Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Based on your understanding of Ganong and Noel's (2018) paper Liquidity v Wealth in houshold debt obligations: 'evidence from housing policy in the great

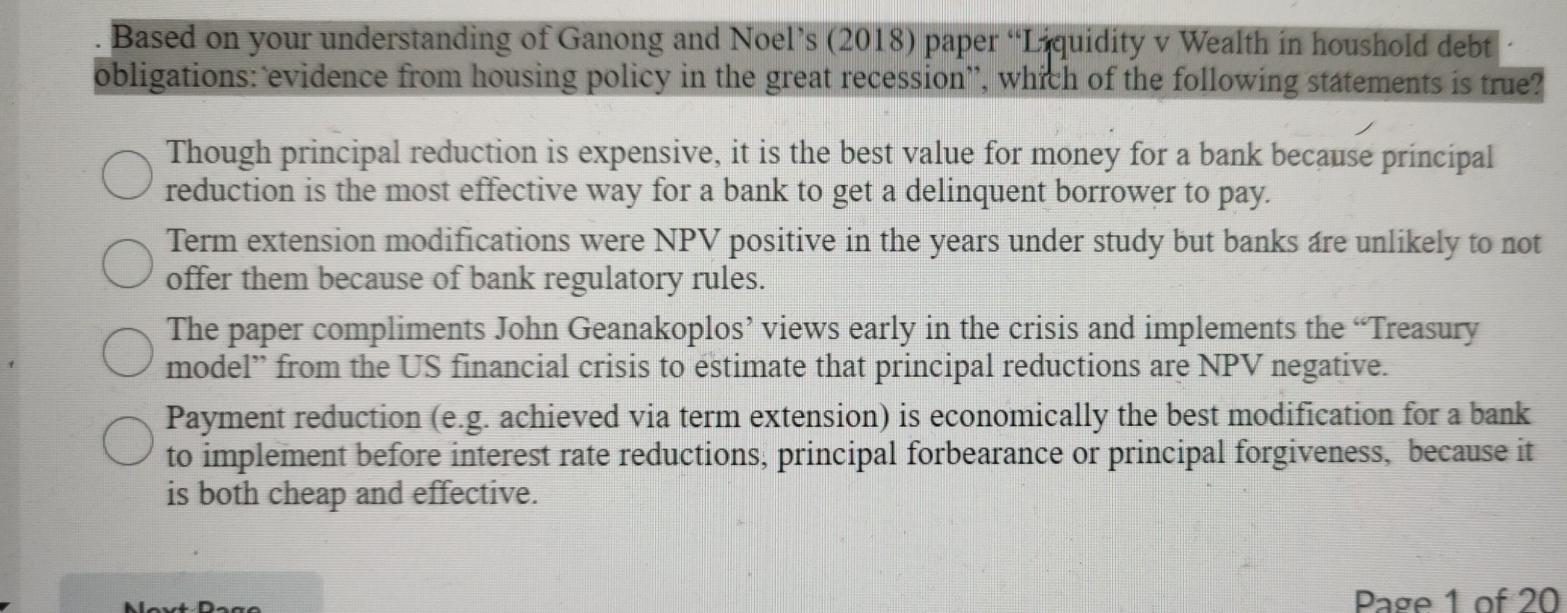

- Based on your understanding of Ganong and Noel's (2018) paper "Liquidity v Wealth in houshold debt obligations: 'evidence from housing policy in the great recession", which of the following statements is true? Though principal reduction is expensive, it is the best value for money for a bank because principal reduction is the most effective way for a bank to get a delinquent borrower to pay. Term extension modifications were NPV positive in the years under study but banks are unlikely to not offer them because of bank regulatory rules. The paper compliments John Geanakoplos' views early in the crisis and implements the Treasury model from the US financial crisis to estimate that principal reductions are NPV negative. Payment reduction (e.g. achieved via term extension) is economically the best modification for a bank to implement before interest rate reductions, principal forbearance or principal forgiveness, because it is both cheap and effective. Nav Dage Page 1 of 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started