Answered step by step

Verified Expert Solution

Question

1 Approved Answer

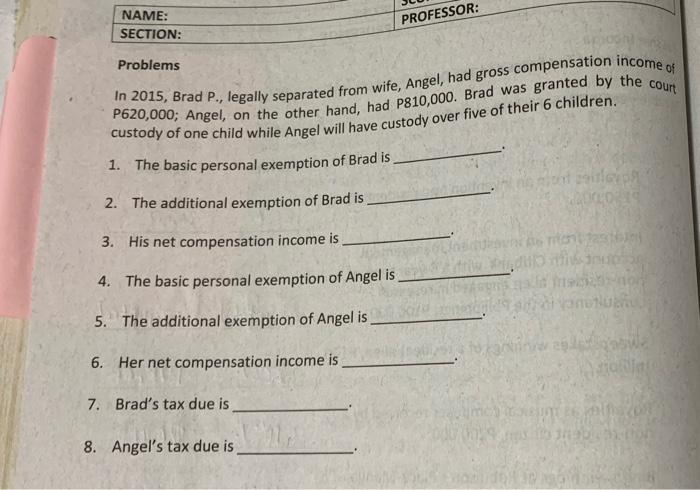

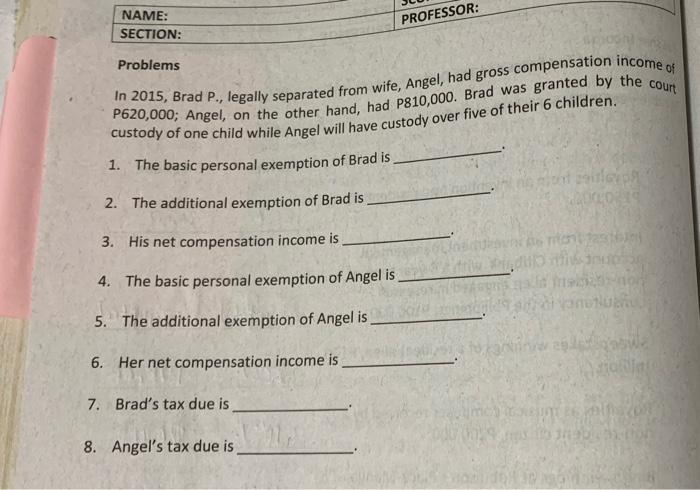

based on train law ph NAME: SECTION: PROFESSOR: Problems In 2015, Brad P., legally separated from wife, Angel, had gross compensation income of P620,000; Angel,

based on train law ph

NAME: SECTION: PROFESSOR: Problems In 2015, Brad P., legally separated from wife, Angel, had gross compensation income of P620,000; Angel, on the other hand, had P810,000. Brad was granted by the court custody of one child while Angel will have custody over five of their 6 children. 1. The basic personal exemption of Brad is 2. The additional exemption of Brad is 3. His net compensation income is Boost 4. The basic personal exemption of Angel is 5. The additional exemption of Angel is 6. Her net compensation income is 7. Brad's tax due is 8. Angel's tax due is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started