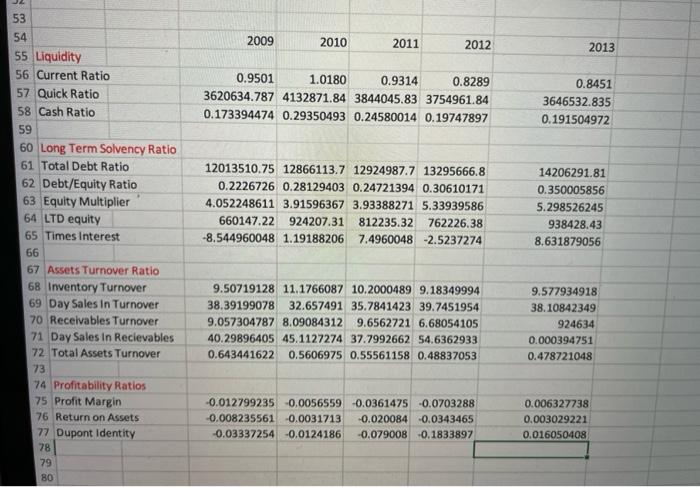

Based on these calculations, discuss the financial management performance from year to year as a shareholders point of view. (300 words)

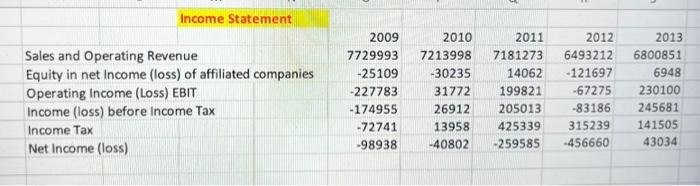

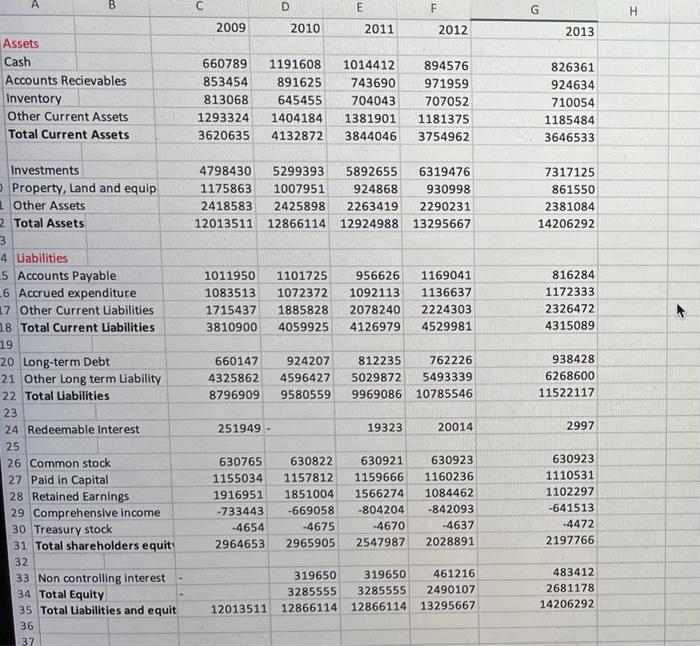

Income Statement Sales and Operating Revenue Equity in net Income (loss) of affiliated companies Operating Income (Loss) EBIT Income (loss) before Income Tax Income Tax Net Income (loss) 2009 7729993 -25109 -227783 -174955 -72741 -98938 2010 7213998 -30235 31772 26912 13958 -40802 2011 7181273 14062 199821 205013 425339 -259585 2012 6493212 -121697 -67275 -83186 315239 -456660 2013 6800851 6948 230100 245681 141505 43034 A B D E F G H 2009 2010 2011 2012 2013 Assets Cash Accounts Recievables Inventory Other Current Assets Total Current Assets 660789 853454 813068 1293324 3620635 1191608 891625 645455 1404184 4132872 1014412 743690 704043 1381901 3844046 894576 971959 707052 1181375 3754962 826361 924634 710054 1185484 3646533 4798430 1175863 2418583 12013511 5299393 1007951 2425898 12866114 5892655 924868 2263419 12924988 6319476 930998 2290231 13295667 7317125 861550 2381084 14206292 1011950 1083513 1715437 3810900 1101725 1072372 1885828 4059925 956626 1092113 2078240 4126979 1169041 1136637 2224303 4529981 816284 1172333 2326472 4315089 660147 4325862 8796909 924207 4596427 9580559 812235 5029872 9969086 762226 5493339 10785546 938428 6268600 11522117 Investments Property, Land and equip Other Assets 2 Total Assets 3 4 Liabilities 5 Accounts Payable -6 Accrued expenditure 17 Other Current Liabilities 18 Total Current Liabilities 19 20 Long-term Debt 21 Other Long term Liability 22 Total Liabilities 23 24 Redeemable Interest 25 26 Common stock 27 Paid in Capital 28 Retained Earnings 29 Comprehensive income 30 Treasury stock 31 Total shareholders equit: 32 33 Non controlling interest 34 Total Equity 35 Total Liabilities and equit 36 37 251949 - 19323 20014 2997 630765 1155034 1916951 -733443 -4654 2964653 630822 1157812 1851004 -669058 -4675 2965905 630921 1159666 1566274 -804204 -4670 2547987 630923 1160236 1084462 -842093 -4637 2028891 630923 1110531 1102297 -641513 -4472 2197766 319650 3285555 12866114 319650 461216 3285555 2490107 12866114 13295667 483412 2681178 14206292 12013511 2009 2010 2011 2012 2013 0.9501 1.0180 0.9314 0.8289 3620634.787 4132871.84 3844045.83 3754961.84 0.173394474 0.29350493 0.24580014 0.19747897 0.8451 3646532.835 0.191504972 12013510.75 12866113.7 12924987.7 13295666.8 0.2226726 0.28129403 0.24721394 0.30610171 4.052248611 3.91596367 3.93388271 5.33939586 660147.22 924207.31 812235.32 762226.38 -8.544960048 1.19188206 7.4960048 -2.5237274 14206291.81 0.350005856 5.298526245 938428.43 8.631879056 53 54 55 Liquidity 56 Current Ratio 57 Quick Ratio 58 Cash Ratio 59 60 Long Term Solvency Ratio 61 Total Debt Ratio 62 Debt/Equity Ratio 63 Equity Multiplier 64 LTD equity 65 Times Interest 66 67 Assets Turnover Ratio 68 Inventory Turnover 69 Day Sales in Turnover 70 Receivables Turnover 71 Day Sales In Recievables 72 Total Assets Turnover 73 74 Profitability Ratios 75 Profit Margin 76 Return on Assets 77 Dupont Identity 78 79 80 9.50719128 11.1766087 10.2000489 9.18349994 38.39199078 32.657491 35.7841423 39.7451954 9.057304787 8.09084312 9.6562721 6.68054105 40.29896405 45.1127274 37.7992662 54.6362933 0.643441622 0.5606975 0.55561158 0.48837053 9.577934918 38.10842349 924634 0.000394751 0.478721048 -0.012799235 -0.0056559 -0.0361475 -0.0703288 -0.008235561 0.0031713 -0.020084 0.0343465 -0.03337254 -0.0124186 -0.079008 -0.1833897 0.006327738 0.003029221 0.016050408