Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the portfolio constructed, what are some of the differences you are seeing in the efficient frontier curves? What are the contributing factors behind

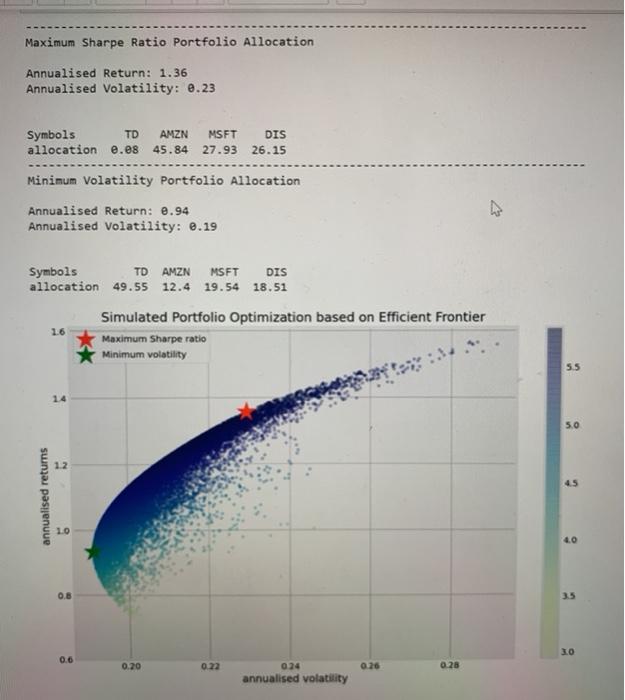

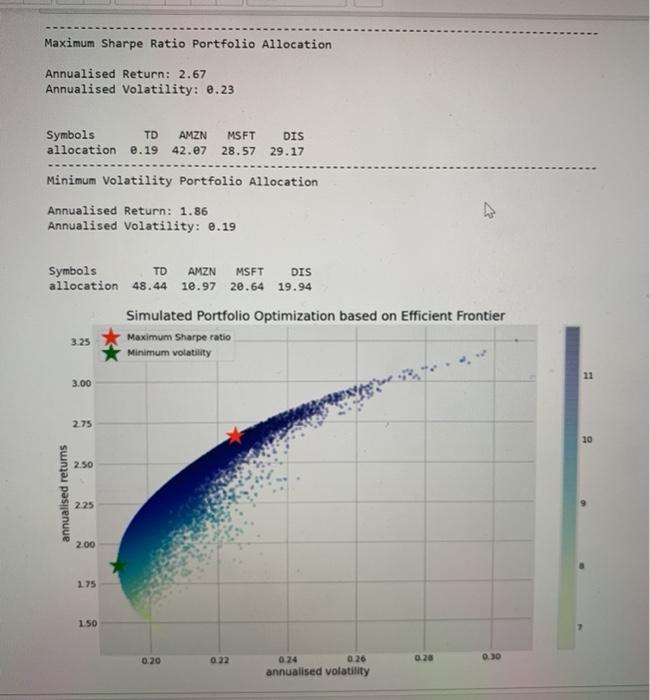

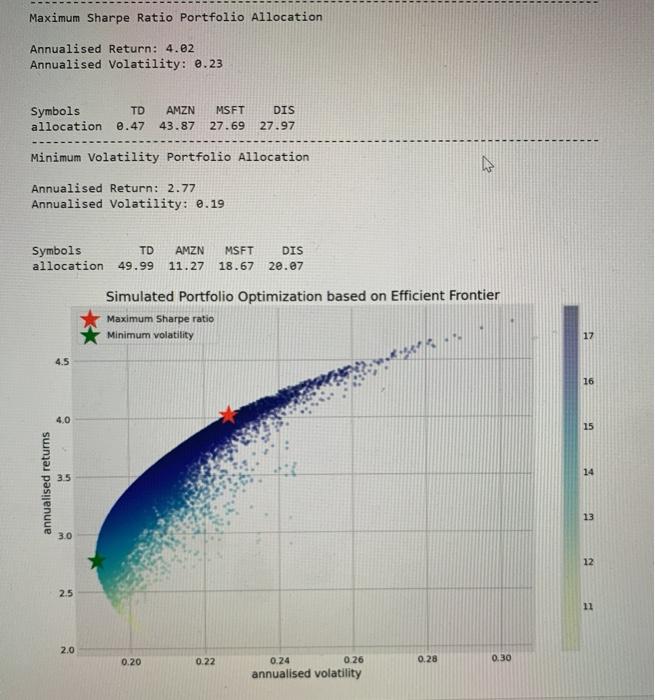

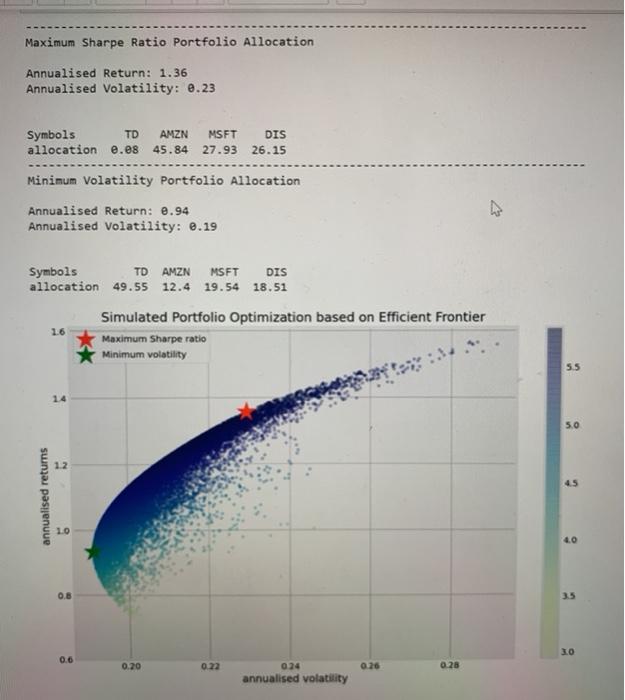

Based on the portfolio constructed, what are some of the differences you are seeing in the efficient frontier curves? What are the contributing factors behind the difference?

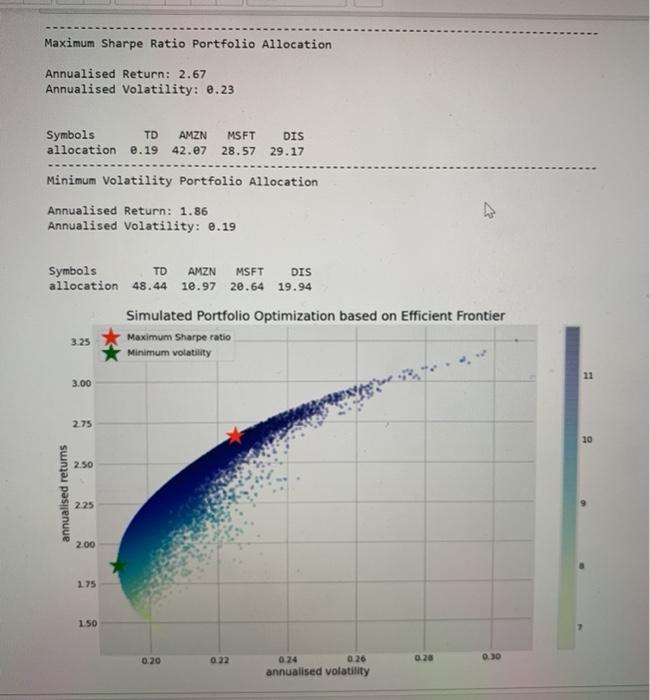

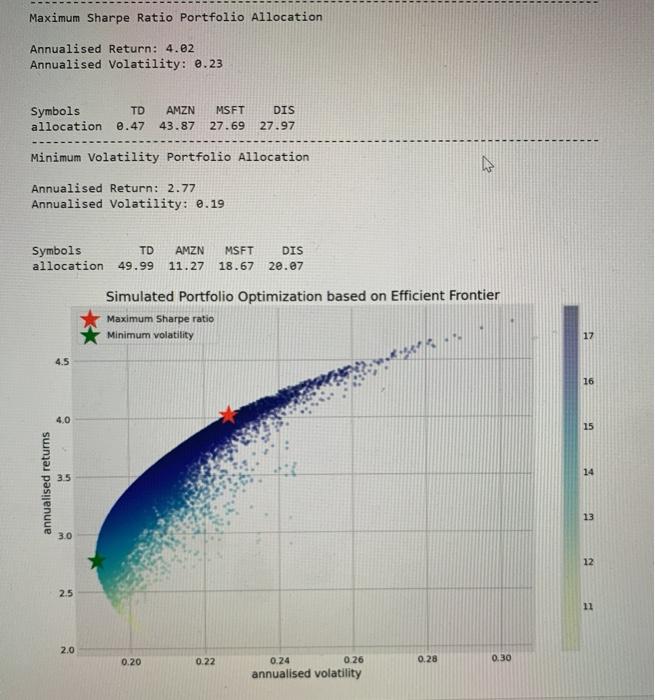

Maximum Sharpe Ratio Portfolio Allocation Annualised Return: 1.36 Annualised Volatility: 0.23 Symbols TD allocation e.es AMZN MSFT 45.84 27.93 DIS 26.15 Minimum Volatility Portfolio Allocation Annualised Return: 0.94 Annualised Volatility: 0.19 Symbols TD AMZN MSFT DIS allocation 49.55 12.4 19.54 18.51 Simulated Portfolio Optimization based on Efficient Frontier Maximum Sharpe ratio Minimum volatility 16 55 5.0 12 45 annualised returns 10 0.8 35 10 0.6 0.20 0.22 0.26 0.28 024 annualised volatility Maximum Sharpe Ratio Portfolio Allocation Annualised Return: 2.67 Annualised Volatility: 0.23 Symbols TD AMZN allocation 0.19 42.07 MSFT DIS 28.57 29.17 Minimum Volatility Portfolio Allocation Annualised Return: 1.86 Annualised Volatility: 0.19 2 Symbols TD AMZN MSFT DIS allocation 48.44 10.97 20.64 19.94 Simulated Portfolio Optimization based on Efficient Frontier 3.25 Maximum Sharpe ratio Minimum volatility 3.00 2.75 10 2.50 annualised retums 2.25 2.00 175 150 0.20 0.22 0.20 0.30 0.24 0.26 annualised volatility Maximum Sharpe Ratio Portfolio Allocation Annualised Return: 4.02 Annualised Volatility: 0.23 Symbols TD allocation 0.47 AMZN 43.87 MSFT 27.69 DIS 27.97 Minimum Volatility Portfolio Allocation De Annualised Return: 2.77 Annualised Volatility: 0.19 Symbols TD AMZN MSFT DIS allocation 49.99 11.27 18.67 20.07 Simulated Portfolio Optimization based on Efficient Frontier Maximum Sharpe ratio Minimum volatility 17 4.5 16 4.0 15 3.5 14 annualised returns 13 3.0 12 2.5 12 2.0 0.20 0.22 0.28 0.30 0.24 0.26 annualised volatility

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started