Calculation Problems: Note: For the following problems use the following rates, ceiling, and maximum taxes. Please show your work. 6. Crow earned $585.15 during the week ended March 1, 20--. Prior to payday, Crow had cumulative gross earnings of $4,733.20. What is the amount of OASDI taxes to withhold from Crow's pay? What is the amount of HI taxes to withhold from Crow's pay? 7. Dee is paid $2,345 on November 8, 20--. Dee had cumulative gross earnings, including overtime pay, of $141,500 prior to this pay. What is the amount of OASDI taxes to withhold from Dee's pay? What is the amount of HI taxes to withhold from Dee's pay? 8. Beginning with the first pay of the year, Carson will make $2,900 each week. In which numbered pay of the year will Carson hit the OASDI taxable limit? 9. Eager, a tipped employee, reported to his employer that he had received $320 in tips during March. On the next payday, April 5 , he was paid his regular salary of $400. What was the amount of OASDI taxes that were withheld from his pay? What was the amount of HI taxes withheld from his pay? 10. In this pay, Moss Company deducted OASDI taxes of $5,276.24 and HI taxes of $1,233.95 from the $85,100.90 of taxable wages paid. What is Moss Company's portion of the social security taxes for OASDI and HI? Based on the module assignments and readings, please complete the following mastery assignment. You will be graded against the rubric provided. Part I Theory Questions: Using a minimum of a paragraph on each item, thoroughly answer the following: 1. Identify, for social security purposes, those persons covered under the law and those services that make up employment. 2. Identify the types of compensation that are defined as wages. 3. What are the current tax rates and wage base for FICA and SECA purposes? 4. Describe the different requirements and procedures for depositing FICA taxes and income taxes withheld from employees' wages. 5. How do different Social Security requirements affect your place of work or prospective career? Part II Calculation Problems: Note: For the following problems use the following rates, ceiling, and maximum taxes. Please show your work. 6. Crow earned $585.15 during the week ended March 1, 20--. Prior to payday, Crow had cumulative gross earnings of $4,733.20. What is the amount of OASDI taxes to withhold from Crow's pay? What is the amount of HI taxes to withhold from Crow's pay? 7. Dee is paid $2,345 on November 8, 20--. Dee had cumulative gross earnings, including overtime pay, of $141,500 prior to this pay. What is the amount of OASDI taxes to withhold from Dee's pay? What is the amount of HI taxes to withhold from Dee's pay? 8. Beginning with the first pay of the year, Carson will make $2,900 each week. In which numbered pay of the year will Carson hit the OASDI taxable limit? 9. Eager, a tipped employee, reported to his employer that he had received $320 in tips during March. On the next payday, April 5 , he was paid his regular salary of $400. What was the amount of OASDI taxes that were withheld from his pay? What was the amount of HI taxes withheld from his pay? 10. In this pay, Moss Company deducted OASDI taxes of $5,276.24 and HI taxes of $1,233.95 from the $85,100.90 of taxable wages paid. What is Moss Company's portion of the social security taxes for OASDI and HI