Based on your analysis, do you think Karen Short should continue to maintain the buy recommendation for Whole Foods?

use the below info to come to a conclusion.

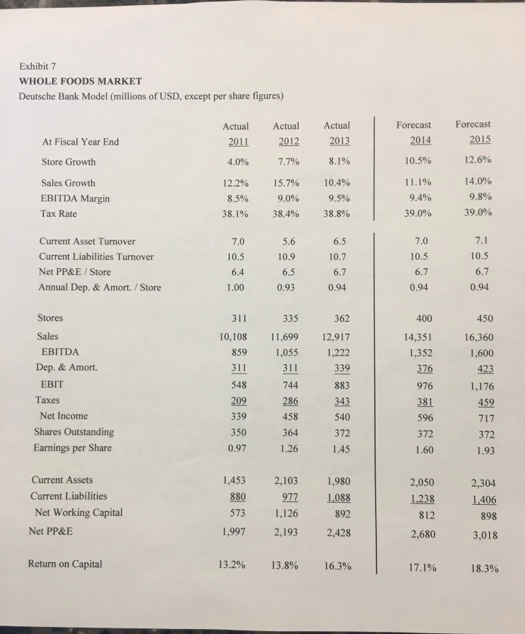

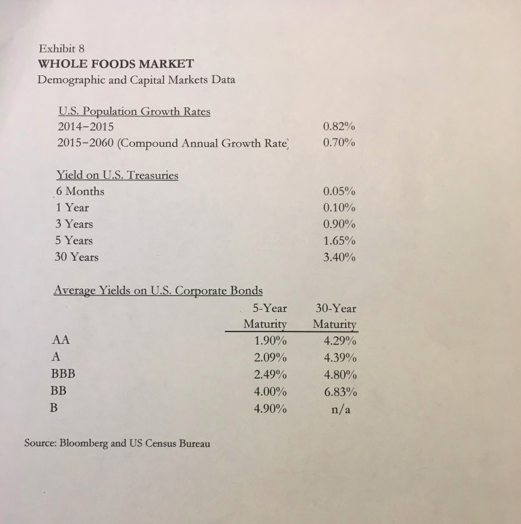

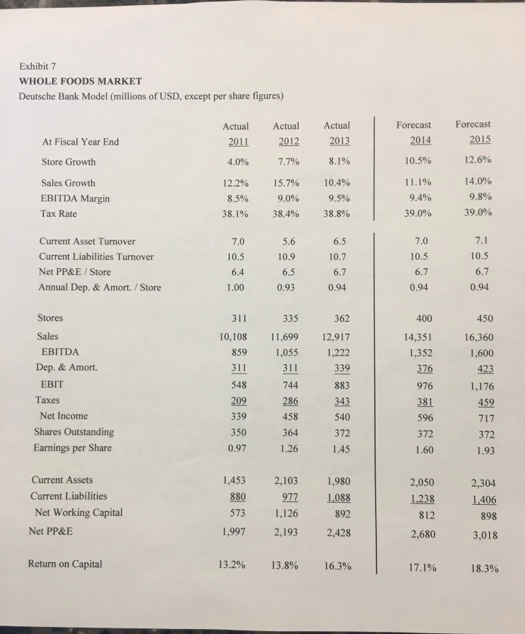

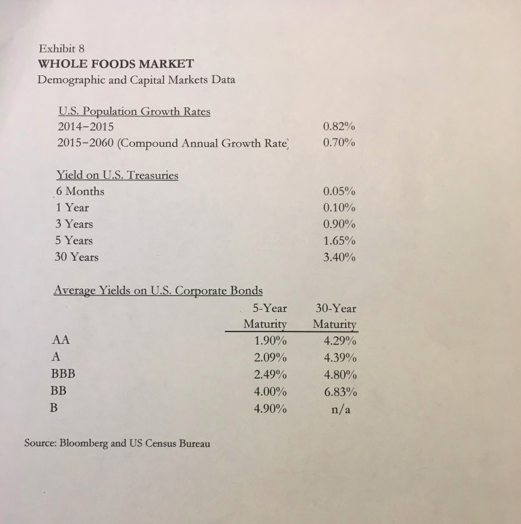

le Foods Market: Deutsche Bank Report The latest numbers coming out of Whole Foods Market, Inc. (Whole Foods) in May 2014 took Deutsche Bank research analyst Karen Short and her team by surprise. On May 6 , Whole Foods reported just $0.38 per share in its quarterly earnings report, missing Wall Street's consensus of $0.41 and cutting earnings guidance for the remainder of the year. The company's share price fell 19% to $38.93 the next day as Whole Foods' management acknowledged that it faced an increasingly competitive environment that could compress margins and slow expansion. The only upbeat news was the 20% increase in the company's quarterly dividend, up from $0.10 to $0.12 per share. Short and her team knew this was not the first time the market believed Whole Foods had gone stale. In 2006, Whole Foods' stock had also declined 20% over fears of slowing growth and increasing competition, but had since bounced back and outperformed both its competition and the broader market (see Exhibit 7.1 for stock price performance). Nevertheless, it was time for Short and her team to discuss how the news altered their outlook for the company in a revised analyst report. The main point of discussion would certainly be whether Whole Foods still had a recipe for success. The Grocery Industry The U.S. grocery industry as a whole had historically been a low-growth industry, and, as a result of fierce competition, had typically maintained low margins. In 2012, the industry recorded over $600 billion in sales, a 3% increase from the previous year.' Real demand growth was strongly tied to population growth, and consensus estimates for nominal long-term growth rate were between 2% and 3%.2 Key segments included 'Whole Foods Market annual report, 2013. 'Hoover's Inc., Grocery Stores \& Supenmarkets Industry Report, 2015. This public-sourced case was prepared by Chris Blankenship (MBA '17) under the supervision of Michael J. Schill, Professor of Business Administration. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2017 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an e-mail to sales@dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a Market (Sprouts), and The Fresh Market (Fresh Market); and wholesalers such as Costco and Sam's Club. Conventional grocers remained the primary destination for shoppers, but competition from Wal-Mart, wholesalers, and other low-price vendors Consumers were extremely price conscious and came to expect promotions (which were largely funded by manufacturers), and most shoppers did not have strong attachments to particular retail outlets. Given this environment, companies relentlessly searched for opportunities to achieve growth and improve margins. Many grocers had implemented loyalty programs to reward repeat shoppers, and most were trying to improve the in-store customer expe. rience, for instance by using self-checkout lines and other operational adjustments to reduce checkout times, a source of frequent complaints. Given the high percentage of perishable goods in the industry, supply chain management was essential, and comGrocers also began promoting prepared foods, which eould eommand higher ingeries. and reach consumers who did not regularly cook their own meals. Finally. most major grocers offered private-label products, which allowed them to offer low prices while still capturing sufficient margins. in over 20,000 natural food stores and nearly three out of four conventional grocers. 10 Even in the face of this competition, Whole Foods maintained a position as the concerned about the source and content of their food, which fueled naturat grocers sustained growth (over 20% per year since 1990) despite their comparatively higher prices. 4 In 2012 , natural and organic products accounted for $81 billion in total sales in the United States, a 10% increase from the previous year. $81 billion in total sales in were more narrowly defined than natural products, accounted for about $28 billion of these sales and were expected to top $35 billion by the end of 2014.6 Exhibit 7.3 provides growth forecast and share data on the natural and organic segments. As of 2014. 45\% of Americans explicitly sought to include organic food in their meals, and more than half of the country's 18-29-year-old population sought it out. 7 By specializing in such products, natural grocers were able to carve out a profitable niche; the three leadWhole Foods Market ing natural grocers (Whole Foods, Sprouts, and Fresh Market) had EBITDA margins of Whole Foods traced its roots to 1978, when John Mackey and Renee Lawson opened a small organic grocer called SaferWay in Austin, Texas. Two years later, it partnered Whith Craig Weller and Mark Skiles of Clarksville Natural Grocery to launch the first 1984, the company began expanding within Texas and in 1988 made its first move across state lines by acquiring the Louisiana-based Whole Foods Company; the next year $60 to $40, Whole Foods would still trade at a premium to its competitors in the conventional grocers' segment. The bulls believed the combination of Whole Foods' leadership in natural and organic offerings, shifting consumer preferences, and organic food's small but rapidly growing market provided ample runway for sustained growth at high margins. 23 As the clear leader in the segment, Whole Foods was well positioned to benefit from consumers' increasingly health-conscious decision making. Moreover, Whole Foods was not just another retailer that offered natural products; it was the standard bearer and thought leader for the industry, making it top of mind for anyone interested in the type of healthy products Whole Foods brought into the mainstream. Its competitors were merely imitating what Whole Foods pioneered and continued to lead, giving the company a sustainable advantage. 24 While competition could put downward pressure on some of Whole Foods' prices, the company had the stature to maintain its margin targets even with competitive price cuts by driving sales toward higher-margin categories like prepared foods, where the grocer could more readily differentiate its products. Moreover, the company's high prices gave it more room to adjust prices on goods where it directly competed with lower-cost retailers; past work by Short's team had shown that Whole Foods could match Kroger on 10,000 SKUs-equivalent to all the non privatelabel nonperishable products the company offered-and still maintain nearly a 35% gross margin, which was within Whole Foods' target range. 25 Similar analyses against other competitors also suggested ample room to selectively compete on prices while maintaining its overall margin targets. Additionally, Whole Foods had opportunities to reduce operating expenses, which the bulls thought would offset decline in revenue from pricing pressure over the next few years. While some analysts were concemed that Whole Foods' expansion would take it into lower-income areas that were distinct from the company's historical target market, the bulls believed that Whole Foods privatelabel products offered a chance to provide similar, high-quality products at a more accessible price point while protecting margins and providing a promising new avenue for growth. 26 While the bulls acknowledged that Whole Foods traded at a premium, they thought the company's higher growth rates, attractive margins, and position as a market leader provided ample justification for its higher valuation. Whole Foods' CEO John Mackey was firmly in the bull camp. While he acknowledged that Whole Foods' best-in-the-industry sales per square foot and margins would attract competition, he claimed: "We are and will be able to compete successfully" and that the pricing gap between Whole Foods and the competition would not disappear. 2T More importantly, he claimed that no competitor offered the quality of products that Whole Foods could, regardless of how these competitors chose to market their products. Alluding to the lack of a clear legal definition for natural foods, he alleged that many competitors marketed standard commercial meat and other perishable goods under misleading labels, and said that Whole Foods could more aggressively advertise its superior quality to maintain its differentiation from the competition. Similarly, the company was making investments to improve the customer experience, already seen by many as one of its stronger points, by shortening wait times and offering higherquality self-service food. Behind the scenes, it was reallocating support personnel on a regional rather than store-by-store basis in an effort to cut costs. After hinting at several projects in the pipeline that would help Whole Foods thrive in the new reality of stronger competition, he said that Whole Foods "is not sitting still. We are still very innovative!" Exhibit 7 WHOLE FOODS MARKET Deutsche Bank Model (millions of USD, except per share figures) Exhibit 8 WHOLE FOODS MARKET Demographic and Capital Markets Data Source: Bloomberg and US Census Bureau le Foods Market: Deutsche Bank Report The latest numbers coming out of Whole Foods Market, Inc. (Whole Foods) in May 2014 took Deutsche Bank research analyst Karen Short and her team by surprise. On May 6 , Whole Foods reported just $0.38 per share in its quarterly earnings report, missing Wall Street's consensus of $0.41 and cutting earnings guidance for the remainder of the year. The company's share price fell 19% to $38.93 the next day as Whole Foods' management acknowledged that it faced an increasingly competitive environment that could compress margins and slow expansion. The only upbeat news was the 20% increase in the company's quarterly dividend, up from $0.10 to $0.12 per share. Short and her team knew this was not the first time the market believed Whole Foods had gone stale. In 2006, Whole Foods' stock had also declined 20% over fears of slowing growth and increasing competition, but had since bounced back and outperformed both its competition and the broader market (see Exhibit 7.1 for stock price performance). Nevertheless, it was time for Short and her team to discuss how the news altered their outlook for the company in a revised analyst report. The main point of discussion would certainly be whether Whole Foods still had a recipe for success. The Grocery Industry The U.S. grocery industry as a whole had historically been a low-growth industry, and, as a result of fierce competition, had typically maintained low margins. In 2012, the industry recorded over $600 billion in sales, a 3% increase from the previous year.' Real demand growth was strongly tied to population growth, and consensus estimates for nominal long-term growth rate were between 2% and 3%.2 Key segments included 'Whole Foods Market annual report, 2013. 'Hoover's Inc., Grocery Stores \& Supenmarkets Industry Report, 2015. This public-sourced case was prepared by Chris Blankenship (MBA '17) under the supervision of Michael J. Schill, Professor of Business Administration. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2017 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an e-mail to sales@dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a Market (Sprouts), and The Fresh Market (Fresh Market); and wholesalers such as Costco and Sam's Club. Conventional grocers remained the primary destination for shoppers, but competition from Wal-Mart, wholesalers, and other low-price vendors Consumers were extremely price conscious and came to expect promotions (which were largely funded by manufacturers), and most shoppers did not have strong attachments to particular retail outlets. Given this environment, companies relentlessly searched for opportunities to achieve growth and improve margins. Many grocers had implemented loyalty programs to reward repeat shoppers, and most were trying to improve the in-store customer expe. rience, for instance by using self-checkout lines and other operational adjustments to reduce checkout times, a source of frequent complaints. Given the high percentage of perishable goods in the industry, supply chain management was essential, and comGrocers also began promoting prepared foods, which eould eommand higher ingeries. and reach consumers who did not regularly cook their own meals. Finally. most major grocers offered private-label products, which allowed them to offer low prices while still capturing sufficient margins. in over 20,000 natural food stores and nearly three out of four conventional grocers. 10 Even in the face of this competition, Whole Foods maintained a position as the concerned about the source and content of their food, which fueled naturat grocers sustained growth (over 20% per year since 1990) despite their comparatively higher prices. 4 In 2012 , natural and organic products accounted for $81 billion in total sales in the United States, a 10% increase from the previous year. $81 billion in total sales in were more narrowly defined than natural products, accounted for about $28 billion of these sales and were expected to top $35 billion by the end of 2014.6 Exhibit 7.3 provides growth forecast and share data on the natural and organic segments. As of 2014. 45\% of Americans explicitly sought to include organic food in their meals, and more than half of the country's 18-29-year-old population sought it out. 7 By specializing in such products, natural grocers were able to carve out a profitable niche; the three leadWhole Foods Market ing natural grocers (Whole Foods, Sprouts, and Fresh Market) had EBITDA margins of Whole Foods traced its roots to 1978, when John Mackey and Renee Lawson opened a small organic grocer called SaferWay in Austin, Texas. Two years later, it partnered Whith Craig Weller and Mark Skiles of Clarksville Natural Grocery to launch the first 1984, the company began expanding within Texas and in 1988 made its first move across state lines by acquiring the Louisiana-based Whole Foods Company; the next year $60 to $40, Whole Foods would still trade at a premium to its competitors in the conventional grocers' segment. The bulls believed the combination of Whole Foods' leadership in natural and organic offerings, shifting consumer preferences, and organic food's small but rapidly growing market provided ample runway for sustained growth at high margins. 23 As the clear leader in the segment, Whole Foods was well positioned to benefit from consumers' increasingly health-conscious decision making. Moreover, Whole Foods was not just another retailer that offered natural products; it was the standard bearer and thought leader for the industry, making it top of mind for anyone interested in the type of healthy products Whole Foods brought into the mainstream. Its competitors were merely imitating what Whole Foods pioneered and continued to lead, giving the company a sustainable advantage. 24 While competition could put downward pressure on some of Whole Foods' prices, the company had the stature to maintain its margin targets even with competitive price cuts by driving sales toward higher-margin categories like prepared foods, where the grocer could more readily differentiate its products. Moreover, the company's high prices gave it more room to adjust prices on goods where it directly competed with lower-cost retailers; past work by Short's team had shown that Whole Foods could match Kroger on 10,000 SKUs-equivalent to all the non privatelabel nonperishable products the company offered-and still maintain nearly a 35% gross margin, which was within Whole Foods' target range. 25 Similar analyses against other competitors also suggested ample room to selectively compete on prices while maintaining its overall margin targets. Additionally, Whole Foods had opportunities to reduce operating expenses, which the bulls thought would offset decline in revenue from pricing pressure over the next few years. While some analysts were concemed that Whole Foods' expansion would take it into lower-income areas that were distinct from the company's historical target market, the bulls believed that Whole Foods privatelabel products offered a chance to provide similar, high-quality products at a more accessible price point while protecting margins and providing a promising new avenue for growth. 26 While the bulls acknowledged that Whole Foods traded at a premium, they thought the company's higher growth rates, attractive margins, and position as a market leader provided ample justification for its higher valuation. Whole Foods' CEO John Mackey was firmly in the bull camp. While he acknowledged that Whole Foods' best-in-the-industry sales per square foot and margins would attract competition, he claimed: "We are and will be able to compete successfully" and that the pricing gap between Whole Foods and the competition would not disappear. 2T More importantly, he claimed that no competitor offered the quality of products that Whole Foods could, regardless of how these competitors chose to market their products. Alluding to the lack of a clear legal definition for natural foods, he alleged that many competitors marketed standard commercial meat and other perishable goods under misleading labels, and said that Whole Foods could more aggressively advertise its superior quality to maintain its differentiation from the competition. Similarly, the company was making investments to improve the customer experience, already seen by many as one of its stronger points, by shortening wait times and offering higherquality self-service food. Behind the scenes, it was reallocating support personnel on a regional rather than store-by-store basis in an effort to cut costs. After hinting at several projects in the pipeline that would help Whole Foods thrive in the new reality of stronger competition, he said that Whole Foods "is not sitting still. We are still very innovative!" Exhibit 7 WHOLE FOODS MARKET Deutsche Bank Model (millions of USD, except per share figures) Exhibit 8 WHOLE FOODS MARKET Demographic and Capital Markets Data Source: Bloomberg and US Census Bureau