Question: Based on what you have learned in Module 2 (Charter 5 and 6). please describe your approach at solving the following two scenarios. This should

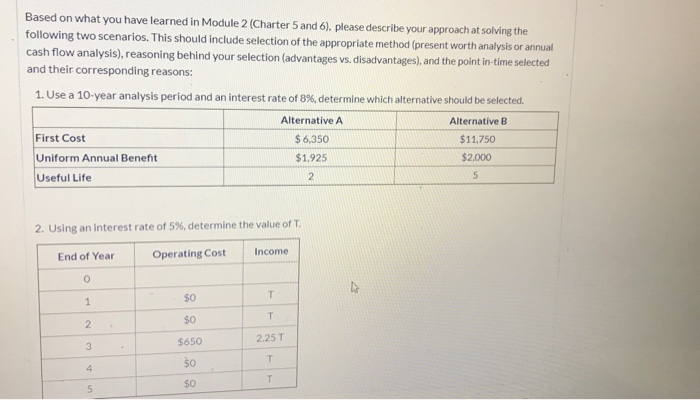

Based on what you have learned in Module 2 (Charter 5 and 6). please describe your approach at solving the following two scenarios. This should include selection of the appropriate method (present worth analysis or annual cash flow analysis), reasoning behind your selection (advantages vs. disadvantages), and the point in time selected and their corresponding reasons: 1. Use a 10-year analysis period and an interest rate of 8%, determine which alternative should be selected. Alternative A Alternative B First Cost $6,350 $11.750 Uniform Annual Benefit $1,925 $2,000 Useful Life 2. Using an interest rate of 5%, determine the value of T. End of Year Operating Cost Income $0 $650 2.25 T Based on what you have learned in Module 2 (Charter 5 and 6). please describe your approach at solving the following two scenarios. This should include selection of the appropriate method (present worth analysis or annual cash flow analysis), reasoning behind your selection (advantages vs. disadvantages), and the point in time selected and their corresponding reasons: 1. Use a 10-year analysis period and an interest rate of 8%, determine which alternative should be selected. Alternative A Alternative B First Cost $6,350 $11.750 Uniform Annual Benefit $1,925 $2,000 Useful Life 2. Using an interest rate of 5%, determine the value of T. End of Year Operating Cost Income $0 $650 2.25 T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts